Times of Acceleration Are Upon Us—Here's How We Profit

'Crisis Investing' Issue 10 / October 2025 – Vol 2

Dear Reader,

We’re living in times of acceleration. And I don’t just mean how fast young people grow up or how quickly technology moves. Because one thing that’s accelerating even faster is U.S. government debt.

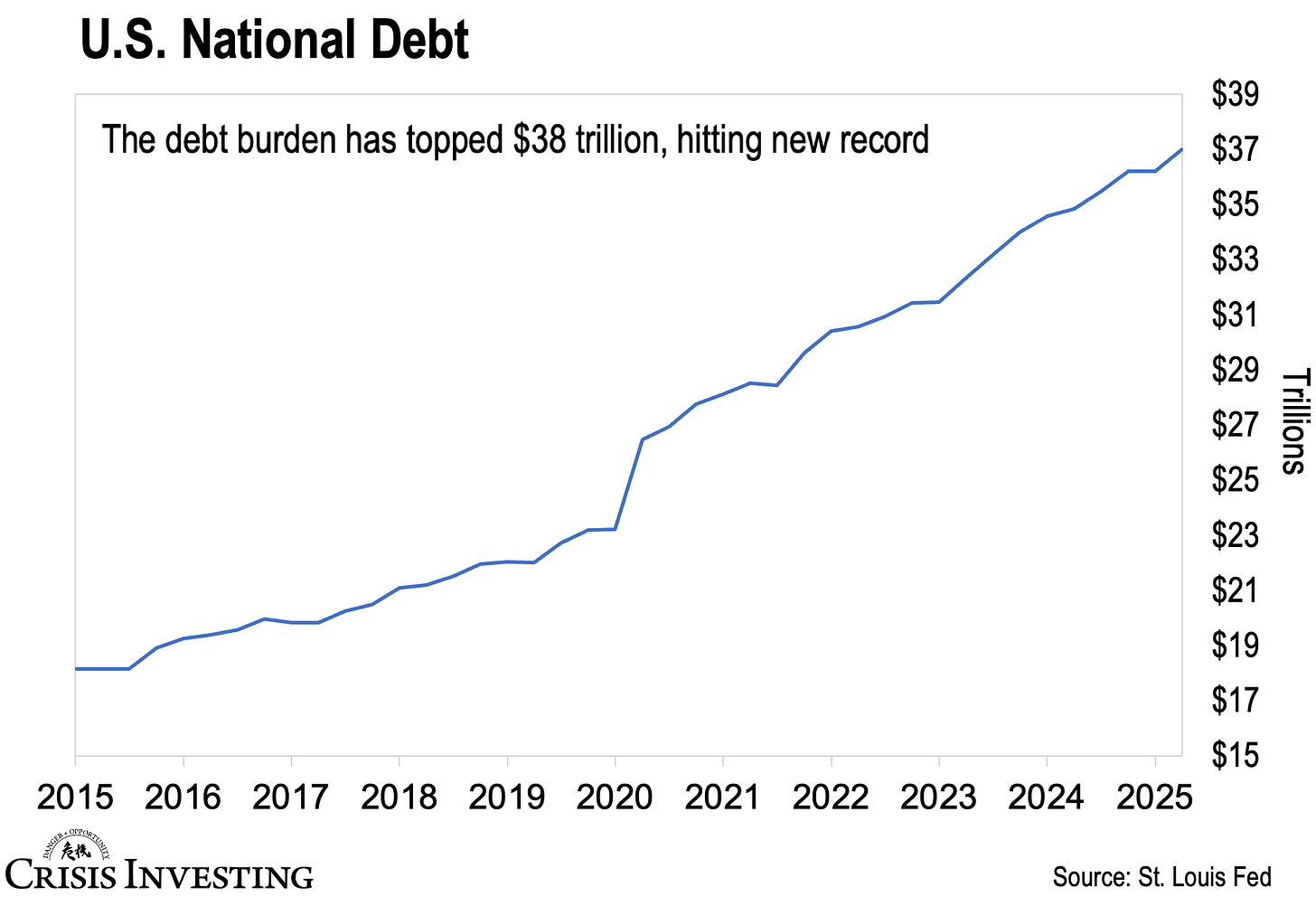

Last week, it crossed $38 trillion for the first time in history.

