The 120-Year (Low) Opportunity

Chart of the Week #67

I don’t usually start the week with a Chart of the Week. But since we skipped last week—and with the Fed’s rate cut imminent at tomorrow’s meeting under mounting pressure from Trump—I thought it was the perfect time to share this with you without delay.

As of now, J.P. Morgan is pricing in a 95% chance the Fed will cut rates in some capacity, and an 87.5% chance it’ll be a 25-basis-point cut. The bond market is telling the same story — 2-year Treasury yields have eased — and Fed funds futures are also pointing to similar odds for a 25-basis-point cut.

Meanwhile, Trump has been calling for the Fed to slash rates by at least three full percentage points — six times larger than what’s currently on the table.

Granted, that kind of cut won’t happen tomorrow… but make no mistake: it’s coming.

And so here it goes again: rate cuts are on the way. And with them, more inflation, a weaker dollar, and mountains of new debt.

That’s the bad news.

The good news—at least for those holding “real stuff”—is that this backdrop creates a major tailwind for real, unprintable assets. And at the very top of that list? Gold — the timeless haven in a sea of paper promises.

As I write this, the yellow metal is trading at all-time highs, while silver has surged to levels not seen in 14 years.

Now, Doug Casey always recommends holding physical gold in your long-term portfolio. But he also recommends gold stocks for amplified returns, since they provide leverage to the underlying metal price.

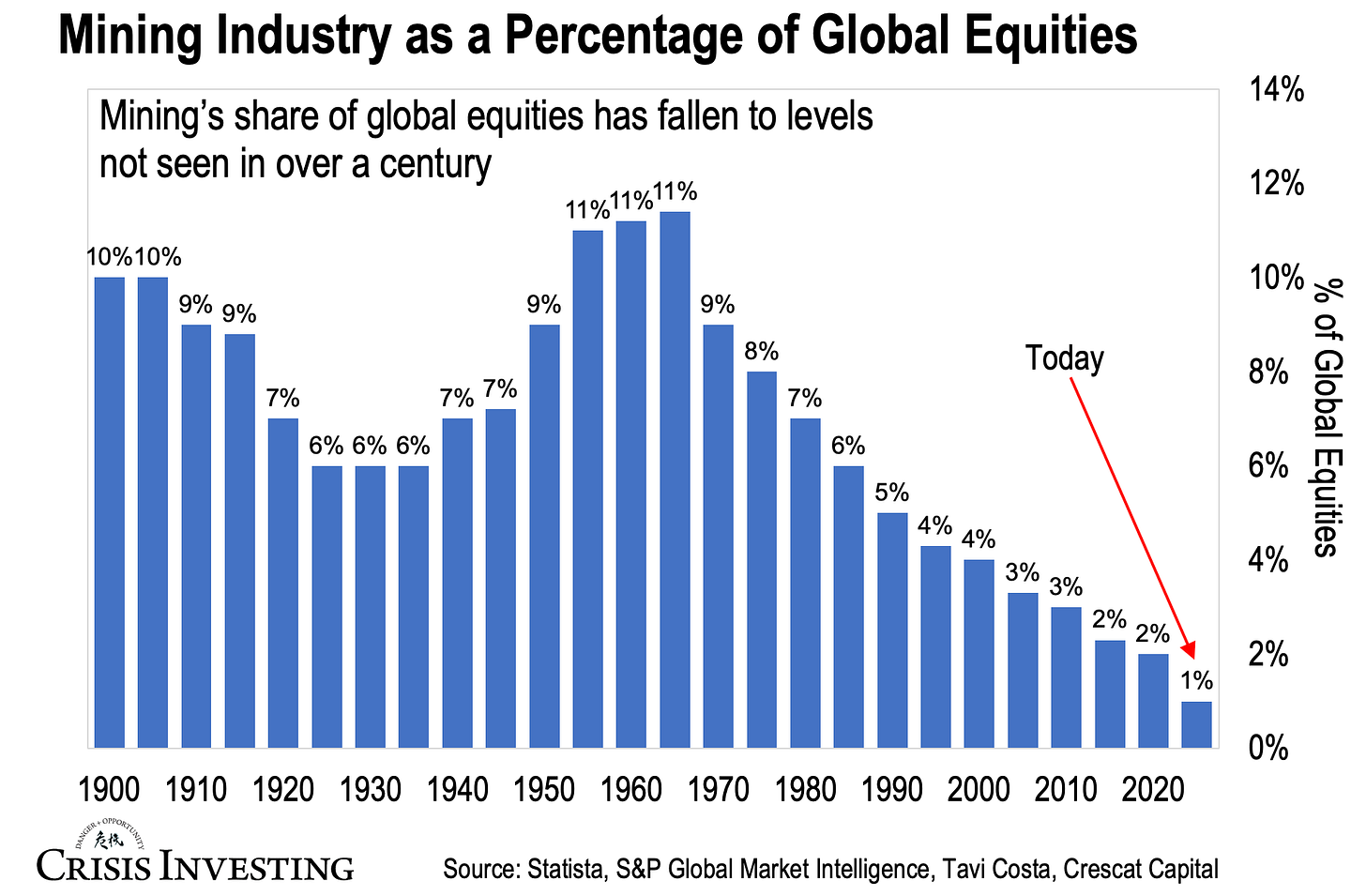

That’s where things get interesting. For those who are new to mining stocks and worry they’ve already missed the boat, the reality is quite the opposite. Take a look at today’s chart—it shows mining companies as a percentage of global stock market value.

As you can see, mining’s share of global equities is now trading at levels not seen in over 120 years.

This is what Doug means when he says mining stocks are still hated.

Think about the setup here: we’re starting to see renewed monetary expansion from central banks worldwide (even as inflation remains sticky). Geopolitical flashpoints are multiplying, and the U.S. dollar has sunk to its weakest level in more than half a century. On top of that, central banks themselves continue buying record amounts of gold. And yet, mining stocks remain among the cheapest they’ve ever been in relative terms.

If I’ve ever seen a disconnect, this is it — and it’s creating one of the most compelling contrarian opportunities we’ve seen in years.

That’s why we’ve been combing through our watchlists and Doug’s own portfolio for a compelling precious metals pick positioned to take full advantage of this situation. Expect to find it in this month’s Crisis Investing. Paid subscribers — keep an eye on your inbox in the coming days so you don’t miss it when it drops.

Regards,

Lau Vegys

Succinct and helpful. Thanks.

It would be further helpful to compare the prospects of the precious metal miners to the oil and gas producers so one might know whether to sell the latter to purchase the former. Thank you.