Weekly Recap

Doug & Matt Take Questions, Silver & China Factor, State Capitalism & Mining Stocks, Miners Still Priced for $2,000 Gold, Doug on Bitcoin, Gold, and Crisis Investing, Another Silver Position Doubles

Silver Top? When To Sell?

·

In the latest episode of Doug Casey’s Take, we take questions from subscribers after discussing Iran and the crash in metals. If you’re a subscriber and would like to ask Doug a question, post them …

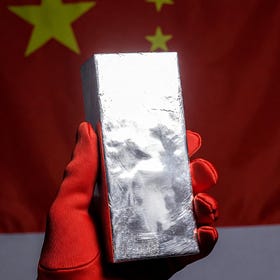

Silver and the China Factor

·

A few days ago, we published our January Crisis Investing issue with updated guidance on some of our precious metals positions. The issue went out Friday after market close, which means most subscrib…

State Capitalism & Mining Stocks

·

Government “Help,” Strategic Stockpiles, Rogue AI Bots… and the Silver Price That Doesn’t Make Sense

Gold Hit $5,000—But Miners Are Priced Like It's Still $2,000

·

I’ve been writing a lot about gold miners lately—and for good reason.

What Happens To Gold Stocks In A Crisis?

·

Bitcoin, Buenos Aires Real Estate, and Why Gold Miners Still Look Mispriced

Gold stocks pricing seems to take their forward off-take contract pricing into account, as that limits their ability to benefit from spot price rises.