Europe Just Entered Rare Earth Panic

Inside the EU’s Rush to Secure Rare Earths

Last week, the Financial Times broke a story that should make every investor sit up and take notice.

Turns out, the European Commission—the most powerful institution in the European Union (EU)—is preparing to boost emergency stockpiles of critical minerals (in addition to nuclear fuel, and even food and medicines).

According to a draft EU document, the measure serves as a safeguard for the 27-nation bloc facing "an increasingly complex and deteriorating risk landscape marked by rising geopolitical tensions.”

Translation: Europe’s top brass is so rattled by everything going on in the world, they’ve basically gone full prepper mode.

The Commission is now advising member states to ramp up stockpiling of rare earth minerals and permanent magnets. These, as you probably know, are critical for both energy and military systems.

Often, when governments start acting erratically, it has real investment implications—and this is a textbook example.

Let’s unpack it.

When the Eurocrats Start Panicking

Now, if you know anything about European politicians and bureaucrats, you probably know they don't move fast. These are the same people who spent years debating the curvature of bananas and the proper wattage of vacuum cleaners.

I should know.

As a student, I interned at the European Parliament and ran into plenty of these types. They love shuffling papers, but actual work—and this will involve actual work—is like kryptonite to Superman. They’d much rather mingle at a taxpayer-funded wine-and-cheese reception, applauding interpretive dance pieces about colonial guilt.

I remember once being asked to help draft a position paper on lightbulb efficiency standards. After hours of back and forth, the big debate wasn’t about energy savings or cost—it was whether the wording should include “environmentally harmonious illumination.” Meanwhile, outside the building, farmers were literally spraying manure at police and setting hay bales on fire. That was the moment I realized most of these people live in a different universe.

So if Europe is suddenly scrambling to stockpile rare earths, you can bet the crisis is already well underway.

But why now?

Well, as you probably know, rare earths are essential for modern tech, advanced weaponry, and industrial systems—you name it. These aren’t just nice-to-have materials for consumer gadgets. They’re foundational to the modern world. And China controls nearly 70% of global rare earth production—and an even bigger share of the processing.

But none of that is news.

It’s also not exactly breaking news that China happens to be Russia’s biggest ally. Sure, that’s a problem for the EU. But they could’ve lived with it—if it weren’t for what’s happened over the past year.

You see, China’s been tightening its grip on rare earth exports throughout 2024 and 2025. First came restrictions on gallium, germanium, and antimony—aimed at the U.S. That was just the opening shot.

Then China dropped the real bombshell.

In April, it imposed export restrictions on seven of the 17 rare earth elements, including the high-performance magnets that power everything from fighter jets to wind farms. And this wasn’t just aimed at the U.S.—this was a blanket policy. Everyone got hit.

As I told you back in June, this sent much of the developed world scrambling. Automakers across the U.S., Europe, Japan, and Korea either halted production or warned that full factory shutdowns “could be needed.”

So yeah… you can see why the EU’s career politicians are spooked.

No rare earths? Say goodbye to the green agenda, a functioning military, and what's left of Europe's industrial base. For EU politicians, that could mean the unthinkable—losing their cushy seats.

Just In

Just as I was about to hit send on this piece, I did a little more digging—and wouldn’t you know it, Reuters just dropped some fresh news:

The European Parliament condemned China on Thursday over its export restrictions on rare earths and insisted the European Union must reject any attempts by Beijing to use the restrictions to force concessions from the bloc.

As Ron Burgundy would say: “Well, that escalated quickly.”

But don’t be fooled—this is just Brussels doing what it does best: puffing its chest while tripping over its own shoelaces.

The motion—passed by a wide majority—urges China to lift restrictions “imposed in the midst of a trade war with the United States.”

Yeah, I’m sure China is shaking in their boots.

Sure, it might ruffle a few feathers in Beijing, but in reality, it’s just another textbook case of the EU talking tough while doing nothing that actually helps its own citizens.

If Brussels actually wanted to help, it could start by getting out of the way—and nudging member states to cut through the environmental red tape and streamline permitting.

But your average EU Joe shouldn’t hold his breath.

A European version of Trump’s March 2025 Executive Order—which used emergency powers to fast-track domestic rare earth mining and processing—isn’t coming anytime soon.

There’s no mention of boosting local mining or processing in the draft EU Commission document I mentioned.

Classic Brussels. They want the benefits, but none of the mess.

And with Europe's layers of red tape, strong NIMBY sentiment, and only patchy refining capacity so far... good luck. Just look at the Norra Kärr project in Sweden—stalled for years over environmental protests. Or here in Spain—where I happen to be at the moment—the Matamulas deposit continues to face ferocious opposition, despite being one of the most advanced rare earth projects in Western Europe.

Trust me, Europe won’t be mining or refining rare earths in any meaningful way anytime soon.

Before the Mania Begins

This means Europeans will stay buyers—just much bigger ones—not producers.

And that’s great news if you’re on the other side of the trade.

