The Day the Markets Bled

Liberty Day, Reciprocal Tariffs, a $2 Trillion Selloff

Today, just one day after “Liberty Day,” markets in the U.S. and around the world opened deep in the red as Trump’s tariff blitz rattled investors.

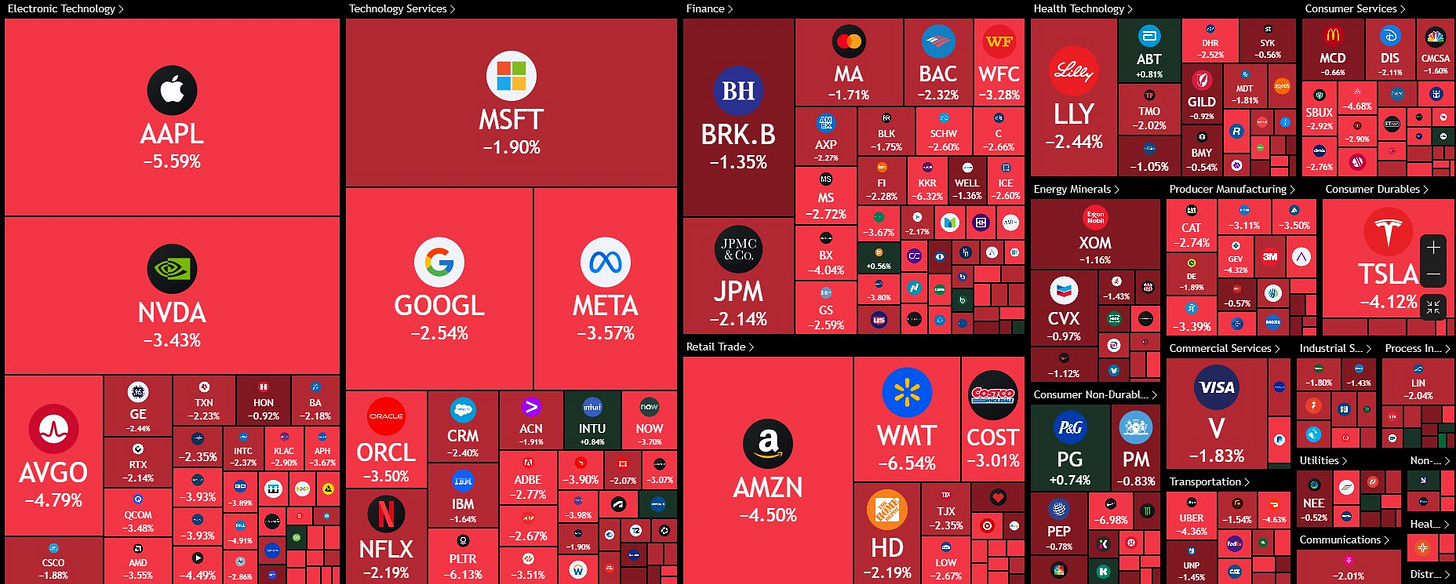

Tech stocks led the rout, with the Nasdaq down more than 5%. But zooming out, losses were broad-based. The S&P 500 fell. So did the Dow Jones. Global stocks and the dollar tumbled too, as you can see in the chart below.

Even yesterday, as I was watching live while Trump made the announcement, the markets were already crashing in real time. In fact, within just 20 minutes of his tariff reveal, close to $1 trillion in market value was wiped out. As of today, the total loss has already surpassed $2 trillion.

Reciprocity—Redefined

Some analysts I spoke with were genuinely surprised by the market’s reaction. Why such steep losses? Wasn’t this already priced in? Why the surprise?—they wondered.

After all, Trump had been floating the idea of “reciprocal tariffs” for months. So wasn’t this just a matter of formalizing what everyone already knew?

Well—turns out, not quite.

The general assumption across the market was that “reciprocal tariffs” meant a straightforward tit-for-tat: “You hit us with 25%, we hit you with 25%.”

But the Trump team appeared to take a different approach. Instead of matching tariff rates one-for-one, they seemed to base new tariffs on the size of the trade deficit with each country. For example, if the U.S. imports $100 billion from a country but exports just $10 billion, that’s a 90% imbalance—which, in many cases, mirrors the tariff rate imposed.

