When Americans Need Help With Their Mortgages Like It’s 2008 Again

Chart of the Week #71

Reports of housing stress are starting to pop up everywhere—stories about homeowners struggling to make payments, rising delinquencies, and growing anxiety about affordability. But is this just clickbait media, or is something real happening beneath the surface?

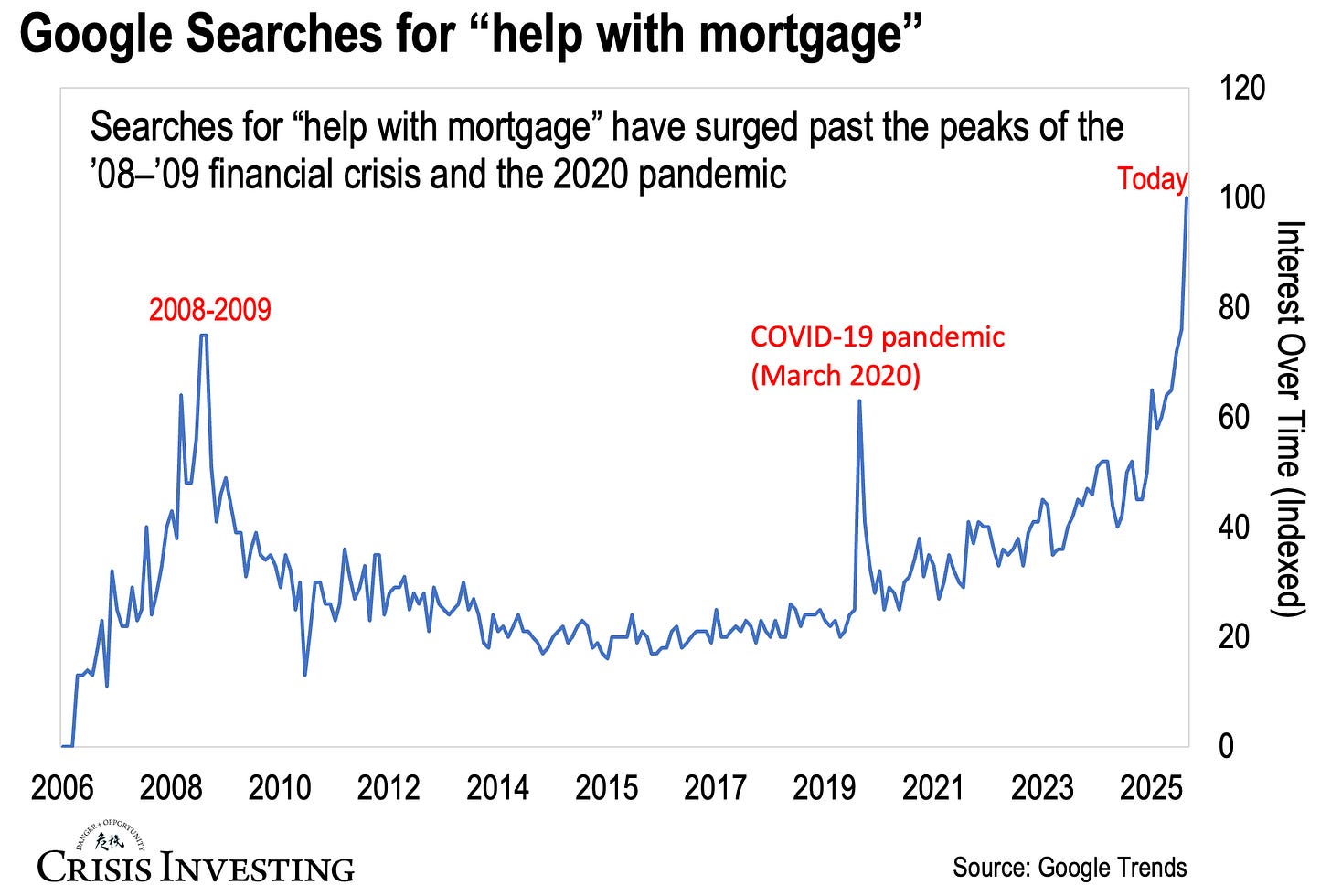

To find out, I decided to dig a little deeper. And some of the most revealing data comes from the simplest source—what people type into Google when they’re worried. Take a look at the chart below.

