The Xi-Trump Rare Earths "Deal" That Never Was

China's Still Blocking Exports (and That's an Opportunity)

As I wrote recently, our rare earths picks were among the best performers in our Crisis Investing portfolio in 2025.

In fact, that performance is part of why we’ve introduced a new December tradition: highlighting our top gainer as both a teaching example and a way of saying thank you to those of you who follow Doug Casey’s Crisis Investing but aren’t yet on the inside.

For 2025, that spotlight went to MP Materials (MP)—North America’s only rare earth mine and processing operation operating at scale.

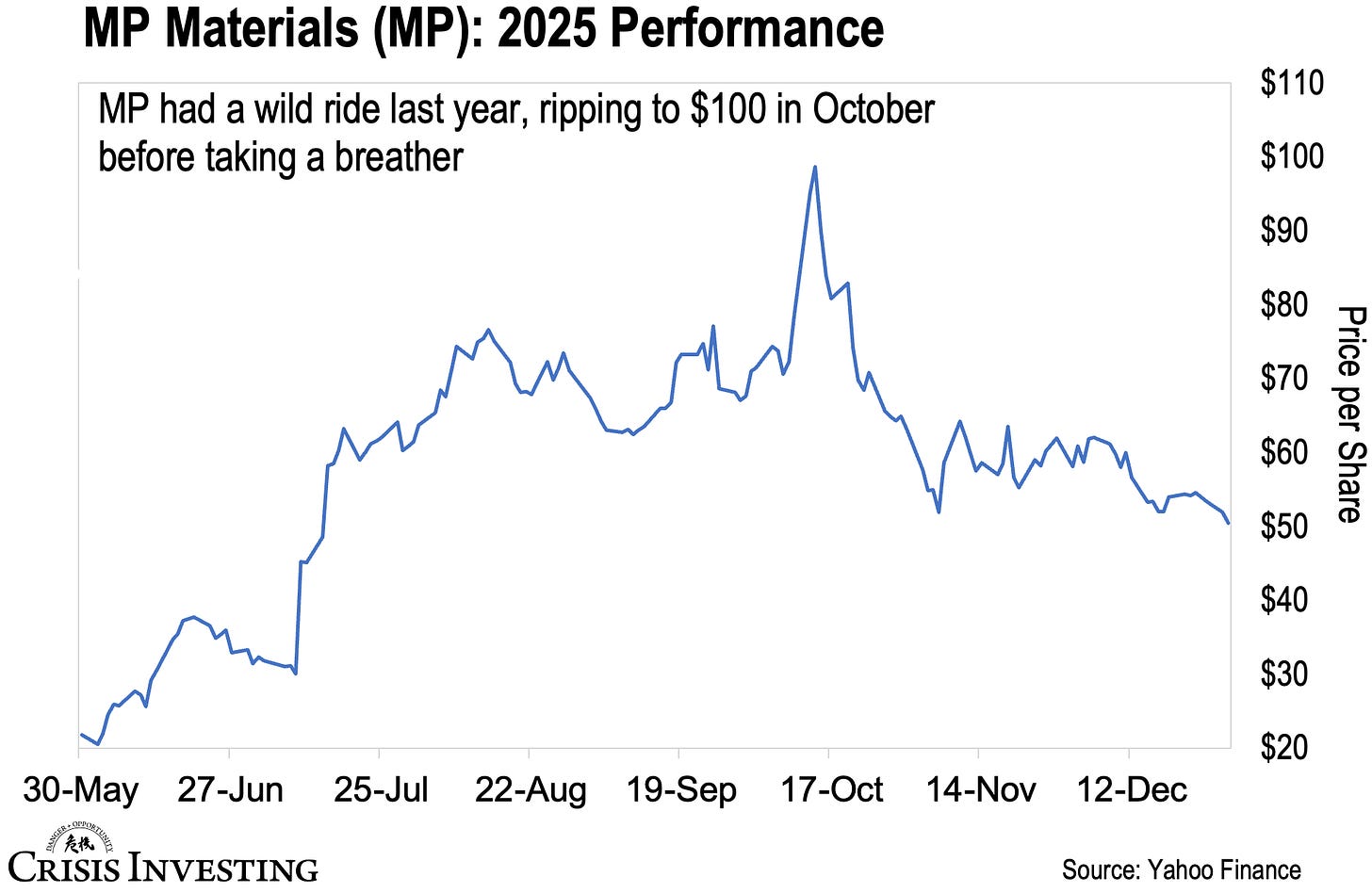

The stock ran to nearly $100 per share in October—turning into a four-bagger. Since then, MP Materials—along with the broader rare earths sector—has pulled back significantly. You can see how this unfolded in the chart below.

So what happened? Understanding this matters because it isn’t just an MP Materials story—it’s the story of the entire rare earths space.

The Deal That Looked Too Good to Be True

First, some context.

