Minnesota’s Welfare Scandal Is Just the Tip of the Iceberg

Chart of the Week #85

In late December, a 23-year-old YouTuber named Nick Shirley posted a 43-minute video titled “I Investigated Minnesota’s Billion Dollar Fraud Scandal.”

The video showed Shirley visiting Somali-run childcare centers across Minneapolis, finding locked doors, empty storefronts registered as daycares, and facilities billing the state for services that clearly weren’t being provided. Within days, the video racked up millions of views—amplified by Elon Musk, Vice President JD Vance, and eventually President Trump himself.

The federal government responded immediately. The Department of Health and Human Services froze all childcare payments to Minnesota. The FBI and DHS ramped up their presence in the state. And within a week, Governor Tim Walz announced he was dropping his reelection campaign.

Now, to be clear: Shirley didn’t uncover this fraud. Federal investigations and prosecutions had been underway for years. What the video did was bring national attention to a scandal that had been quietly simmering in Minnesota—and force people to finally pay attention to just how massive the problem really is.

The scale of the fraud is staggering.

The largest scheme—”Feeding Our Future”—involved a nonprofit that prosecutors say falsely claimed to provide meals to tens of thousands of hungry children during COVID. Court records show fake food distribution centers, fraudulent invoices for meals never served, children who didn’t exist. More than 78 people have been indicted in that case alone. Over 50 have already pleaded guilty.

But “Feeding Our Future” was just the beginning.

Federal prosecutors have since uncovered fraud across at least 14 different Minnesota-run welfare programs—not just food assistance, but housing programs, autism services, Medicaid, and more. Defendants opened sham autism therapy centers staffed by unqualified teenagers. They created fake housing assistance providers. They billed the state for services never rendered, then used the money to buy lakefront property and luxury cars.

Federal prosecutors estimate the total fraud could exceed $9 billion.

Let that sink in. Of the roughly $18 billion in federal funding sent to 14 Minnesota-run welfare programs since 2018, half appears to have been stolen.

And those are just the ones that were prosecuted.

