The Trouble with Trump’s Tariff Math

How Bad Arithmetic Is Shaping U.S. Trade Policy

Yesterday wasn’t a good day in the markets. The Dow dropped 349 points, the S&P notched its third straight loss, and bond yields spiked as investors scrambled to make sense of Trump’s new tariff policy.

But it wasn’t just the tariffs themselves—it was the chaos around them. Rumors of a 90-day pause, Trump blasting those reports as “fake news,” Elon Musk publicly trashing the White House’s trade logic, and China slapping a 34% retaliatory tariff on U.S. goods. It was a full-blown mess. Honestly, I’m surprised the market didn’t fall even harder.

But the biggest head-scratcher of them all? President Trump’s actual tariff formula.

I touched on this in a recent piece, but during our usual Monday VIP members call, it hit me that a lot of folks probably still hadn’t fully wrapped their heads around just how flawed the logic behind it really is… and to make matters worse, there’s an actual error baked in (more on that below).

Now, I actually support a lot of what the current administration is trying to do—but I wouldn’t be doing my job if I didn’t speak up when something just doesn’t add up.

Why is this important?

Because it’s a mistake—and mistakes of this caliber are dangerous. If left unchallenged, they could steer the U.S. down some seriously troubled roads.

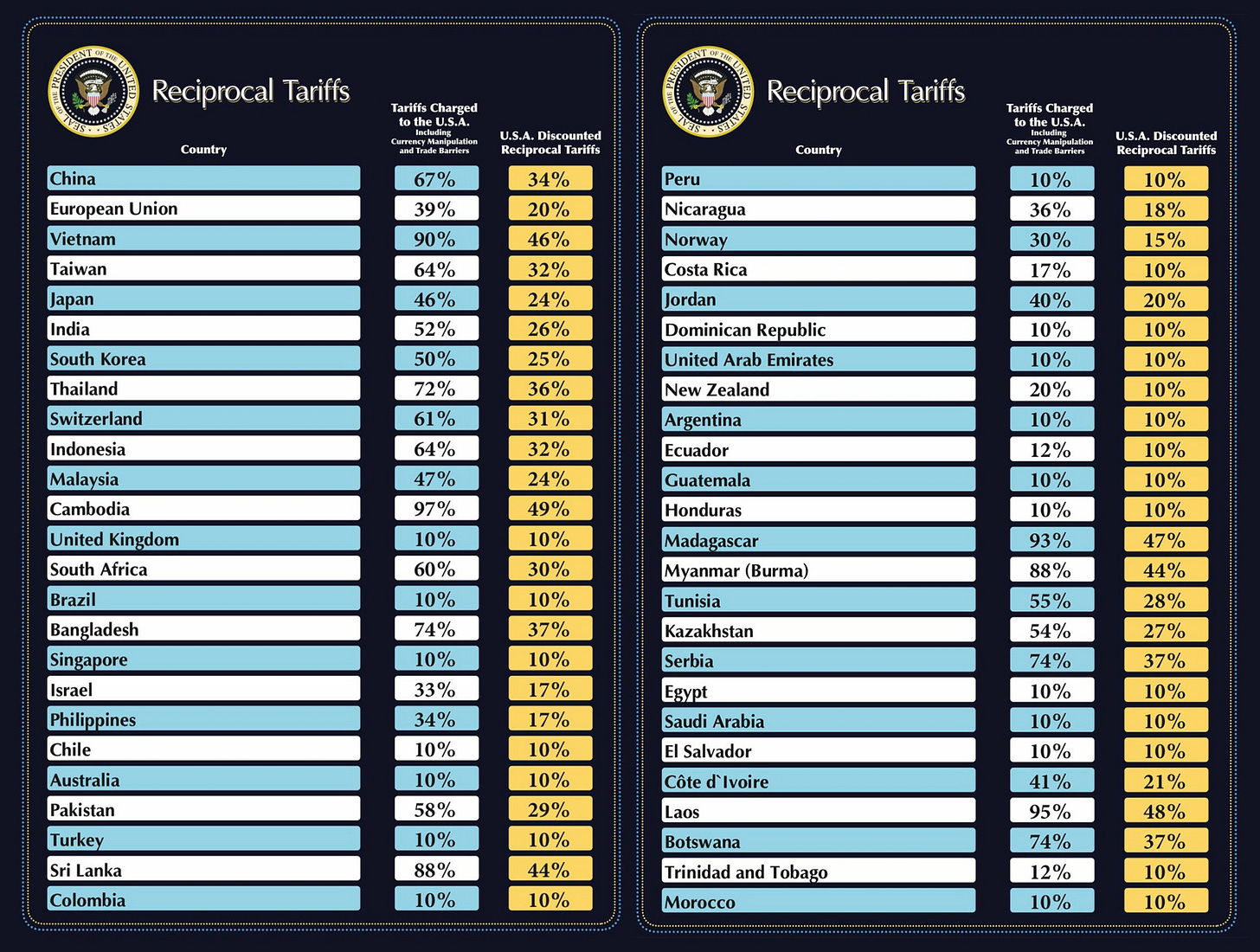

With all that in mind, let’s revisit Trump’s “Liberation Day” tariff chart.