We added $500 billion in October alone—$23 billion per day. That’s one of the fastest surges outside the pandemic years.

Here’s how fast it’s piling up: $34 trillion in January 2024. $35 trillion by July. $36 trillion by November that year. $37 trillion in August 2025. And now $38 trillion in October.

Clearly, the pace is accelerating.

And the same thing shows up when you zoom out.

Back in 2015, the U.S. national debt was about $18.1 trillion. Today it’s $38 trillion and counting. That’s more than a double in just ten years—a staggering pace compared to previous decades.

So when people ask whether gold and silver still have room to run, I just point to this chart. You can literally see the acceleration right there.

Point is, there’s no way all of this debt gets paid off without massive currency devaluation. None. Zero. Zilch.

But that’s just the debt.

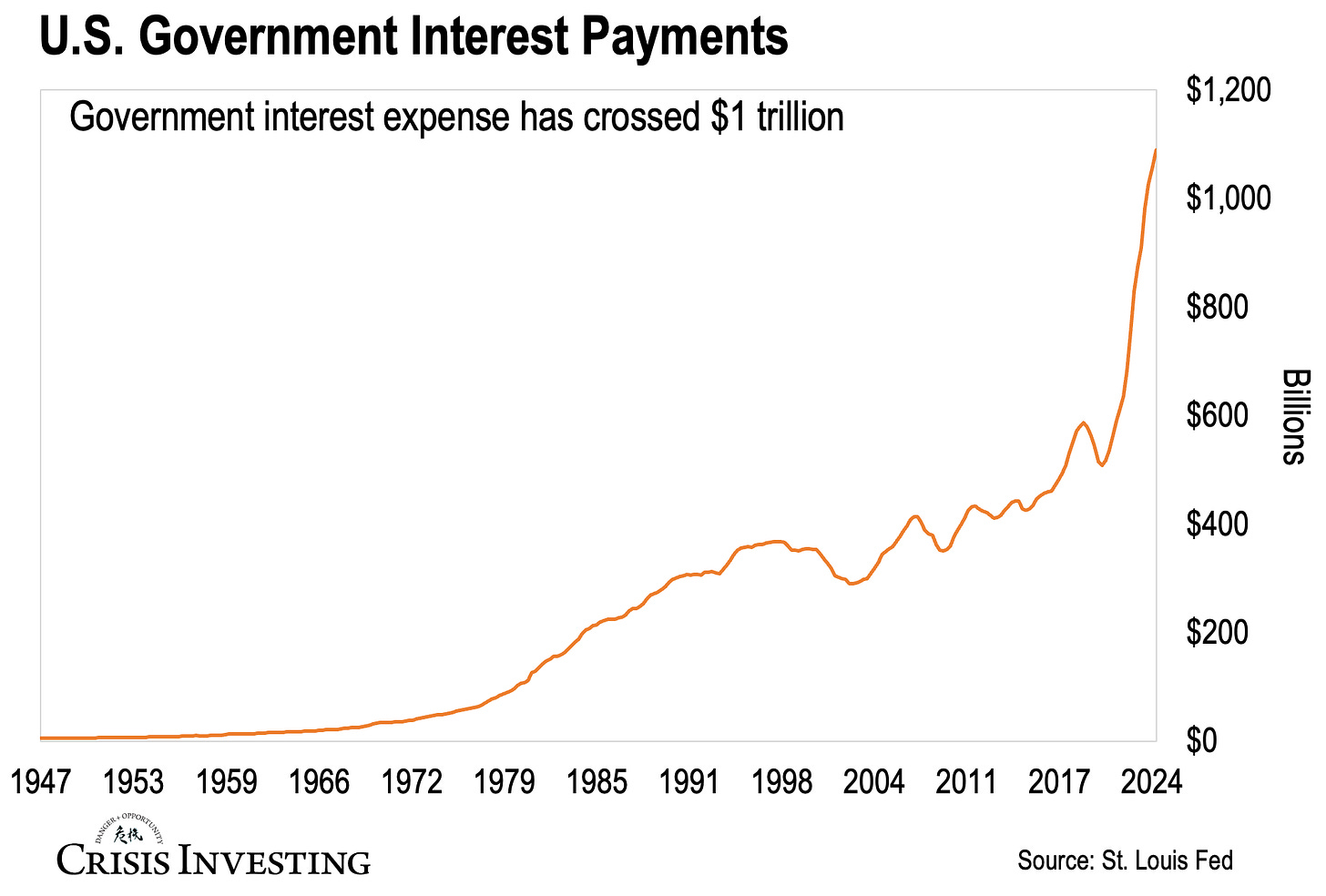

Because we all know what the real killer is—the interest.

Right now, the U.S. is spending over $1 trillion a year just to service the federal debt—that’s more than it spends on the military.

Note: Even after the Fed’s latest rate cut, average borrowing costs are still more than double what they were in 2021—sitting around 3.4% today.

Over the past decade, Washington has paid roughly $5 trillion in interest. But again, everything’s accelerating. Over the next ten years, that figure is projected to soar to around $14 trillion.

All of this debt. All of this interest.

Again, there’s simply no way all of this gets paid off without massive currency devaluation.

The math doesn’t work any other way. They can’t cut spending enough—it’s politically impossible. They can’t tax enough—it’s economically destructive. And they certainly can’t default—that would be globally catastrophic.

And as crazy as it sounds, it actually gets worse. Remember, that $38 trillion figure only covers federal government debt. Add in corporate, household, and financial sector debt, and America’s total debt now stands near $100 trillion. That’s about 324% of GDP—more than three times the size of the entire U.S. economy.

That leaves the powers that be with only one option: inflate it away. Debase the currency and let inflation quietly chip away at the real value of what we owe.

