Powell Just Signaled the End of Quantitative Tightening

America’s Next Inflation Wave Starts Here

Jerome Powell, the Fed’s chairman, just gave the clearest signal yet that the Federal Reserve’s so-called “quantitative tightening” is about to end.

Speaking at the National Association for Business Economics conference in Philadelphia this week, Powell said:

Our long-stated plan is to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserves conditions. We may approach that point in coming months.

Translation: the money printer is warming back up.

Now, if you’ve been paying attention, this shouldn’t come as a surprise. The playbook has been obvious for a while—first come the rate cuts (happening now), then they stop quantitative tightening (Powell just confirmed this), and then comes quantitative easing, or good old-fashioned money printing, probably sometime in early 2026.

What’s forcing their hand?

Even without President Trump’s constant pressure, the Fed doesn’t have a choice. I wrote to you about that earlier this week.

The job market is collapsing—companies have announced 946,426 job cuts so far this year. That’s a 55% jump from 2024 and the highest since 2020.

Meanwhile, Americans are searching “help with mortgage” on Google at levels not seen since the 2008 financial crisis. With mortgage rates around 6.3% (double the 3% rates most locked in during 2020-2021) and inflation compounding 10-15% over four years, homeowners are tapped out.

The Fed can’t fix these problems with rate cuts alone. So they’re moving to the next phase: ending QT now, and firing up QE soon after.

The Tightening That Hardly Was

But here’s the irony: the Fed is ending QT before they’ve made any significant dent in the mountain of cash they created last time around.