What we see here is basically three columns. The first is a list of countries, the second is labeled “Tariffs charged to the U.S.A.,” and the third—somewhat ridiculously—is titled “U.S.A. Discounted Reciprocal Tariffs.” I’ll explain why I call it “ridiculous” in a moment, but the gist is this: “Look how much these bad guys are ripping us off… but we’ll be the bigger man and only hit them with half in return.”

Of course, the problem is that both the formula itself and the very use of the word “reciprocal” are completely off-base here.

Deficit ≠ Tariff

When President Trump unveiled his “Liberation Day” tariffs, the general assumption across the market was that “reciprocal tariffs” meant a straightforward tit-for-tat: “You hit us with 25%, we hit you with 25%.”

That’s not what happened at all.

Let’s take a real-life example: Vietnam.

According to U.S. trade data, in 2024 the United States imported around $137 billion worth of goods from Vietnam. In contrast, we only exported about $13 billion in American-made products to them.

That leaves a trade deficit of roughly $124 billion.

Here’s how the administration’s formula works: they take the $124 billion trade deficit and divide it by the $137 billion in imports. That gives you around 90%, which they claim represents the "effective tariff" Vietnam supposedly charges on U.S. goods.

Then, in the name of “fairness,” they cut that number in half and slap a 46% tariff on Vietnamese imports.

That’s the math.

But as you’ve probably figured out, the real issue is in the assumption itself—that Vietnam’s "90% tariff" is real. It’s not.

The administration’s logic boils down to this: if America buys more from Vietnam than Vietnam buys from America, the only possible explanation is that Vietnam is unfairly taxing U.S. products.

That’s nonsense.

The U.S. runs a trade deficit with Vietnam for many reasons that have nothing to do with tariffs. Vietnam produces electronics, furniture, and clothing cheaply—often with labor that costs a fraction of U.S. wages. Naturally, American consumers buy a lot of it. Meanwhile, Vietnam is still a developing country with less purchasing power, so they buy fewer U.S. goods, which tend to be higher-end and more expensive.

That’s not cheating. That’s just how global trade works.

But in the Trump administration’s worldview, every trade deficit is an injustice that must be punished.

Faulty Math

But, as I mentioned earlier, that’s not all. Turns out there’s an actual math error baked into the formula—and it inflates these already-inflated tariffs by a factor of four.

The American Enterprise Institute found that the White House used the wrong number in their calculation. Instead of checking how tariffs affect actual import prices, they accidentally used data about retail prices. It’s a bit like trying to measure your grocery bill by checking restaurant menu prices.

As AEI puts it:

Our view is that the formula the administration relied on has no foundation in either economic theory or trade law. But if we are going to pretend that it is a sound basis for U.S. trade policy, we should at least be allowed to expect that the relevant White House officials do their calculations carefully.

Crucially, fixing that mistake would reduce most of the new tariffs to the administration’s own 10% floor—and in some cases, no tariff would’ve been necessary at all.

Below is a table showing what those corrected tariffs should actually look like. (You can find the full version on AEI’s site.)

Look, I’m not saying the U.S. doesn’t have valid trade grievances or that it’s always been treated fairly—far from it. One example is the long-running EU-U.S. dispute over aircraft subsidies, where the WTO ruled that Europe had provided illegal subsidies to Airbus (causing serious harm to American manufacturer Boeing).

But if the goal is to rewrite the rules of trade, the very least you can do is get the logic and the numbers right.

Regards,

Lau Vegys

P.S. Yesterday, businessman and “Shark Tank” investor Kevin O’Leary expressed confidence that the Trump administration will eventually rescind the sweeping tariffs (imposed on 185 countries). Whether that happens or not, we believe tariffs are just the opening act in Team Trump’s broader economic strategy. As Matt Smith recently documented, the real plan goes far beyond countering a strong dollar (which the tariffs quietly target along the way). Trump aims to fundamentally overhaul the U.S. economy and monetary system. Whether they succeed or not, we don’t know—but either way, the impact will be far-reaching. So it’s worth paying close attention now.

excellent.

your writing style allows for easy understanding.

Your analysis while not wrong on its face entirely misses the overarching goal of the tariffs.

Yes, the tarrif rates announced are a) far too high and b) calculated via an absurd method, and c) irrelevant. The rates are just Trump’s usual way of getting his negotiating partners to accept his frame by metaphorically slapping him in the face. It’s the start of negotiations, nothing more. And the smarter countries understand this; they are either caving very publicly or refraining from retaliating, because they know US tariffs are a) necessary, b) justified, and c) long overdue.