It’s already happening—and like everything I mentioned above—the debt, the interest expense, all of it—it’s going to accelerate.

This environment is rocket fuel for assets that can’t be printed—things with real scarcity and no counterparty risk. The trick is, you need to have exposure… or, as the younger crowd likes to say, you’re cooked.

Last month, we recommended a gold play to capitalize on this dynamic. This month, I want to focus on silver.

Because silver is setting up for its most explosive move in decades. Yes, it’s already up about 60% this year—but I think that’s only the beginning.

Now, I’ve written about silver at length before—so I won’t rehash what’s already been said (you can catch up here and here). But I will remind you that silver is known for its gold-lagging behavior. It tends to trail gold early in precious-metals bull markets, then catches up with explosive force that often leaves gold in the dust.

For example:

During the 1970s bull market, gold climbed about 440% from its 1976 low near $100/oz to over $540/oz by 1980. Silver, meanwhile, soared more than 700%, exploding from around $4 to nearly $35.

In the 2000s bull market, gold rose roughly 600% between 2001 and 2011 (from $255 to $1,900), while silver skyrocketed about 1,050%, from $4.10 to almost $48.

Even in the pandemic rally of 2020, gold gained around 40% from its 2018 low to 2020’s peak, while silver jumped roughly 125% from its March 2020 bottom to August that same year.

These are just a few examples off the top of my head—there have been more.

But here’s the point: with U.S. debt at an all-time high and the Fed warming up the money printer, gold is going higher. It just is. I’ve been saying it for almost two years now, and while the trend’s already played out beautifully, the real fireworks likely haven’t even begun.

And silver? Well, its catch-up phase is just getting started—but if everything else is accelerating, you can bet its gains probably will too.

Remember — the metal only broke above its 2011 all-time high last month. Gold did that back in 2020 — five years ago. And silver stocks? They still haven’t broken through. Despite gaining over 70% in the past year, the Global X Silver Miners ETF (SIL) is still sitting about 30% below its 2011 peak.

This creates exactly the kind of asymmetric opportunity we look for.