Silver Soared 160% in 2025—But Silver Stocks Are Just Getting Started

Chart of the Week #83

Silver had an extraordinary year in 2025—as I highlighted in our latest Crisis Investing issue.

The poor man’s gold climbed from around $29 per ounce at the start of the year to nearly $75—a gain of roughly 160%. That’s silver’s strongest annual performance since 1979.

We’ve been banging the table on silver all year—explaining its gold-lagging but explosive nature across several essays (catch up here, here, here, and here). So it feels good to be proven right.

Now, you might expect silver mining stocks to have crushed it even harder. After all, miners typically provide leverage to the underlying metal—when gold and silver rise, their profit margins expand dramatically since production costs stay relatively fixed.

But here’s where things get interesting.

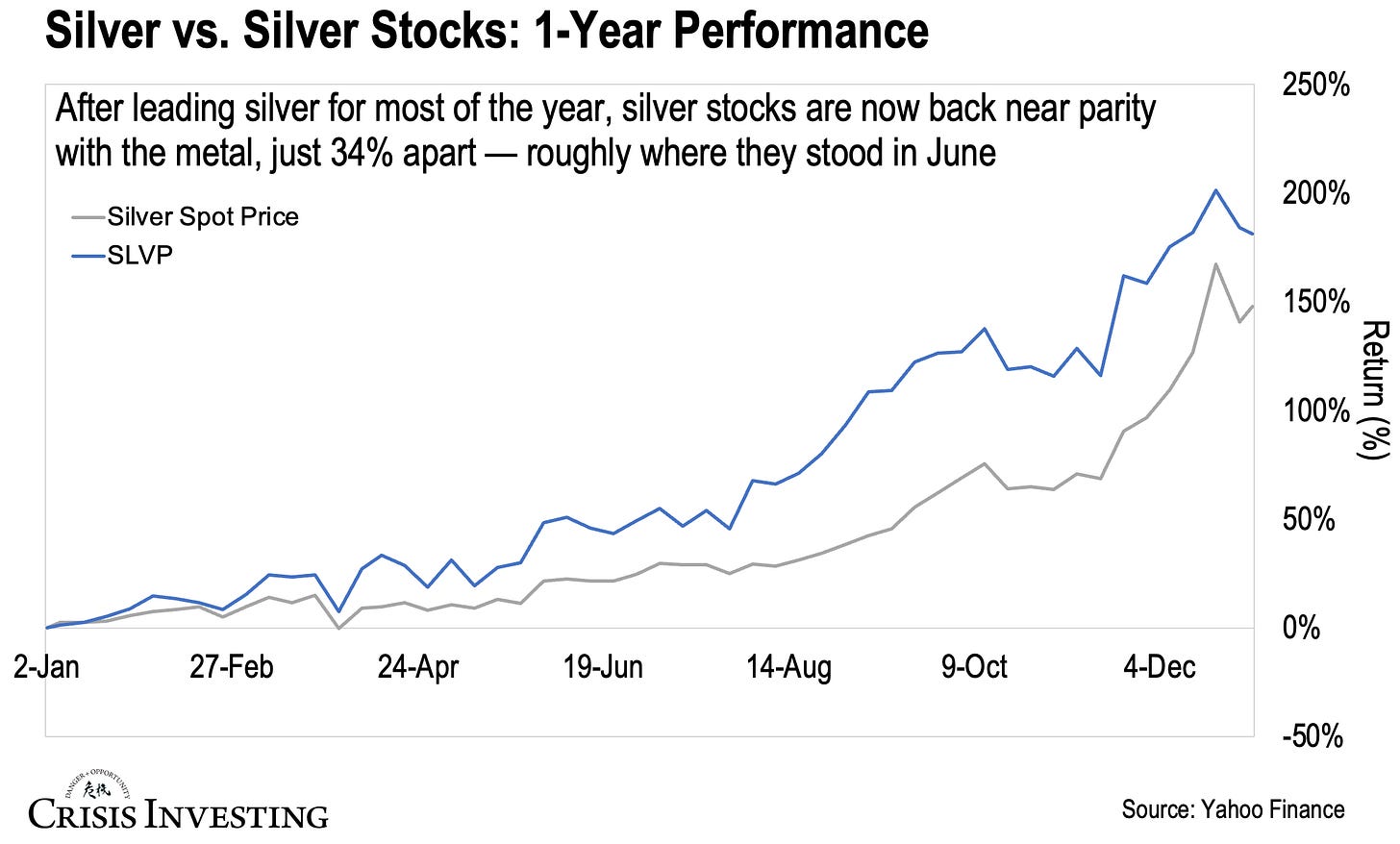

Take a look at this week’s chart showing silver versus the iShares MSCI Global Silver Miners ETF (SLVP), a widely used benchmark for global silver mining stocks, over the past year.

After leading silver for most of the year, silver stocks are now back near parity with the metal. Silver gained 147% over the past year to today, while silver stocks returned 181%—just 34% apart. As you can see in the graph above, that’s down from a much wider gap that peaked in October.

This points to a disconnect—and an opportunity.

Once again, the thing about silver stocks—much like gold stocks and other mining equities—is that they amplify moves in the underlying metal. A 160% gain in silver can easily translate into 300%, 500%, or even larger gains in well-positioned miners. That’s exactly why we invest in these stocks. As the chart shows, that leverage still exists today—just barely. Which means there’s plenty of room for silver stocks to deliver the kind of outperformance they’re known for.

And for anyone who looked at silver's impressive 2025 performance and thought they missed the boat on silver stocks—this is good news.

Regards,

Lau Vegys

P.S. In our latest Crisis Investing issue—which we just published—we reviewed all our 2025 picks, including silver plays positioned to benefit as silver continues its run. If you’re a paid subscriber, make sure you haven’t missed it. If you’re not yet a subscriber, the lead is free for all readers.

I’m grateful for the work you do, and finally decided to subscribe. It’s was an investment I made because I thought I could listen to each episode, due to vision issues. Recently Substack no longer allows this apparently. When I push the button, all I get is Audio Processing spinning indefinitely. Is this a problem for anyone else?

I have contacted Substack several times with no resolution. Unfortunately if this isn’t resolved I’ll be canceling most of my subscriptions. I’ve met Mr. Casey at a Sprott/ Stansberry Conference in 1999 in Vancouver BC, and have followed him through newsletters for many years. Because of his work we bought RGLD, and Silver Wheaton for under $5. I also followed several of your newsletters that Porter Stansberry bought till they were discontinued, and of course I have followed Mr. Rule for many years too, so am fortunate to have so much excellent advice. I loved Substack, but without the ability to listen, its value is far less. I don’t know if you have any influence over Substack, but they’re unresponsive to me. If I can’t get this resolved I will cancel my Substack subscriptions. Thanks again for your help and of course your work.

Thanks.