The Reset Has Begun—Our 2026 Thesis and How to Position

'Crisis Investing' Issue 1 / January 2026 – Vol 3

Dear Reader,

Welcome to the new year—and to many of you, welcome to Crisis Investing.

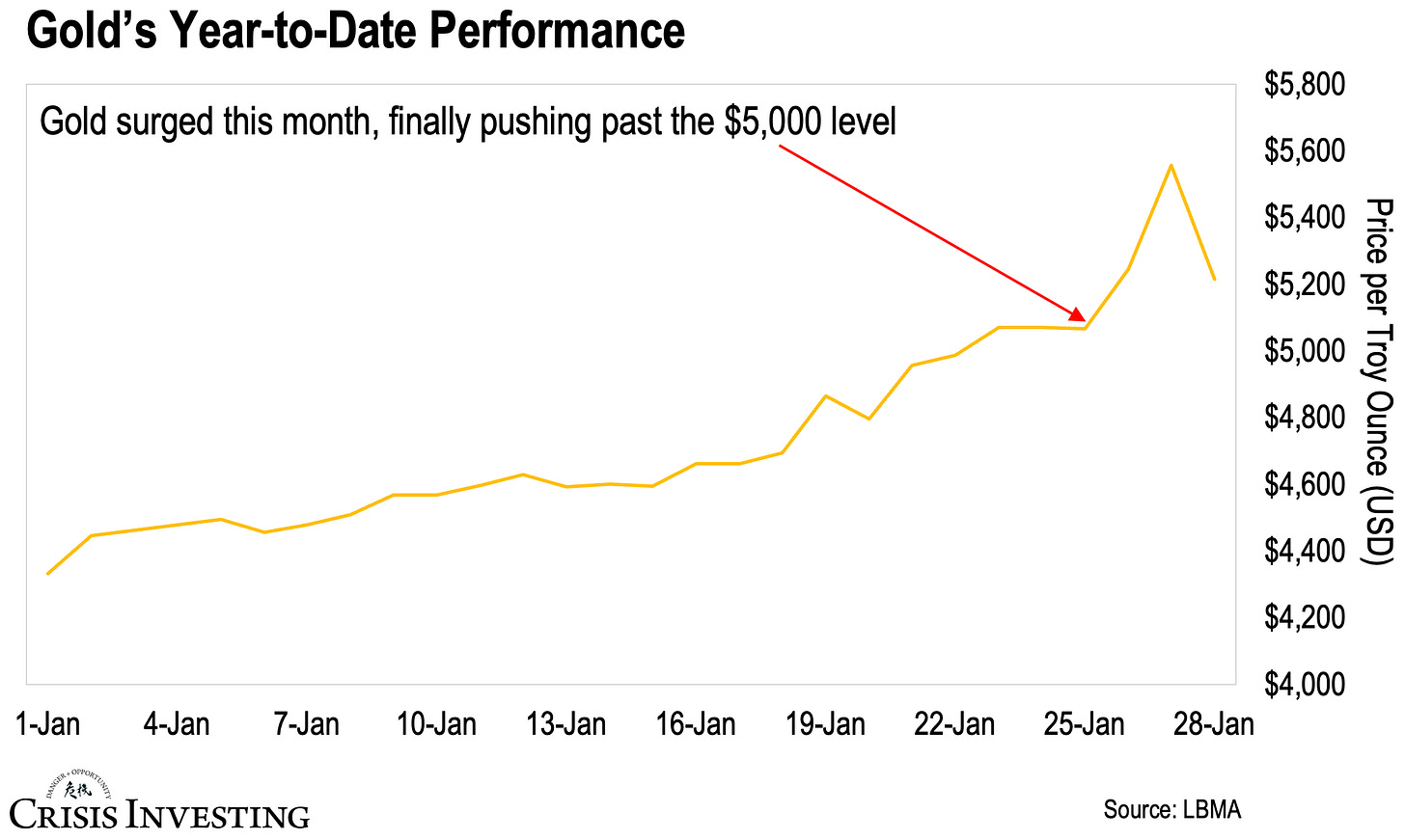

If you’ve just joined us over the past few weeks, you’re arriving at a remarkable moment. Gold has broken above $5,000 per ounce for the first time in history. Silver crossed $100. The forces we’ve been tracking for years aren’t speculation anymore—they’re delivering in real time.

This month’s issue does three things.

First, Matt Smith maps out our thesis for 2026—what’s changed, what’s intensified, and how we’re positioning for what comes next. He also walks through our 2025 predictions, so you can see the framework in action. If you’re new here, this piece is your roadmap.

Second, we're taking profits. We're locking in Casey Free Rides on two uranium holdings that have more than doubled since we recommended them. Time to secure gains and let the rest ride.

Third, for those who’ve just come aboard: we hear you. We know you’re eager to start building positions, but everything’s run up significantly. That's why we've been working through our existing holdings to identify opportunities we can responsibly open up (while continuing to look for new ones).

Yesterday, we sent a special alert on two silver positions—moving both from HOLD to BUY specifically for new subscribers looking to establish positions. Today, we’re raising buy-up-to guidance on two gold positions for anyone who doesn’t yet own them—whether you’re a new subscriber or an existing one who passed on the original recommendations.

Combined, that gives you four quality entry points in precious metals—two in silver, two in gold. We won’t recommend buying just to give you something to do—only when it actually makes sense, as is the case now.

This issue is packed, so let's get to it.

Lau Vegys

Part I: Our 2025 Thesis in Review

Matt here.

As I sat down to write about what we see unfolding in 2026, something happened. Something we’ve anticipated for over a year, yet something that still commands attention when it arrives: gold broke above $5,000 per ounce for the first time in history.

Now, if you recall last February, we laid out what we called the “Mar-a-Lago Accord” - a deliberate effort by the Trump administration to devalue the dollar and bring gold back to the center of the monetary system. Here’s what we wrote at the time:

If the U.S. devalues the dollar first—since this would be a Plaza Accord on steroids—I wouldn’t be surprised to see gold spike to $5,000–$8,000 per ounce just from speculative trading on that news alone.

Twelve months later, we’re there - and that’s all the proof you need that our 2025 thesis played out.

But that $5,000 breakthrough isn’t the end of the story though. It’s confirmation that the forces we identified are now in motion. And so going into 2026, it’s worth reviewing exactly what we predicted, what the data shows, and what likely comes next.