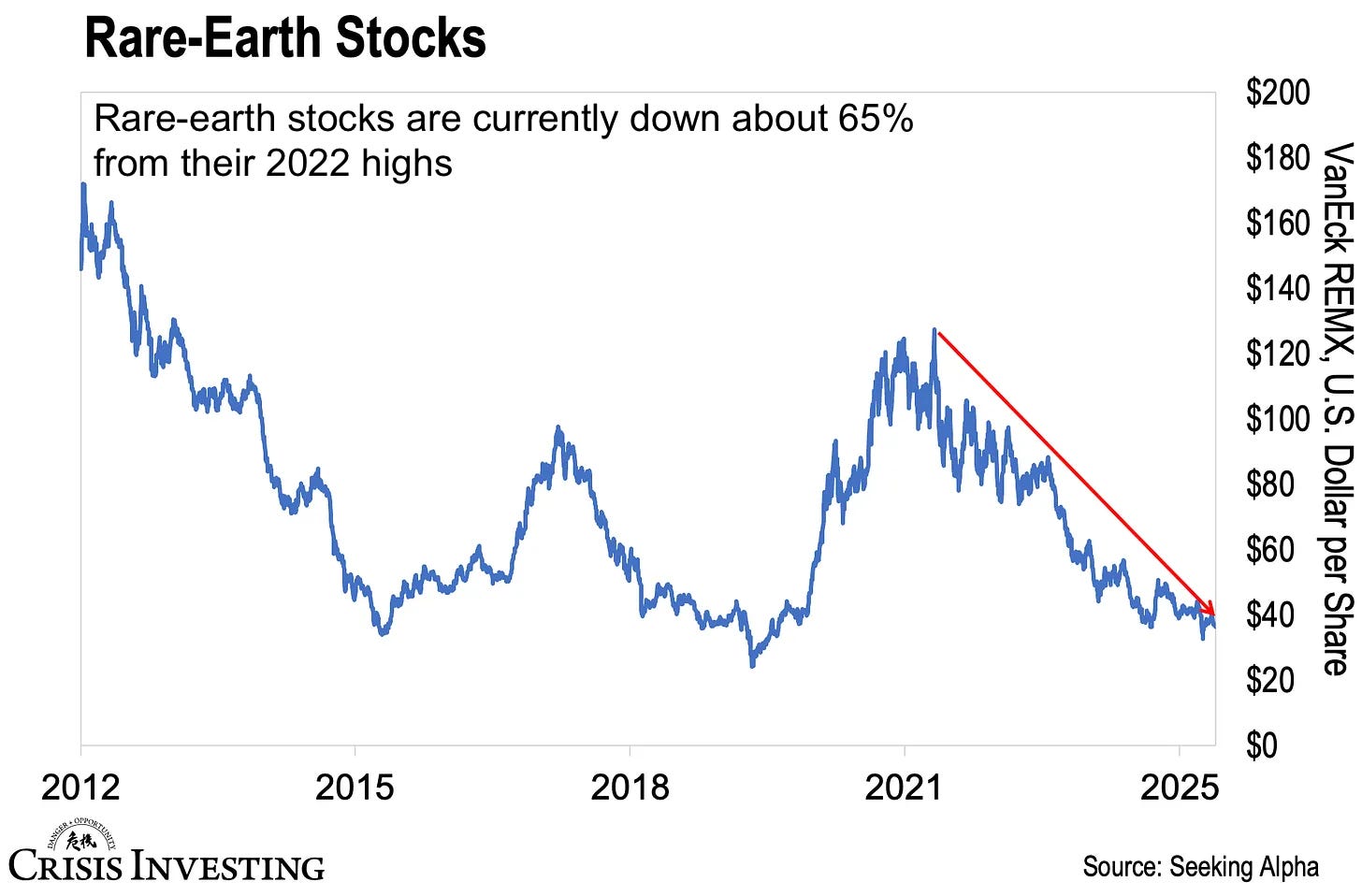

Yet despite this perfect storm of geopolitical tension and government panic, rare earth stock prices are near cycle lows. Take a look.

What jumps out is that rare earth stocks still haven’t broken out of their three-year downtrend. The chart shows the VanEck Rare Earth and Strategic Metals ETF (REMX)—a go-to proxy for the rare earths sector—and it remains nearly 65% below its 2022 peak.

Now, here's something else to note that's not super clear in the chart above: just how much rare earth stocks remain down from the 2010 bull market. That was when China's rare earths export ban sparked a frenzied rally in rare earth stocks. While I couldn't track down all the price data going that far back for this chart, a quick search on Yahoo Finance will show you that REMX is now trading nearly 90% below its 2010 highs.

Not a bad time to get in ahead of a potential mania (which we already did—here and here, in our last two issues of Crisis Investing).

Regards,

Lau Vegys

P.S. It doesn’t take much to see that these are uncertain times. And if there’s one thing you’ll want when things start to unravel, it’s a Plan B. If you’re seriously considering one, we’re hosting The Plan B: Uruguay Conference, October 13-16, 2025, in Punta del Este. There’s going to be a lot going on, but the goal is simple—to show you why an increasing number of people, including Matt Smith and Doug Casey himself, chose Uruguay as their Plan B destination, and how you might, too. It’s gearing up to be a fantastic event, and I suggest you take a look. Here’s the link for more information.

MP Materials on a tear yesterday. I took my first Casey free ride at 98% gain. Thanks Lau.

For the remaining free ride shares owned, what would the strategy be? Just hold until one becomes bearish on the stock, then sell all the remaining shares?

Sweden recently found an enormous rare earth deposit that can supply EU for the next 50 years. It’s called ”Per Geijer” and the state owned company LKAB owns it.