Throughout 2024, China steadily tightened its grip on rare earth exports. In April 2025, for instance, Beijing introduced export controls requiring exporters to obtain case-by-case approval to ship seven rare earth elements and permanent magnet materials.

On October 9, China went further, slapping new export restrictions on five more rare earth elements—holmium, erbium, thulium, europium, and ytterbium—along with controls on processing equipment and technology. More importantly, Beijing started requiring overseas exporters using even trace amounts of Chinese rare earths to get a license.

In practice, that gave Beijing visibility into—and veto power over—the entire downstream supply chain for anything containing Chinese rare earths.

China already produces about 70% of the world’s rare earths, holds nearly half of global reserves, and controls over 90% of refining and processing capacity. That made this a big deal.

So it was hardly any wonder that by mid-October, rare earth stocks had surged on mounting supply fears. MP Materials did too, as you can clearly see in the chart above. At Crisis Investing, we kept banging the table and telling people to take a closer look at the space.

That’s when President Trump and President Xi met in South Korea.

China agreed to suspend its aggressive rare earth export controls, issuing what the White House called “general licenses” that amounted to a “de facto removal of controls.”

Everyone breathed a sigh of relief. Rare earth stocks sold off. MP Materials dropped from nearly $100 to the mid-$50s. Crisis over, right?

Wrong.

Last week, Bloomberg published a report: “US Rare Earth Buyers Still See China Curbs Despite Trump Deal.”

Here’s the key takeaway:

China is still restricting the rare earth elements that the US needs to produce its own permanent magnets and other products even after President Donald Trump reached a deal with his Chinese counterpart in October to lift restrictions.

The piece goes on to note that “while China has boosted deliveries of finished products — primarily permanent magnets — the US industry remains unable to acquire the inputs needed to make those items on its own.”

Bloomberg surveyed more than a dozen consumers, producers, government officials, and trade experts, who asked not to be identified because the discussions aren’t public.

In other words, despite the supposed “truce,” Beijing never really lifted the restrictions that matter.

Why This Is Important

For anyone serious about resource investing, it may pay—quite literally—to understand the true scale of the U.S. rare earths vulnerability.

For instance, did you know U.S. Javelin missiles and F-35 fighter jets—some of America’s most advanced weapons—are practically bursting at the seams with rare earths?

You might have. But that’s just scratching the surface.

A recent report by Govini, a U.S. war-industry analytics firm—From Rock to Rocket: Critical Minerals and the Trade War for National Security—goes well beyond isolated examples. It lays out, in blunt detail, just how deeply Chinese materials are embedded across America’s military-industrial complex.

And the numbers are, frankly, staggering.

According to Govini, roughly 80,000 individual components across nearly 1,900 U.S. military weapons systems contain Chinese-sourced minerals. That’s 78% of all DoD platforms.

The vulnerability cuts across every branch of the armed forces:

Navy: 92% of its 739 weapon systems rely on Chinese minerals.

Air Force: 85% of its 302 systems.

Army: 70%.

Marine Corps: over 60%.

Think about that for a moment.

America’s most advanced weapons—fighter jets, missiles, radar systems, submarines—are all built with materials that run through China.

Isn’t it ironic that this just happens to be the same country the U.S. has declared its main adversary?

The Problem/Opportunity

All well and good—but the rare earth problem isn’t going anywhere, no matter how many handshakes and photo ops Trump and Xi stage.

Because the issue for the U.S. isn’t just securing raw materials. The real challenge is rebuilding the entire industrial ecosystem—something Washington is clearly intent on, given its view of China as enemy numero uno.

But that’s not a quick fix—it’s a decades-long project.

You can’t just flip a switch and start mining rare earths at scale. You need refineries. You need magnet plants. You need end-to-end infrastructure—and you need to do it efficiently enough to compete. China spent 40 years building this capacity while America was busy financializing its economy and fighting endless wars in the Middle East.

Even if Washington threw unlimited money at the problem tomorrow, it would still probably take a generation to catch up.

Put differently, the thesis that made rare earth stocks like MP Materials four-baggers and more is alive and well.

Have a good weekend,

Lau Vegys

P.S. In our latest Crisis Investing issue—which we just published—we reviewed all our 2025 picks, including our rare earths plays positioned to benefit as supply risks continue to build. If you’re a paid subscriber, make sure you haven’t missed it. If you’re not yet a subscriber, the lead is free for all readers.

Critical facts about our vulnerability, thanks for stating them clearly. Nothing gets better by looking the other direction and lying to ourselves.

This two-part article published in Alaska concerning Trump's seeming support for rare earth mining may be of interest:

Part 1: https://mustreadalaska.com/susan-szwarc-rare-earth-minerals-trump-and-the-pebble-mine-paradox/

Part 2: https://mustreadalaska.com/sandy-szwarc-pebble-paradox-puzzling-evidence-and-a-sham-permitting-council-part-ii/