Profiting From Disorder: A Crisis Investing Year in Review

'Crisis Investing' Issue 12 / December 2025 – Vol 2

Dear Reader,

As we wrap up 2025 and turn our attention to what lies ahead, now’s a good moment to look back at how the year unfolded.

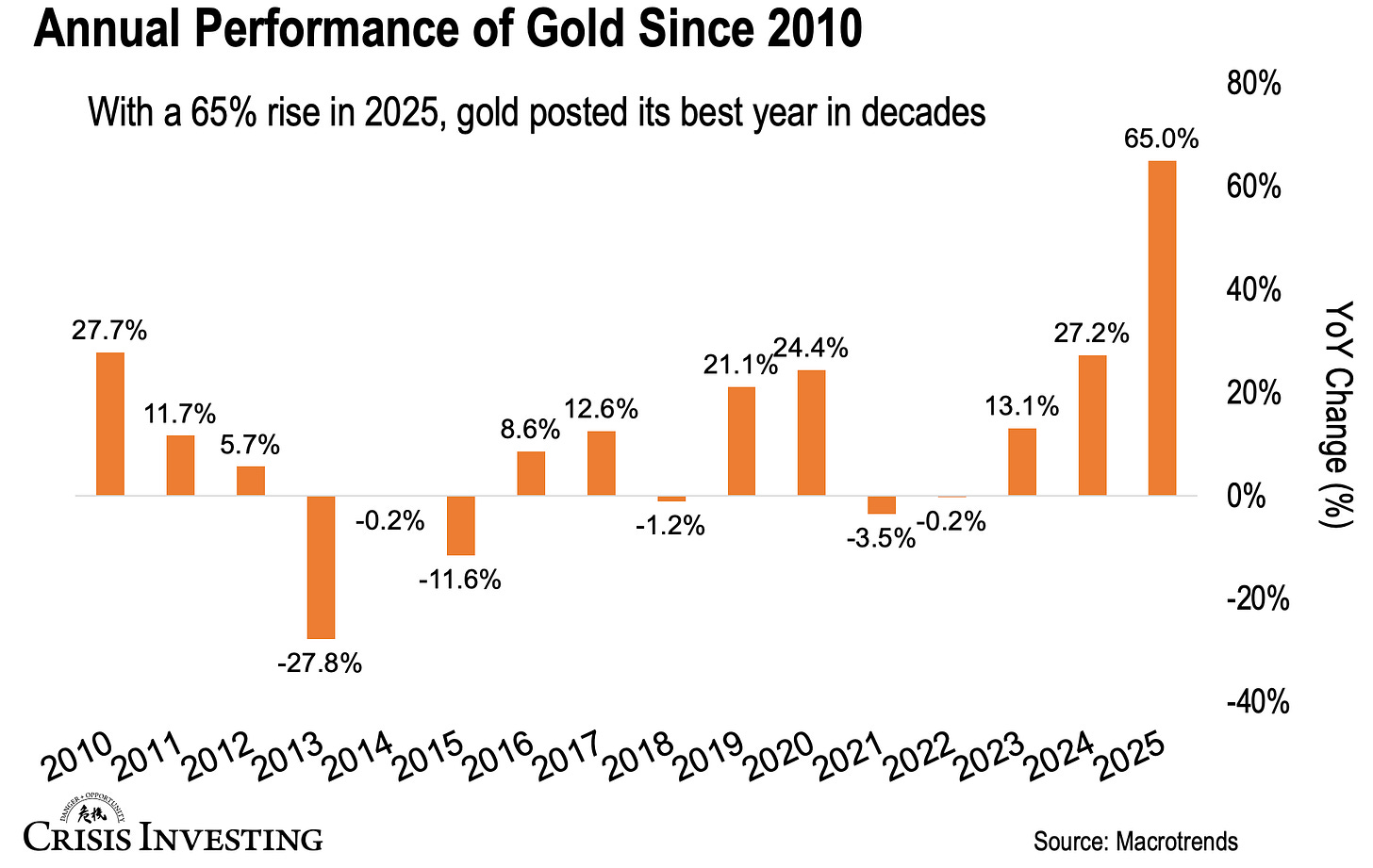

2025 was an extraordinary year for precious metals—one of the strongest performances in decades.