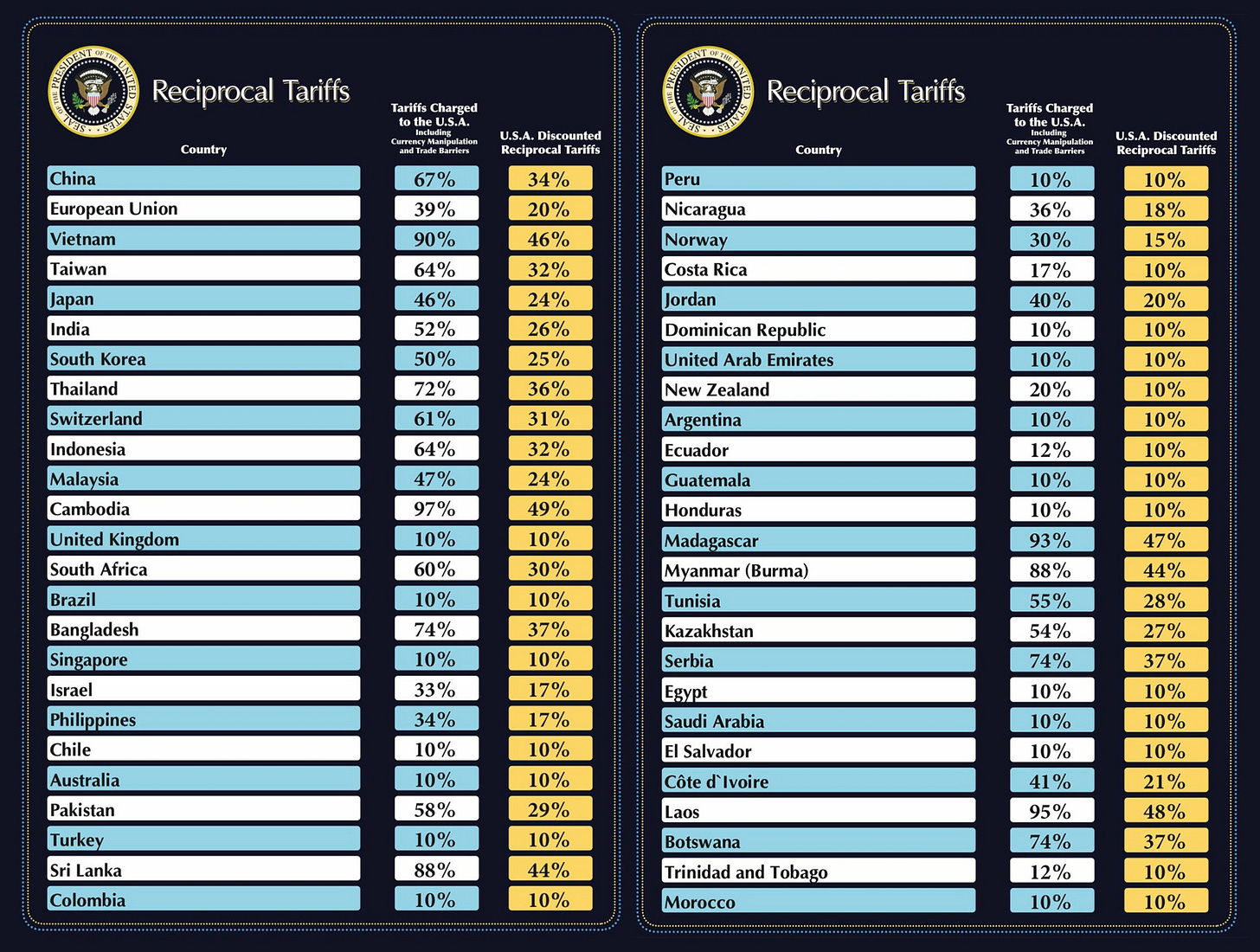

That’s why the “Liberation Day” tariff chart looked the way it did (click below to enlarge). No—Vietnam doesn’t actually impose a 90% tariff on U.S. goods. And Cambodia doesn’t hit us with 97%.

Another surprise for the markets was that even countries running a trade surplus with the U.S.—that is, they buy more from us than we buy from them—like Australia, Brazil, and Colombia—were still hit with a punitive 10% tariff.

More Pain Ahead?

