Gold Just Broke $5,000 (But the Real Story Is What Hasn’t Happened Yet)

Chart of the Week #87

Yesterday was historic.

Gold broke $5,000 per ounce for the first time in history.

It’s incredible to think that just a few months ago, back in October, I wrote about gold shattering $4,000. And here we are, barely three months later, watching it break through $5,000.

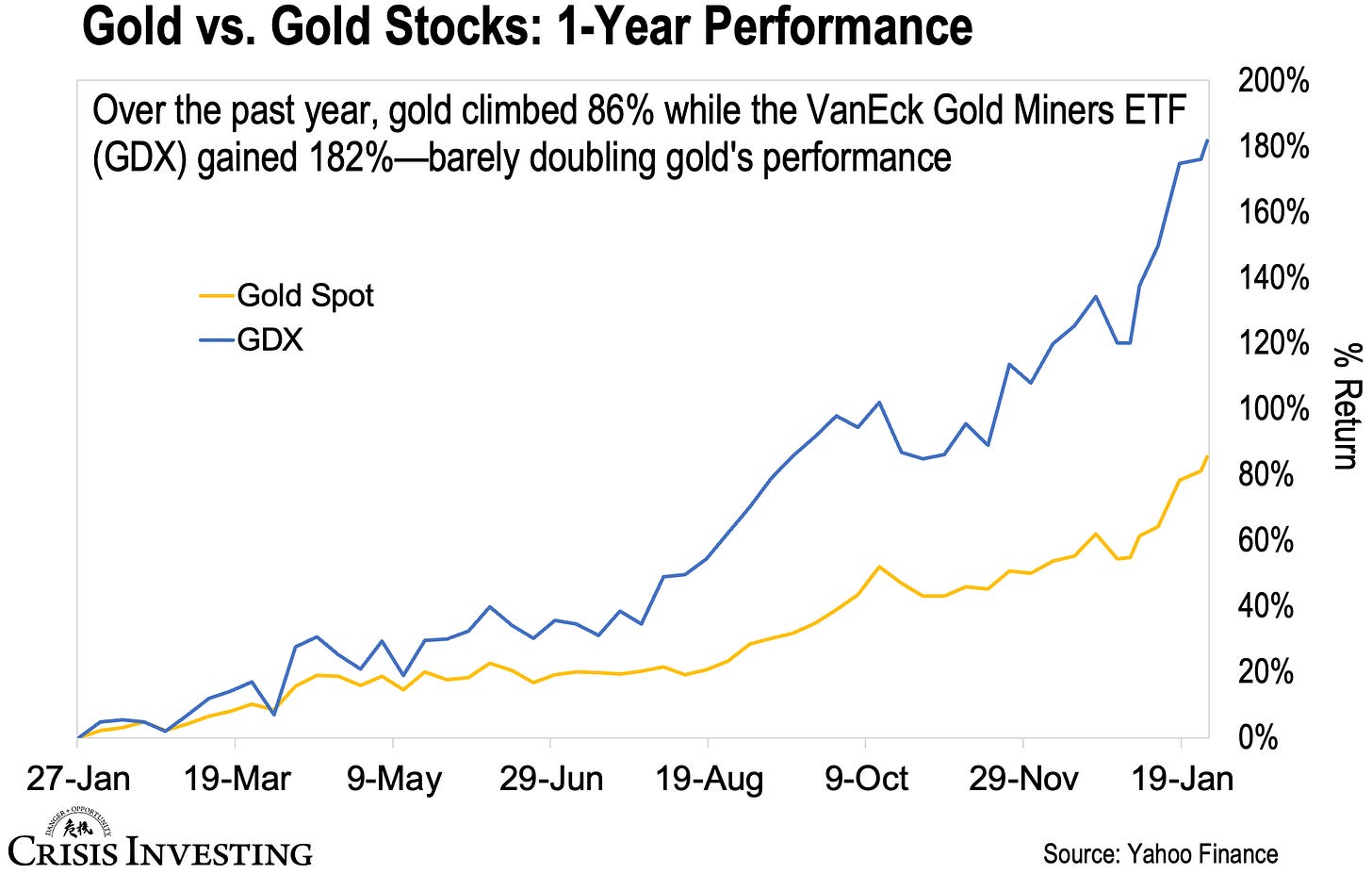

That’s a major milestone by any measure. Gold has gained 86% over the past year—climbing from around $2,735 to over $5,000. For context, the S&P 500 gained about 16% over the same period. In other words, gold didn’t just outperform stocks—it crushed them.

It's an extraordinary run that confirms the gold thesis we've been pounding the table on.

If you’ve been holding gold—or better yet, if you’ve been accumulating it over the past year—congratulations. You were right.

But the bigger opportunity might still be ahead. Here's what Doug Casey highlighted in a recent podcast:

The mining stocks are lagging. Badly.

Take a look at today’s chart comparing gold to the VanEck Gold Miners ETF (GDX)—a widely used benchmark for gold mining stocks—over the past year:

Now, at first glance, you might think: “Wait—gold miners are up 182%. That’s more than double gold’s 86% return. Isn’t that exactly the leverage we’re supposed to see?”

Not quite.

For mining stocks—which are supposed to amplify moves in the underlying metal—that 2-to-1 ratio is underwhelming. It’s not as disconnected as what we’ve seen with silver miners recently (which I wrote about here), but it’s still barely leverage. When gold moves this aggressively, well-positioned miners should be delivering 3-to-1, 5-to-1, or even 10-to-1 returns in a real bull market.

The fact that GDX is only up 182% while gold has climbed 86% tells you that the leverage hasn’t fully kicked in yet.

And that’s an opportunity.

History tells us why. Mining stocks tend to lag in the early-to-middle stages of precious metals bull markets. Investors pile into the metal first. The stocks follow later—but when they catch up, they move violently.

In the 1970s and early 2000s bull markets, miners eventually delivered 10-to-1, 50-to-1, or even 100-to-1 returns. That’s exactly what Doug’s been saying for months: we’re heading into another bubble like those earlier cycles, and the early stages are playing out right now.

Make no mistake, gold breaking $5,000 is a major milestone. It validates the thesis. But if history is any guide—and if Doug's right—the parabolic run in gold mining stocks is still ahead.

Regards,

Lau Vegys

P.S. In last month's Crisis Investing issue, we reviewed all our 2025 picks, including gold and precious metals plays positioned to benefit as this bull market accelerates. If you're a paid subscriber, make sure you haven't missed it. This month's issue is coming out this week, where we'll cover our thesis for 2026 and what we see shaping up—so keep an eye out for it, too.