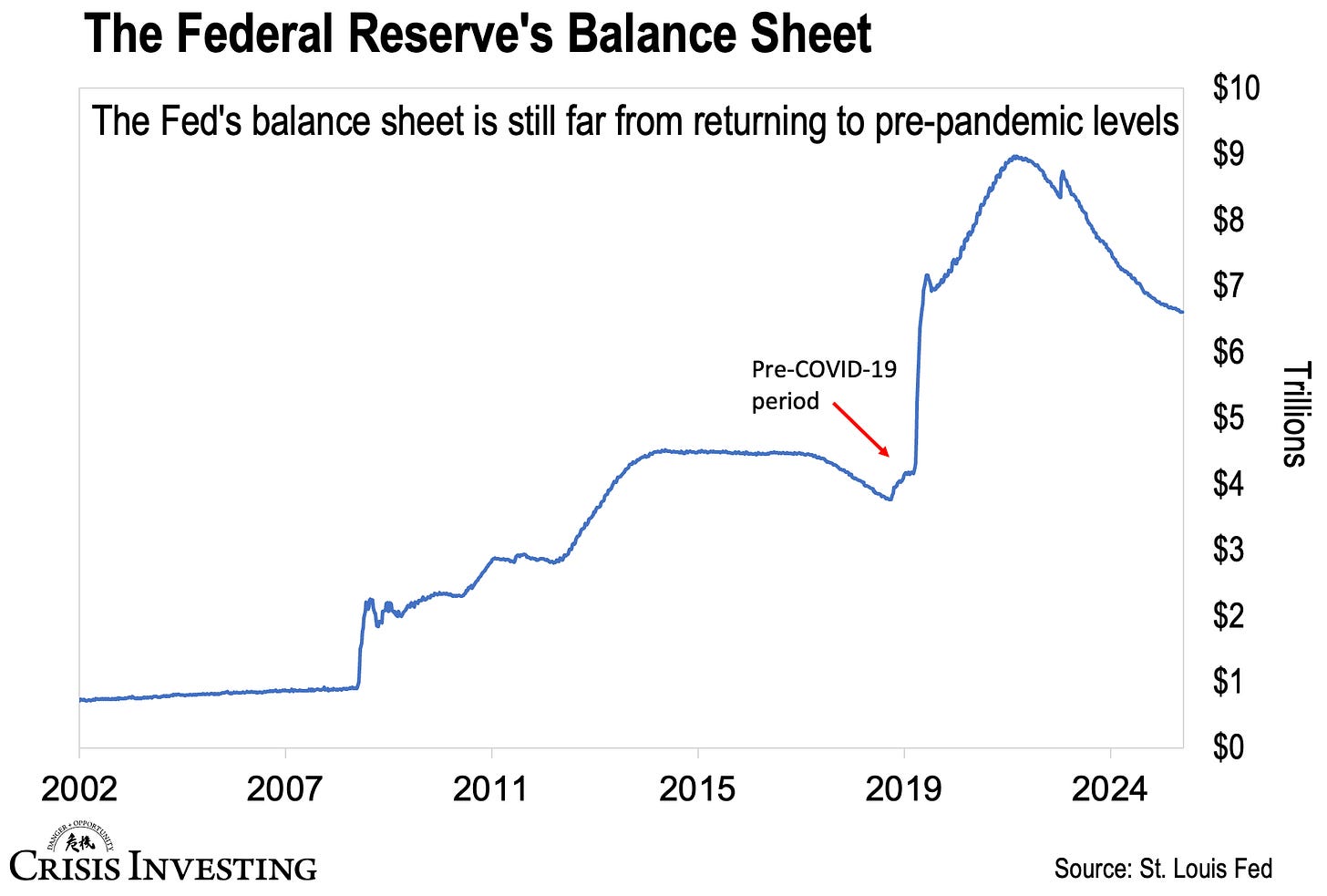

If you look at the chart below, you’ll see that since June 2022, the Fed has reduced its balance sheet by $2.2 trillion. That sounds impressive until you realize they’re still sitting on $6.6 trillion.

In other words, the Fed is nowhere close to the pre-pandemic levels of roughly $4 trillion. After more than three years of “tightening,” they’ve only managed to shrink the balance sheet by about 27%.

To say that’s unimpressive would be a gross understatement. But it’s by design.

The simplest way to reverse QE would have been for banks to return the money to the Fed in exchange for their bonds. But that was never going to happen. The Fed and the big banks seem quite content letting all that cash slosh around Wall Street—pushing markets to record highs while the rest of us deal with the inflation.

Another option was for the Fed to sell bonds directly into the market. But they know that dumping a significant portion of their $6.6 trillion bond portfolio could crash the bond market.

So instead, they opted for the slowest, most painless approach—letting bonds “roll off” as they mature. In other words, they don’t print new money to replace maturing bonds.

But even that glacial pace proved too much. And Powell’s already moving the goalposts. At the same conference, he also said this:

Normalizing the size of our balance sheet does not mean going back to the balance sheet we had before the pandemic.

Translation: We’re done pretending. The new “normal” is $6.6 trillion—60% higher than before we destroyed your purchasing power. Deal with it.

The problem, of course, is that when the Fed inevitably restarts QE to push long-term rates down, it’ll be starting from an already bloated balance sheet.

Kicking off the next money-printing cycle from $6.6 trillion instead of $4 trillion—with so much pandemic-era cash still sloshing around the system—all but guarantees double-digit inflation. We’re talking about potential currency destruction on a scale and at a speed America has never seen.

Position accordingly.

Have a great rest of your weekend,

Lau Vegys

P.S. We believe the Fed’s move back into easy money will set off a massive bubble in commodities—especially in monetary metals like gold and silver. That’s why a big portion of our Crisis Investing portfolio is in mining stocks, which Doug Casey himself owns. Now, you might think you’ve missed the boat with gold at record highs and silver at 14-year highs. But as I recently wrote to you, mining stocks are still sitting near their cheapest levels in relative terms. Be sure to check out that essay if you missed it.

Lau, the best articles I read on this platform are from you and it’s not even close. 👍👍

There was no way in the Eccles Building that JPow would NOT choose inflation. The central banksters know it's their best friend.