Trump vs. Xi: Chaos, Tariffs… and a the Next Great Resource Opportunity

Inside the Rare Earth Showdown That Caught Markets Off Guard

What a wild finish to last week.

On Thursday, just ahead of the scheduled Xi–Trump summit in South Korea, Beijing dropped a bombshell—announcing sweeping new export curbs on rare earths, lithium-ion batteries, graphite, and synthetic diamonds. In other words, the stuff the world desperately needs for everything from EVs to missile components.

Then on Friday, Trump fired back with 100% tariffs on Chinese imports—on top of the 30% already in place. Markets didn’t take it well. The S&P 500 plunged 2.7% in its worst day since April, wiping out about $2 trillion in value. The Dow sank 879 points. The Nasdaq dropped 3.6%.

And then there was crypto—a carnage for the history books.

Bitcoin crashed from around $122,000 to under $105,000—a 14% nosedive. In just 24 hours, $19 billion in leveraged positions were liquidated, wiping out 1.6 million trading accounts. The largest single-day wipeout in crypto history.

It got so bad, my X feed was filled with stories of traders smashing up their houses—and some, tragically, even taking their own lives.

Since this whole mess started with China’s rare earths announcement, it’s worth unpacking what happened, why it matters, and what probably comes next.

China’s Tightening Grip

China’s latest move came with a kicker buried in the fine print: the Ministry of Commerce now requires any overseas exporter using even traces of Chinese-sourced rare earths to obtain an export license.

In practice, that gives Beijing visibility into—and veto power over—the entire downstream supply chain for anything containing Chinese rare earths.

Now, if you’ve been with us for a while, you know this didn’t come out of nowhere. China’s been tightening the screws for over a year now.

In December 2023, Beijing banned the export of technology used to produce rare earth magnets—vital for EVs, wind turbines, and advanced military systems.

By October 2024, exporters were required to detail exactly how rare earth shipments were used in Western supply chains.

Then in December 2024, Beijing banned exports of gallium, germanium, and antimony to the U.S.—materials critical for semiconductors, fiber optics, and military applications.

As we suspected, those were just warning shots ahead of the main event.

This tightening grip is a big deal—China already produces about 70% of the world’s rare earths and holds nearly half of global reserves.

But it’s not just about mining. China also dominates refining and processing—controlling over 90% of global capacity.

That means even if the U.S. or Australia digs up rare earths at home, they still usually wind up sending them to China for refining.

The Pentagon’s Nightmare

Washington doesn’t like to discuss its “dangerous vulnerability,” but it would pay (quite literally) for anyone serious about resource investing to understand the true scale of it.

For instance, did you know U.S. Javelin missiles and F-35 fighter jets—some of America’s most advanced weapons—are practically bursting at the seams with this stuff?

You might have. But that’s just scratching the surface.

Since I last wrote about this whole rare earths drama, an interesting report from Govini—a U.S. defense analytics firm—dropped.

The report—titled From Rock to Rocket: Critical Minerals and the Trade War for National Security—goes well beyond individual examples and lays out, in brutal detail, just how deeply Chinese materials are embedded across America’s entire military-industrial complex.

And the numbers are, frankly, staggering.

According to Govini, 80,000 individual components across nearly 1,900 U.S. military weapons systems contain Chinese-sourced minerals. That’s 78% of all DoD platforms.

The vulnerability cuts across every branch of the armed forces:

Navy: 92% of its 739 weapon systems rely on Chinese minerals.

Air Force: 85% of its 302 systems.

Army: 70%.

Marine Corps: over 60%.

Let that sink in.

America’s most advanced weapons—fighter jets, missiles, radar systems, submarines—are all built with materials that run through China.

Isn’t it ironic that this just happens to be the same country the U.S. has declared its main adversary?

The Pickle

By Monday, markets had rebounded somewhat after Trump softened his tone. “The U.S.A. wants to help China, not hurt it!!!” he posted on Truth Social. “Don’t worry about China, it will all be fine!” He called Xi Jinping “highly respected” and said the meeting in Seoul was still on.

All well and good—but the rare earth problem isn’t going anywhere, no matter how that meeting ends.

Because the issue for the U.S. isn’t just securing raw materials. The real challenge is rebuilding the entire industrial ecosystem—something Washington is clearly intent on, given its view of China as enemy numero uno.

