Gold Shatters $4,000

Why This Is Only the Beginning

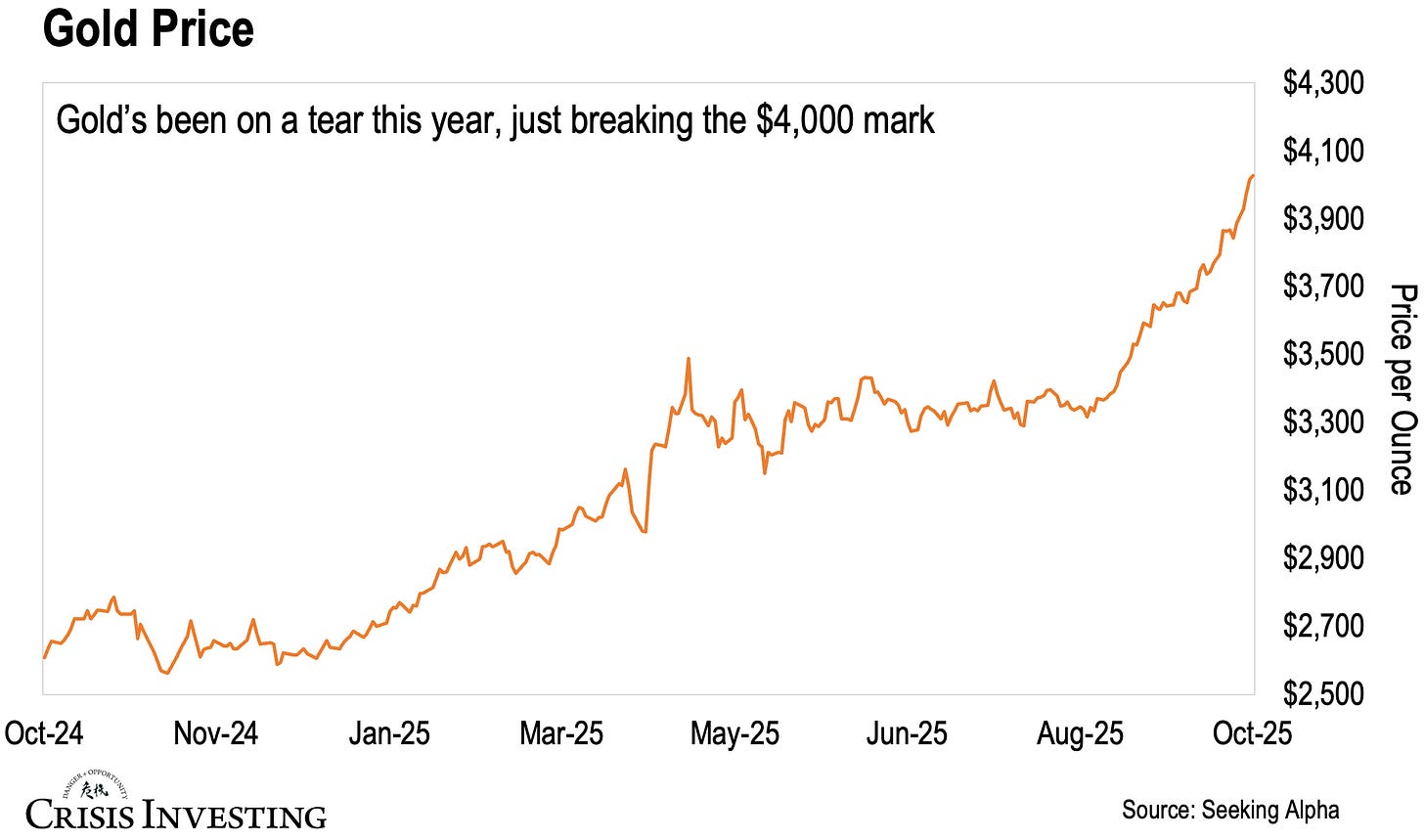

Gold has done it again. It just shattered through the $4,000 barrier. You can see gold’s relentless climb over the past year in the chart below.

As I write this, the metal is up an impressive 54.3% year-to-date—making it one of the best-performing assets of 2025.

I knew this was coming.

Back in December 2024, just weeks after Trump’s election as the 47th president, I published an essay urging people to hold on to their gold—or better yet, buy more. At the time, many thought that with Trump in office, their worries were over and they could dial back their gold investments. But I saw a dangerous naivety in this thinking.

