Silver Valuation Gap—Time-Sensitive Update (Lock In Profits + New Buy Levels)

'Crisis Investing' Alert

Dear Crisis Investing Subscribers,

We’re witnessing history unfold in real time.

Gold just broke through $5,000 per ounce for the first time ever. Silver crossed $100—a level it’s never seen before—and is now trading around $119. Both metals have delivered extraordinary returns over the past year, with gold up 87% and silver up 282%. I’ve been covering this in recent essays (catch up here, and here)—the momentum has been extraordinary.

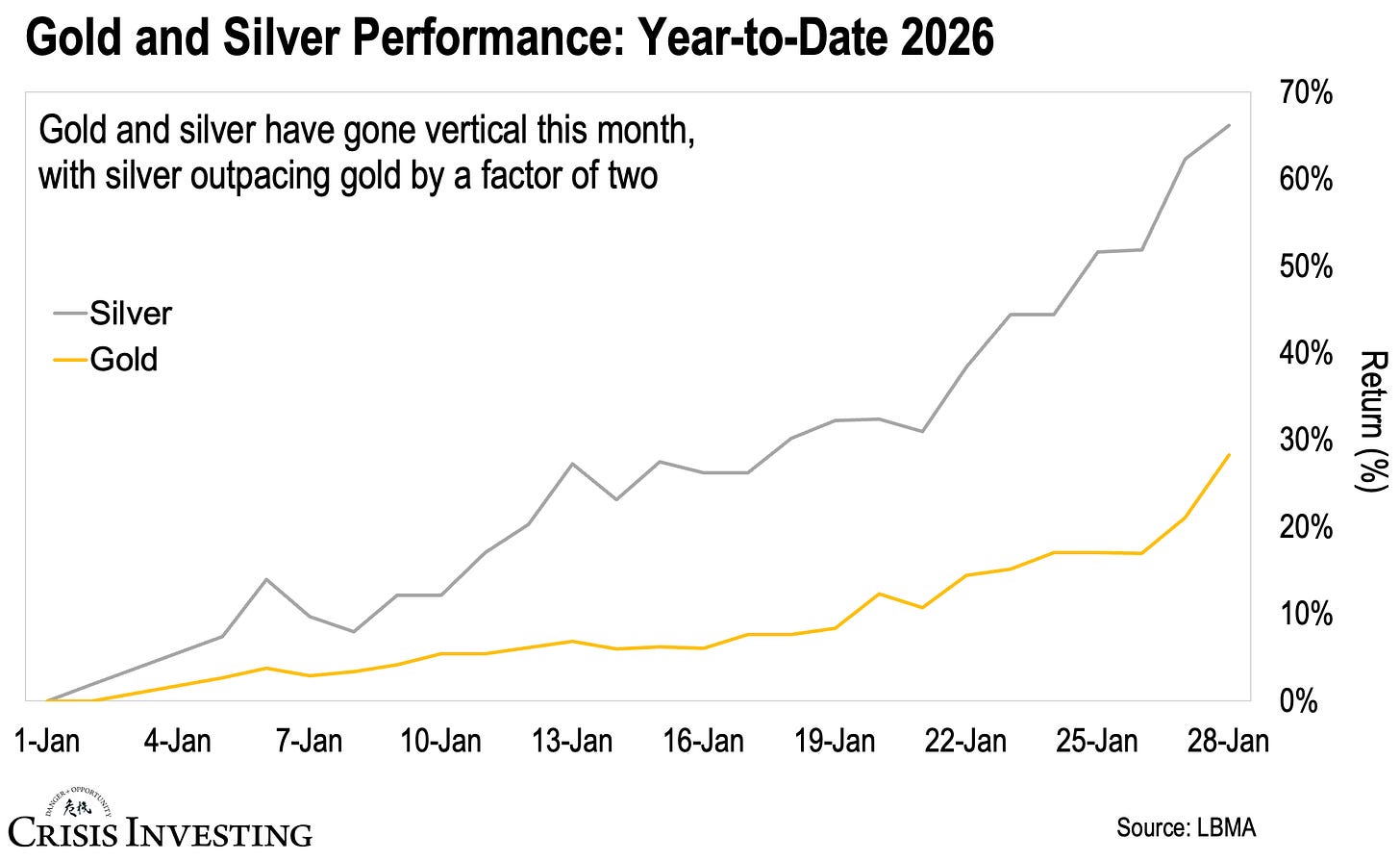

But what’s even more remarkable is the price action we’ve seen just this month. Since January 1st, gold has surged from around $4,330 to over $5,500—a nearly 30% gain in less than 30 days. Silver’s move has been even more dramatic, climbing from around $71 to $118—a 66% jump in the same period.

This shouldn't be surprising to anyone who read our Trump's Reset report last year, in which we outlined our bullish case for precious metals in 2025 and beyond. (By the way, we’ll also be diving into our full 2026 thesis in tomorrow’s issue—look out for that.) So I won’t bore you with outlining the catalysts and drivers behind this move today—you get plenty of information on that in our podcasts, essays, and other content.

But the key point is this: the speed and magnitude of this move suggests we're entering a new phase of the precious metals bull market—one where fear of missing out (FOMO), momentum, and paradigm shifts like China's strategic silver export controls (which I wrote about recently) converge to drive prices into territory that seemed impossible just months ago.

Now, for those tracking our Crisis Investing portfolio—specifically our precious metals section—you’ve probably noticed something: most positions have delivered at least a double and are thus rated Casey Free Rides (our systematic profit-taking protocol where you sell half when a stock doubles and HOLD the rest). As stocks have run up alongside the metals, this has created a challenge for newer subscribers looking to establish positions—and I’ve heard from many of you about it.

Here’s what we’re doing about it.

Tomorrow, we’re publishing the January issue where Matt Smith will be outlining our Crisis Investing thesis for 2026. We’ll also be revising several of our gold and precious metals positions from HOLD to BUY based on this month’s extraordinary price action in the underlying metals. We’re still finalizing which positions make the cut, and we'll share those updates with you tomorrow.

But I didn’t want to wait until tomorrow to give you guidance on our silver positions. Silver’s move has been even more dramatic than gold’s—crossing the psychologically significant $100 milestone for the first time in history—and as I’ve been pointing out in recent essays, silver mining stocks are still dramatically lagging the metal itself.

That unusual valuation gap represents one of the best risk/reward setups in the market right now—and it won’t stay open forever. We’re comfortable enough with our two silver positions that we’re updating them today, ahead of tomorrow’s full issue.

This alert covers:

How to lock in profits on the silver position that’s already doubled.

Why silver mining stocks are still dirt cheap despite silver’s historic rally.

Updated BUY guidance on our two silver positions for new subscribers.

Specific buy-up-to price levels based on current market conditions.

If you’re a paid subscriber, read on. If not, consider subscribing—we’re entering what could be the most explosive phase of the precious metals bull market, and you don’t want to be on the sidelines for what comes next.