Gold surged from around $2,600 per ounce at the start of the year to over $4,300, up roughly 65%. That’s the strongest annual gain since 1979. The yellow metal set multiple all-time highs throughout the year, driven by Trump’s tariffs, geopolitical turmoil, and general boat-rocking, while central banks kept buying at a robust pace despite gold trading near record levels.

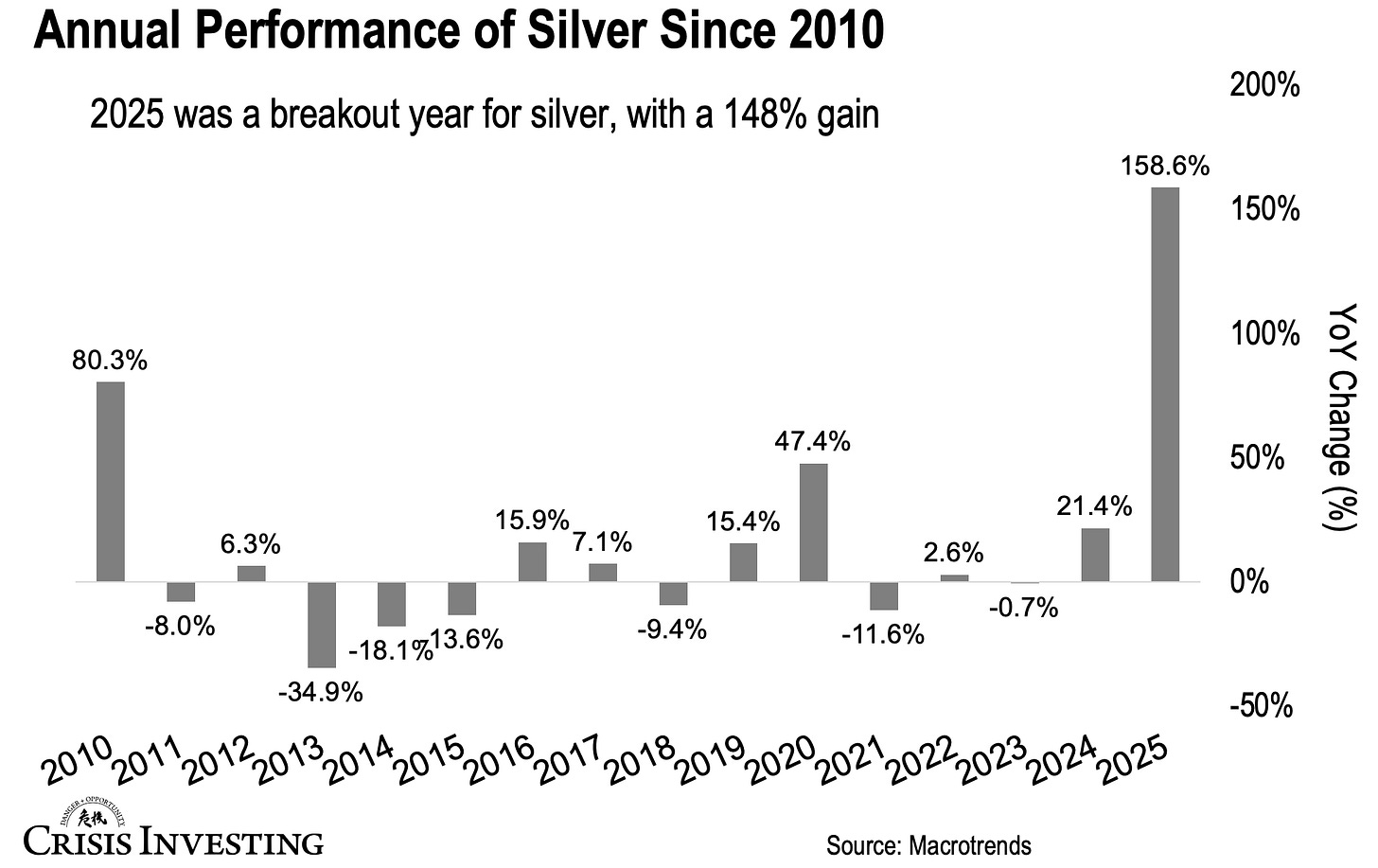

Silver’s performance was even more remarkable. The white metal climbed from around $29 per ounce to nearly $75—a gain of roughly 160%. That also marked silver’s strongest year since 1979. Unlike gold’s relatively steady march higher, silver experienced a dramatic squeeze during the second half of the year, particularly in China, as exchange vaults were emptied and industrial demand from solar, EVs, and data centers collided with surging investment flows.

I’m particularly happy about this one, since I’ve spent a lot of time banging the table on silver — explaining its gold-lagging but explosive nature across several essays. If you missed any of them, catch up here, here, here, and here.

You can see silver’s annual performance since 2010 in the chart below.

Those are spectacular numbers for the metals themselves. But what about our portfolio?

In last December's issue, I pointed to the massive disconnect between precious metals prices and mining stocks:

This disconnect presents some great ‘buy low’ opportunities. This is the essential first step in the ‘buy low, sell high’ formula - one that could pay off handsomely in 2025 for those who follow it.

That’s exactly what happened. Since then, our precious metals portfolio has delivered an average gain of about 140%.

But our wins this year weren't limited to precious metals. We also captured exceptional gains in critical minerals, copper, and other strategic sectors—proving that crisis investing isn't about betting on a single commodity, but identifying opportunities the market is mispricing across multiple areas.

Several individual positions delivered triple-digit returns, with gains of 468%, 365%, 320%, 259%, 152%, and 151%. Returns like that enabled us to take chips off the table along the way. This year we took Casey Free Rides on 11 positions after they doubled, allowing subscribers to lock in their initial capital while letting the remaining shares ride for free.

