The Trump Reset in Action: Dollar Down 9% Since Inauguration

Chart of the Week #90

A year ago this month, we laid out what might be the most important thesis we've ever published in Crisis Investing: the Mar-a-Lago Accord—or, as it became known, the Trump Reset.

The core prediction was simple: the Trump administration was engineering a controlled devaluation of the dollar to reset America’s unsustainable fiscal trajectory. Everything else—surging gold, expanding money supply, Fed policy reversals—flows from that one central bet: a weaker dollar.

And that’s exactly what we got.

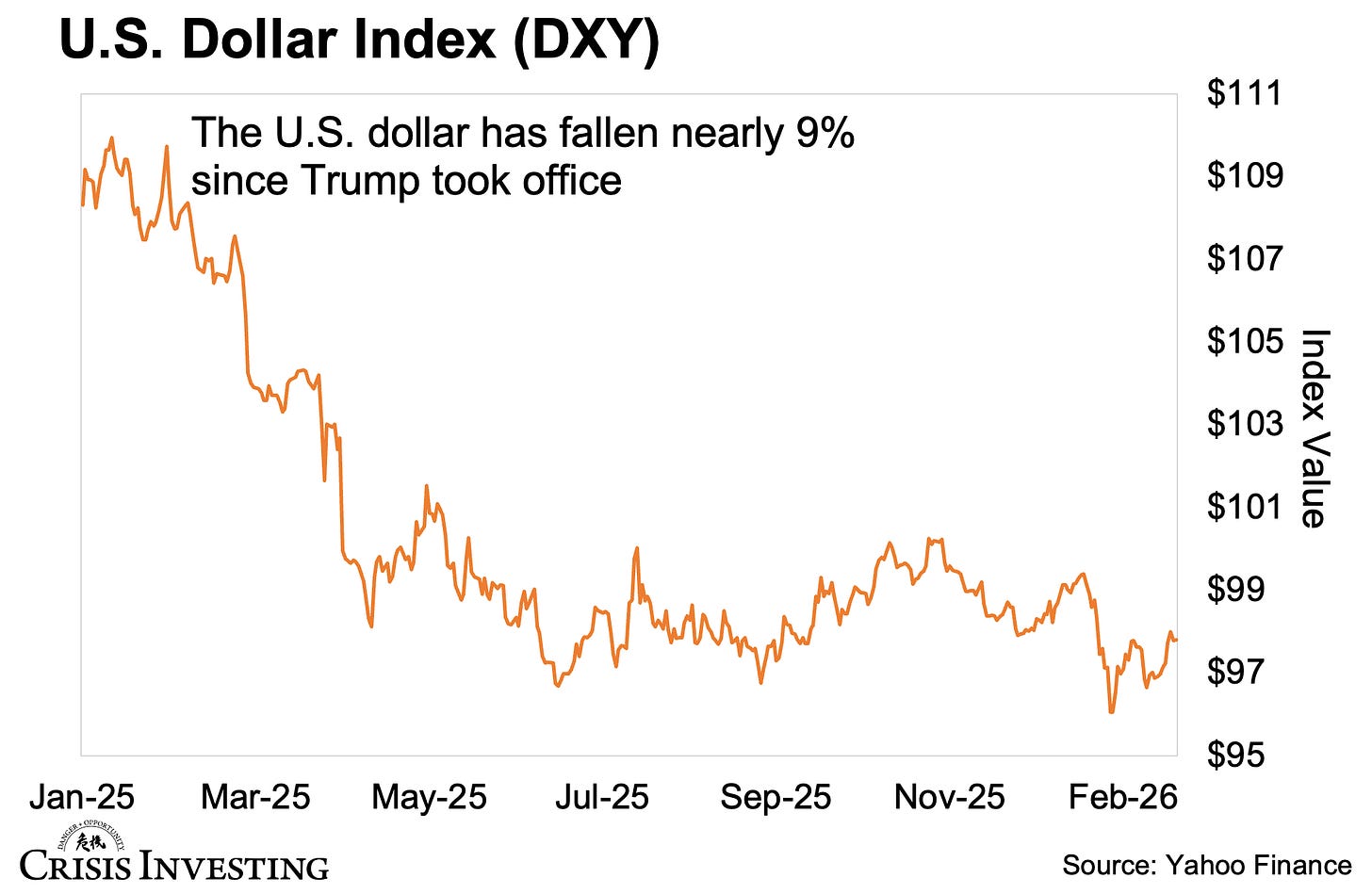

Take a look at today’s chart:

As you can see, the U.S. dollar has fallen nearly 9% since Trump took office. Until recently, the decline was even sharper—through June 2025, the dollar had posted its worst first-half performance in over 50 years, down 10.7%. It’s bounced back slightly since then, but here’s the thing: the dollar isn’t supposed to move like this. It’s the global reserve currency. When it drops this much in a year, that isn’t normal volatility. It’s a deliberate reset.

At the same time, the Fed quietly turned the money printer back on. Starting December 12, the Fed began purchasing roughly $40 billion per month in Treasury bills. Powell calls it “reserve management.” We call it what it is: stealth money printing. The Fed isn’t buying long-dated Treasuries or mortgage-backed securities—not yet—but it is creating $40 billion in fresh liquidity every month. Programs like this are never the end. They’re the warm-up act.

Global central banks were watching—and acting. They kept accumulating gold throughout the year, lifting it to nearly 20% of official reserves, up from 15% at the end of 2023. That buying wasn’t coincidence.

The result? Gold nearly doubled—from around $2,600 when Trump took office to over $5,000 today.

But here’s the thing: it’s just the beginning. And whether this reset unfolds as planned—or spirals into something far worse—remains an open question.

What does “far worse” look like?

Well, Doug Casey warns this could become what he calls the "Greater Depression"—and as we laid out in our latest Crisis Investing issue, the early signs are already here. But this won’t be like the 1930s. That was deflationary. This time is inflationary.

In the 1930s, prices collapsed. Currency became worth more. People holding dollars had the upper hand. This time runs the opposite direction. As Doug recently wrote:

Instead of letting the economy cleanse itself by allowing the financial markets to collapse, governments will probably bail out insolvent banks, create mortgages wholesale to prop up real estate, and central banks will buy bonds to keep their prices from plummeting. All of these actions mean that the total money supply will grow enormously.

The implications are brutal. If you find men selling apples on street corners, Doug says, it won’t be for 5 cents apiece like in the 1930s—but $5 apiece.

The bottom line? Whether the Trump administration pulls off a controlled devaluation or we get Doug's inflationary depression, the outcome for dollar holders is the same: your cash gets destroyed. The only difference is how fast.

So, own physical gold. Own it outside the banking system. Own it in secure jurisdictions. This isn’t speculation. It’s insurance against a reset that’s already happening.

Regards,

Lau Vegys

P.S. For leverage to gold’s rise, Doug also recommends having exposure to precious metals mining stocks. That’s why a significant portion of our Crisis Investing portfolio is dedicated to these stocks, most of which Doug himself owns. In our latest issue, we outlined our thesis for the year and raised buy guidance on several precious-metals positions.

Yes, secure places where my gold cannot be seized. Where are these places? After seeing what happened to that Venezuelan president I don’t think such places exist. Seems like Bitcoin is a better solution. Cannot be seized. Can easily travel with it. Can easily use Lightning to transact.

What are some examples of “secure jurisdictions?” (Places to hold physical gold)