That’s not a quick fix—it’s a decades-long project.

You can’t just flip a switch and start mining rare earths at scale. You need refineries. You need magnet plants. You need end-to-end infrastructure—and you need to do it efficiently enough to compete. China spent 40 years building this capacity while America was busy financializing its economy and fighting endless wars in the Middle East.

Even if Washington threw unlimited money at the problem tomorrow, it would still probably take a generation to catch up.

So when China imposes these export restrictions, it sends a very clear message: we know the chokehold we have on rare earths—and how much you need them—and we’re willing to use it.

Plus, it’s not exactly their first rodeo in this game anyway.

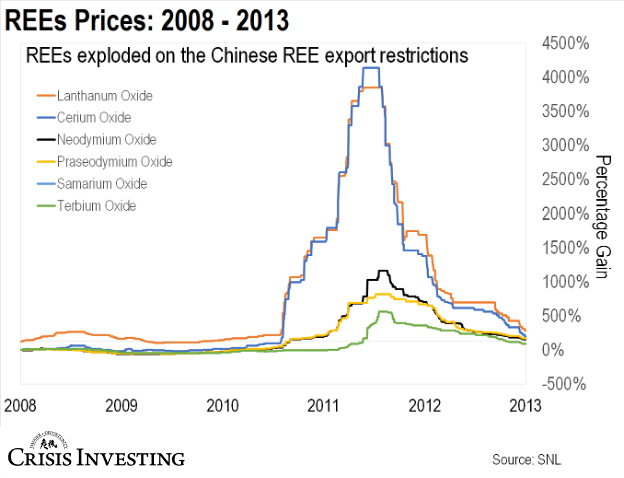

In 2010, Beijing slashed global rare earth exports by 40% during a maritime dispute with Japan.

That was a major blow. Japan depended on Chinese rare earths for key inputs in everything from computers and smartphones to flat-screen TVs and hybrid cars.

The result? One of the biggest commodity booms in history.

Average rare earth prices surged more than 2,100%. Some individual elements went even higher—Lanthanum spiked 4,140%, Cerium jumped 2,980%.

Now, to be clear, what China announced last week isn’t a full-blown export ban like in 2010—but it’s a major escalation that’s taking us in that direction.

What Happens Next

Honestly, I wouldn’t hold my breath on Trump and Xi agreeing to anything lasting—even if they shake hands in Seoul. The last time they tried to patch things up—at the so-called “London framework” in June—it fizzled out before the ink was dry.

The reason is simple: the U.S. wants China to ease up on rare earths. China wants fewer restrictions on advanced chips. But both are strategic levers, not bargaining chips.

For Washington, loosening semiconductor controls is a national security risk—something the Trump administration has made clear time and again.

For Beijing, rare earths are a geopolitical pressure valve—and it won’t be sealing it anytime soon with someone as unpredictable as Trump in the White House.

And politically, neither side can afford to blink. Trump can’t risk looking weak after campaigning on “economic nationalism.” Xi needs to project strength as domestic pressures mount.

So even if they patch something together, it’ll likely be a half-measure—and it could easily fall apart the next time tensions flare over Taiwan or the South China Sea.

Smart money knows this.

That’s why our two U.S.-based rare-earth companies in Crisis Investing—positioned to benefit directly from Washington’s scramble to secure domestic supply—are now up over 300% each. And we recommended them only a few months ago.

That’s not luck. It’s the market recognizing the rare earth situation for what it is—a massive, ongoing problem for the U.S. government, and a money-making opportunity for savvy investors.

And that opportunity’s far from over.

Case in point: the VanEck Rare Earth and Strategic Metals ETF (REMX)—the sector’s bellwether—is still down nearly 35% from its 2022 peak and roughly 75% below its 2011 highs.

In short, even after all the geopolitical fireworks and China’s tightening grip, rare earth stocks are still relatively cheap.

That means there’s still time to get in ahead of what could become an even bigger rare earth bull market than we saw in 2011—because this time, the stakes are much higher.

Regards,

Lau Vegys

Excellent informative article. I appreciate the historical backdrop along with the financial analysis.

Please give us more articles like this.

Excellent, informative article. Thank you!.