Note: Just earlier this month we took our two most recent CFRs—details here.

For context, if you’d owned all 11 from our original recommendations, you’d be averaging over 200% gains—with zero capital still at risk.

With that out of the way, starting this year we’re introducing a new December tradition: highlighting our top gainer as both a teaching example and a way of saying thank you to those of you who follow Doug Casey’s Crisis Investing but aren’t yet on the inside.

For 2025, that spotlight goes to MP Materials (MP)—up 152% from our May recommendation and a textbook example of crisis investing in action.

MP Materials is North America’s only active rare earth mine (and processing operation of scale), operating the Mountain Pass mine in California. When we recommended the stock in late May, the critical-minerals thesis was clear—but it still wasn’t fully appreciated by the market.

Yet for those willing to look, the pieces were already falling into place. The U.S. Department of Defense had committed funding to help MP build out domestic magnet manufacturing—essential for everything from EV motors to guided missiles. At the same time, major automakers were actively searching for non-Chinese rare earth supply for their EV programs.

In fact, just one month after our recommendation, Doug singled out MP Materials as his top pick in the Other Plays section of the portfolio during our portfolio review discussion.

He was right. The stock ran to nearly $100 per share in October—turning into a four-bagger before taking a breather. Along the way, we took profits as MP secured strategic supply agreements with defense contractors and auto manufacturers, continued advancing its magnet facility (expected to come online in 2026), and benefited from China announcing new export restrictions on rare earths.

This wasn’t luck. It was about identifying an undervalued company at the center of a strategic trend, entering at a reasonable valuation, and letting the thesis play out. That’s crisis investing in a nutshell.