As you can see, Google search trends for “help with mortgage” just hit their highest level in 16 years—higher than the COVID spike and higher than the 2008-09 peak. Now, you may remember what happened back then: millions of families losing their homes, unemployment soaring, and a full-blown financial meltdown—the Great Financial Crisis.

Keep in mind, the actual number of people seeking mortgage help right now is probably much higher than this chart shows. Why? Because these days, millions turn to ChatGPT and other AI tools for financial advice instead of Google. So if Google searches alone are surpassing 2008-09 crisis levels, the real distress is likely far worse.

So what’s driving this spike?

It comes down to a toxic combination of two factors: crushing mortgage rates and relentless inflation.

As I write this, the 30-year fixed mortgage rate sits around 6.3%—roughly double the 3% rates most Americans locked in during 2020–2021. With 81% of all outstanding mortgages at 6% or lower, homeowners are trapped. They won’t sell and reset to today’s rates, so inventory stays frozen while affordability craters. In fact, the payment-to-income ratio recently hit 41.8%—near historic lows.

Now layer inflation on top of this. For four straight years, it’s been running above 2.5%—compounding into a 10–15% jump in the overall price level. Groceries, gas, utilities, insurance—all permanently more expensive. Meanwhile, real wages still can’t keep up.

The result? Homeowners are tapped out.

Consider this:

Total household debt just hit $18.4 trillion—a record high.

Home equity lines of credit (basically, borrowing against your house) have risen for eight straight quarters. That’s people dipping into their home value just to access cash.

In Q2 alone, homeowners pulled out $52 billion through cash-outs and second mortgages—the largest quarterly withdrawal in three years, a flashing red light of financial strain.

Foreclosure filings are up 6%.

Foreclosure starts are up 7%.

No wonder people are desperately looking for help with their mortgages.

For that to change, affordability needs to reset—and for that to happen, one of three things must occur: home prices must drop sharply, mortgage rates must fall, or incomes must soar.

The math is brutal—analysts estimate that returning to 2019 affordability would require roughly a 40% decline in home prices, a 60–70% jump in incomes, or mortgage rates back in the low-to-mid-4% range (some say closer to 3%).

None of those outcomes come easily—if at all. But without the Fed stepping in with more cuts, they’re not even theoretically possible.

And as I wrote recently, it looks like the Fed’s hand is already being forced by a collapsing job market. Companies have announced 946,426 job cuts so far this year—a 55% jump from 2024 and the highest total since 2020.

No wonder the CME FedWatch Tool now puts the odds of another rate cut at 97% for the next meeting.

In short, the Fed is out of options but to keep cutting. And when those cuts inevitably fail to fix the underlying problems—there’s only one tool left in the box.

The money printer.

Regards,

Lau Vegys

P.S. The Fed’s inevitable return to the printing press is exactly why so much of our Crisis Investing portfolio is positioned in carefully chosen precious-metals stocks—many of which Doug himself owns. In fact, our latest issue features a compelling new gold pick poised to benefit not only from gold’s continued rise but also from a transformative deal that dramatically expands its growth potential. Even if you’re not a paid subscriber, I’d still recommend checking out the lead story—it’s free and digs deeper into why this gold bull market still has plenty of legs left.

This is why inflation is a government-induced problem: When things go REALLY awful, they have no other solution. Because if they had a real solution, they would have tried it before the iceberg is visible from the stern.

As always, lucid and on point. I don't know how close we are to the economy being totally out of whack, but I do know we are closer than is safe and it's already a calamity for way too many good folks let alone those who volunteered to hang themselves. Thanks for flashing the warning, again.