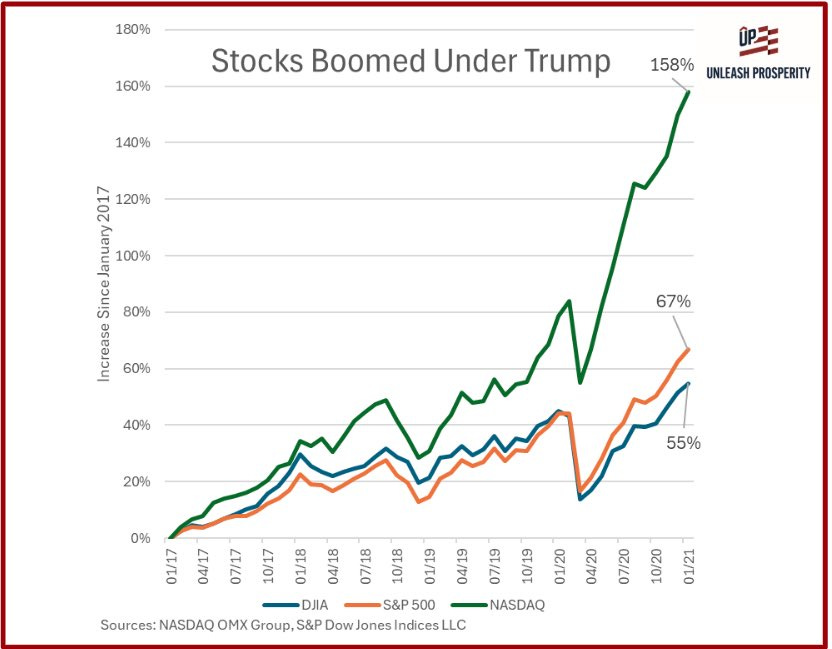

Many Trump supporters were quick to share a chart on X today, arguing that during Trump’s first term, tariffs didn’t hurt the stock market—in fact, markets soared.

Fair enough. Maybe this is just a case of early growing pains that we’ll soon move past.

But as Matt Smith recently documented, tariffs are just the opening act in Team Trump’s broader economic strategy. The real plan goes far beyond countering a strong dollar (which the tariffs quietly target along the way). Trump aims to fundamentally overhaul the U.S. economy and monetary system.

As Matt put it in his Trump’s Monetary Reset report:

Succeed or fail, Trump’s plan will impact all of us and our investments. I confess I’m delighted Team Trump sees the problem… has a plan to avoid the worst, and catapult the US to new prosperity. But what they need to do will not come without pain. A LOT of pain.

Today’s market reaction is very much part of the pain Matt warned about—and it’s far from over. Next in line is the American consumer, because when U.S. importers get hit with tariffs, most will raise prices to pass those costs on to buyers.

Just as with the stock market example above, President Trump’s supporters are quick to say, “Look, prices didn’t spike last time.” And they’re not wrong—consumer inflation held steady at just 1.9% in 2018, 2.3% in 2019, and 1.4% in 2020, even with tariffs in full effect.

But here’s the thing: the sheer scale of Trump’s new tariffs this time around completely changes the equation. We’re talking about potential tariffs on more than $3 trillion worth of imported goods annually—a full order of magnitude above the roughly $300 billion in mostly China-focused tariffs he imposed in 2018–2019.

This means Trump’s current tariff playbook has far less in common with his first term—and far more in common with the 1930s, when the U.S. passed the Smoot-Hawley Tariff Act, slapping duties on over 20,000 goods.

I’m hard-pressed to forget what followed that move: years of economic pain—lasting until 1934, when the Reciprocal Trade Agreements Act finally reversed course—including:

World trade collapsing by 66% as countries imposed tariffs and trade restrictions.

Global GDP falling by about 15-20% (with some countries seeing declines of 30-50%).

Commodity prices plunging 50-80%.

Unemployment reaching 25-33% in some countries.

As it happens—and as Doug Casey has said many times—the stakes are even higher now. That’s because there’s far more trade today than there was in the 1930s. This means the potential fallout could be even worse if this tariff standoff spirals out of control.

It’s a context worth keeping in mind—even if you’re rooting for Trump’s Reset to succeed.

Regards,

Lau Vegys

... remember succession and legality are unrelated - the authority to succeed always supercedes the authority to be governed by evil. "He who dares not offend cannot be honest." [Thomas Paine]