Thankfully, I was able to persuade those close to me—and hopefully some of my readers—to stick to their gold (and gold stocks). Those who heeded that advice are likely sitting on substantial gains right now.

But I’m sending this update — not to brag about having a crystal ball (I don’t) — but because I suspect many readers are feeling uneasy about gold at these record levels, wondering if it’s too late to add more.

I understand the hesitation. Between now and year-end, we’re navigating some of the most uncertain conditions in recent memory. And 2026 isn’t looking any more predictable.

But here’s the reality: gold isn’t trading at $4,000 by accident. It’s a direct reflection of that uncertainty. Time and again, the yellow metal has proven itself as the ultimate hedge — through political upheavals, currency collapses, and market crashes alike.

That’s exactly why it deserves a place in your portfolio now — and why adding to your position could be one of the smartest moves you make before the next storm hits.

But let’s dig a little deeper so you can really appreciate what I’m saying here.

The Central Bank Gold Rush Continues

As I showed you in the latest issue of Crisis Investing, the real story behind this rally is unfolding quietly in the vaults of central banks around the world.

For three consecutive years, central banks have purchased over 1,000 tons of gold annually. To put that in perspective, the average annual buying in the decade before 2022 was just 400-500 tons. In other words, they’ve more than doubled their accumulation rate.

Central banks are now buying roughly 80 metric tons per month—equivalent to about $10.3 billion at current prices.

But what’s even more striking is their outlook on the future. According to the World Gold Council’s recent survey, a record 43% of central bankers plan to boost their gold reserves over the next 12 months—up from 29% a year ago.

Perhaps most remarkable, about 95% of them also believed global official gold reserves would continue to increase.

Let that sink in.

The world’s most conservative financial managers — those overseeing trillions in national reserves — are almost universally saying the same thing: gold accumulation will continue.

(Hardly sounds like the time to sell, wouldn’t you say?)

Why There’s Still Enormous Upside

There are plenty of reasons for this — in fact, you could say there are about $7 trillion of them.

Let me explain.

For years, the dollar made up more than 70% of global reserves. Today, it’s only about 58%.

A big drop, yes — but it still represents $7–7.5 trillion sitting in the vaults of foreign governments and central banks. That’s a lot of dry powder — and it could keep fueling gold’s rise for years to come. After all, a trend in motion tends to stay in motion — and confidence in the U.S. government and its currency is fading quickly around the world.

In fact, with debt now well past $37 trillion, government spending more out of control than ever, and deficits running unchecked, that confidence is probably at an all-time low.

Now, if a relatively modest flow of capital and demand has already pushed gold from $2,000 to $4,000 in recent years, just imagine what happens when even a fraction of those remaining trillions starts shifting into physical metal.

What does a 5% shift in dollar reserves mean for gold prices? Could we see $10,000 per ounce? Would 10% take us to $15,000? What about 20% pushing toward $25,000 or beyond?

Again, I don’t have a crystal ball (to predict the exact figures). But these projections no longer seem far-fetched. The bottom line — the upside here is still huge.

The Real Opportunity

Doug Casey has always said you need to make the trend your friend — and that applies perfectly to gold right now.

The trend is truly your friend here.

Sure, in the short term there’ll be plenty of noise and volatility. But if you can look past that, gold still stands out as one of the biggest opportunities for 2026 and well beyond — possibly the entire next decade.

And that goes double for gold stocks. Because even after the massive run in gold, many miners are still deeply undervalued relative to the long-term intrinsic value of their businesses.

Several of our gold picks in the Crisis Investing portfolio have already doubled, tripled, or even quadrupled over the past year. One of them is up nearly 240% — and even after that, it still trades at a forward P/E below 6 while generating strong operating cash flow. That’s just one example of the kind of value we’re still seeing in this sector. There are plenty more.

On that note, we just published our latest gold-focused issue last week — so make sure to check it out. Even if you’re not a paid subscriber, I’d recommend reading the lead story. It’s free and dives deeper into why this gold bull market still has a long way to run.

Regards,

Lau Vegys

Great article and thanks for the link.

While I agree with your outlook for gold, your near double of central bankers buying gold from 29% to 43% is off. A 50% increase would be 43.5%, no where near a double.