Silver Breaks $100, But Silver Stocks Are Still Dirt Cheap

Chart of the Week #86

In yesterday's podcast, Doug Casey and Matt Smith discussed silver breaking $100 per ounce for the first time in history.

Doug’s take?

I’ll continue to hold, and if I get a chance to buy some more with some spare cash, yeah, I’ll do it. But I’m really interested in the mining stocks, which are just unbelievably lagging.

Doug’s spot on.

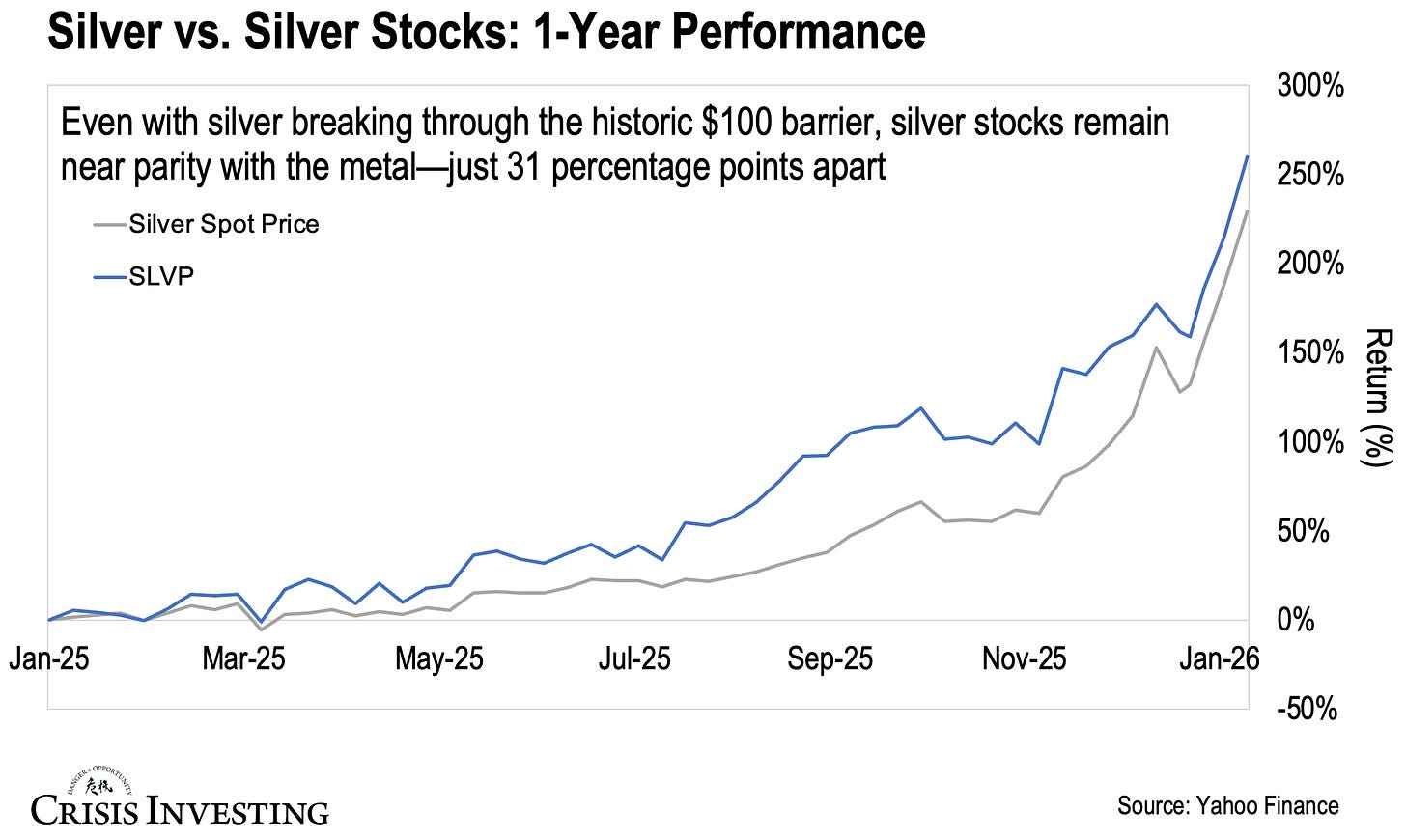

Silver has gained 229% over the past year—climbing from around $31 per ounce to over $100. That’s an extraordinary run by any measure. Meanwhile, silver mining stocks, as measured by the iShares MSCI Global Silver Miners ETF (SLVP), are up 260%. Take a look at this week’s chart:

For mining stocks—which are supposed to provide leverage to the underlying metal—that’s barely anything.

If you’re thinking this looks familiar, you’re right. About a month ago, I showed you a version of this same chart. Back then, silver was up 147% for the year while silver stocks had returned 181%—34 percentage points apart.

Fast forward to today—just one month later—and silver has climbed another 82 percentage points. That's an absolutely stunning run in such a short time. And the gap? It's actually narrowed—from 34 percentage points to just 31.

In other words, even after silver broke $100, mining stocks remain as cheap as ever—seemingly cheaper, even.

Now, these are obviously averages. There are individual stocks that have delivered much bigger gains than the index. But this is representative of the general trend we’ve also observed in our own Crisis Investing portfolio—the leverage from our silver picks hasn’t come in full force yet.

And that’s an opportunity.

As Doug said in yesterday’s podcast, his mining portfolio is already up 30% year to date. But he’s convinced we’re heading into a bubble in mining stocks like we saw in the ‘70s, ‘80s, and ‘90s—when entire portfolios would go 10-to-1 and individual stocks would go 50-to-1 or 100-to-1.

Silver breaking $100 is a major milestone. But if history is any guide—and if Doug’s right—the real fireworks in silver mining stocks are still ahead.

Regards,

Lau Vegys

P.S. In our latest Crisis Investing issue, we reviewed all our 2025 picks, including silver plays positioned to benefit as silver continues its run. If you’re a paid subscriber, make sure you haven’t missed it. If you’re not yet a subscriber, the lead is free for all readers.

https://www.youtube.com/watch?v=RVacfj1eDYU

Rick Rule Sold 80% of His SILVER to Buy THESE Miners - 'I Know I Did the Right Thing'

The leverage gap is whats really wild here. In past bull runs miners would go 10x-100x when the metal doubled, but right now theyre basically moving in lockstep with silver itself. Feels like the market is either priced for silver to crash back down or just hasn't caught on yet that this might be a sustained move. Either way, the assymetry is pretty clear if you think $100+ silver holds.