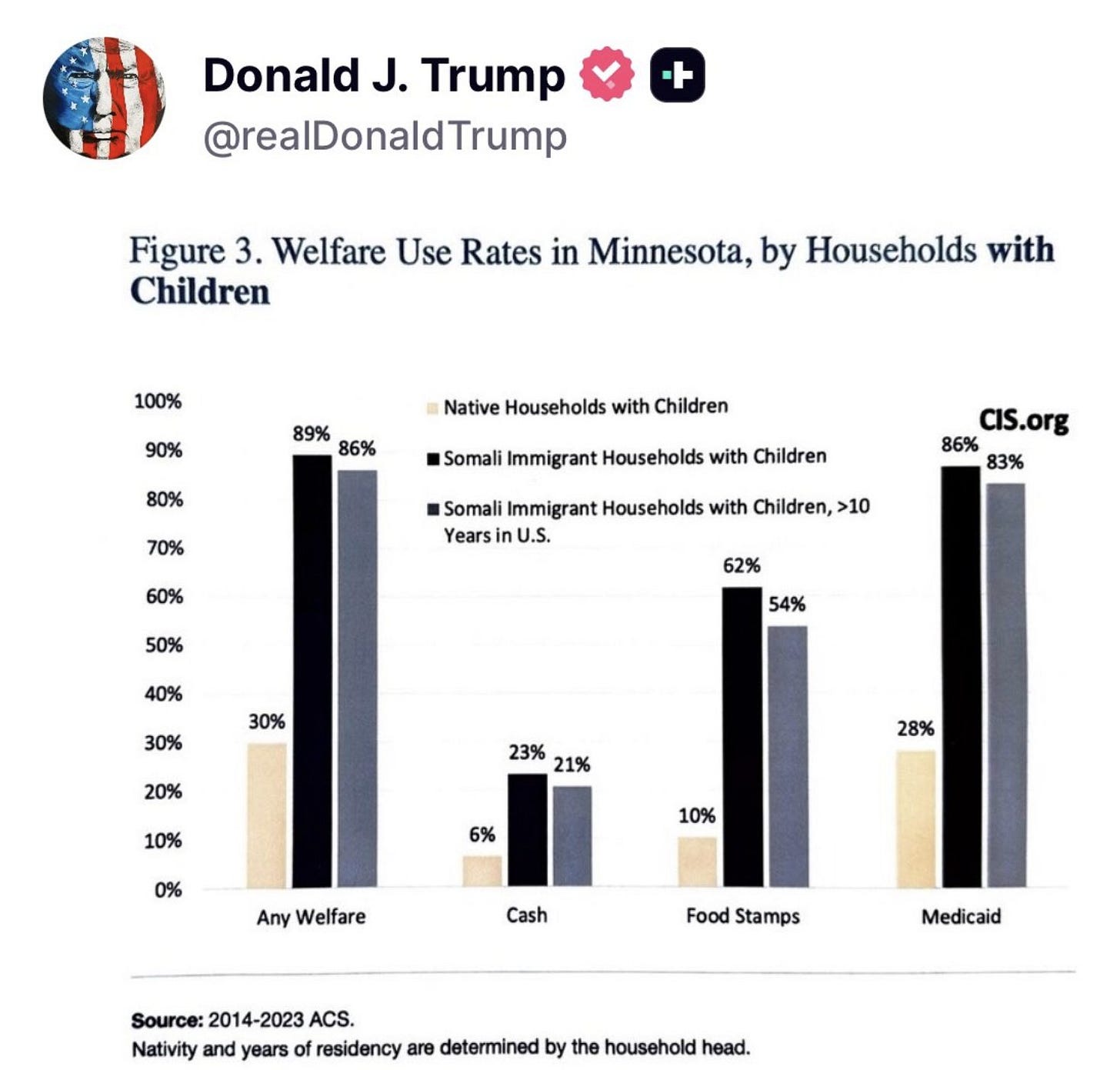

Now take a look at this chart President Trump posted in the wake of the scandal:

The numbers are striking. In Minnesota, 89% of Somali immigrant households with children use some form of welfare, compared to just 30% of native households. For cash assistance: 23% versus 6%. For food stamps: 62% versus 10%. For Medicaid: 86% versus 28%.

Trump posted this chart to make a point about immigration policy. And it’s a valid one.

When you have welfare usage rates this high concentrated in one community, and then you see fraud schemes of this magnitude emerging from that same community, it’s not a coincidence. It’s a pattern.

But here’s the bigger question: why does the system allow this in the first place?

The real problem isn’t just the fraudsters—it’s the government that created the conditions for fraud to flourish.

Think about what happened here. Billions of dollars flowing through poorly supervised state programs. Minimal oversight. Easy-to-game eligibility requirements. And when fraud was finally detected, what happened?

When Minnesota officials finally tried—half-heartedly—to address the fraud in 2021, “Feeding Our Future” sued the state for racial discrimination.

And Minnesota officials under Governor Tim Walz? According to federal investigators and whistleblowers, they were reluctant to act—tolerating, if not tacitly allowing, the fraud to avoid political backlash from the Somali community and accusations of racism.

Whistleblowers who tried to sound the alarm were retaliated against. Evidence was allegedly destroyed. State officials provided little to no evidence to federal investigators, who had to build their cases from scratch.

Walz later claimed credit for "putting people in jail." That, of course, is false. Any prosecutions and convictions came from federal authorities—not state officials.

But here’s the thing: Minnesota isn’t unique.

This is just the tip of the iceberg. How many other states have similar problems that haven’t been exposed yet? How much fraud is happening in California’s welfare programs? New York’s? Illinois’?

We don’t know. Because nobody’s looking.

This is a textbook example of what Doug Casey calls government waste—the inevitable result of programs that are too large, too complex, and too poorly managed to function honestly.

California, for example, spent $25 billion on homeless programs in recent years—roughly $134,000 per homeless person. That’s enough to buy each one a modest home outright. The result? California’s homeless crisis is worse than ever.

We just don’t know how much of that money went to outright fraud, how much to schemes that weren’t technically fraud but might as well have been, and how much wasn’t fraud at all but was simply wasted on programs that achieved nothing.

My point is this: when government programs grow this bloated and this poorly supervised, the waste becomes inevitable—fraud or no fraud.

Minnesota just made it obvious.

Regards,

Lau Vegys

P.S. In our latest Crisis Investing issue, we reviewed all our 2025 picks, including our best performers. If you’re a paid subscriber, make sure you haven’t missed it. If you’re not yet a subscriber, the lead is free for all readers.

We have the same problem here in Australia with the NDIS ( national disability insurance scam ) this in now bigger than the defence budget. Poorly managed. Recipients have been caught using to funding supposed to provide help for the disabled to buy crypto, drugs, overseas holidays, prostitutes and much more. A welfare state always seem to attract parasites .

PPP loans, meme coins. It's almost as if the whole thing is just a house of cards.