The Ace Up China's Sleeve

Chart of the Week #42

I wrote to you recently about how China hit back at the U.S. with some fresh retaliatory tariffs last week, including:

10% tariffs on U.S. oil and machinery

15% tariffs on U.S. coal and gas

Export restrictions on key minerals

Limits on Google’s operations in China

This all came in response to President Trump’s 10% tariff, which kicked in last week too.

China’s latest actions come on the heels of its December ban on exports of gallium, germanium, and antimony—materials critical to U.S. military applications.

That ban wasn’t random either; it was a direct tit-for-tat response to the Biden administration’s new round of export restrictions targeting 140 Chinese companies.

With all this back-and-forth and rising tension, you’ve got to wonder—what’s China’s next move? What big card could it play to hit the U.S. where it really hurts?

The answer seems obvious—rare earth elements (REEs).

Keep in mind, the world’s second-largest economy controls nearly 70% of global REE production and over 85% of processing capacity—giving it near-monopoly power over the supply chain.

With this kind of dominance, China isn’t just a producer; it’s the gatekeeper. If it cuts exports, the U.S. could face not only skyrocketing prices but serious shortages across key industries like military, energy, technology, and automotive.

And if you’ve been paying attention, chances are China is already laying the groundwork for a potential rare earth export ban.

Here’s what we know:

In February 2021, the Financial Times reported that Beijing had asked its rare earth industry: “How much damage could we do to the U.S. military by cutting off rare earth exports? Could we stop their fighter jet production?”

By December 2023, China had banned exports of tech used to produce rare earth magnets, which are crucial for EVs, wind turbines, and advanced military systems.

By October 2024, China started requiring exporters to provide detailed step-by-step reports on how rare earth shipments would be used in Western supply chains.

Looking at all this, it seems China is positioning itself to act before the U.S. can lock down alternative supplies.

And this isn’t just speculation—they’ve done it before.

In 2010, a minor maritime dispute with Japan led China to cut off REE exports to Japan and slash global exports by 40%.

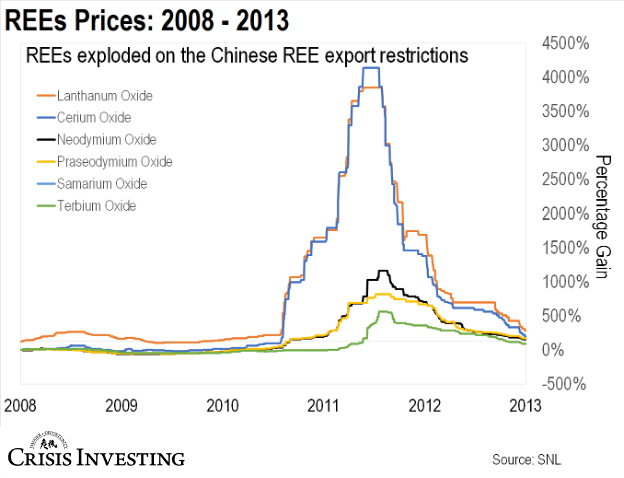

The result? A spectacular REE price boom, with prices surging over 2,100% on average. Some rare earths went even higher—Lanthanum and Cerium spiked by 4,140% and 2,980%, respectively, between 2010 and 2011. This week’s chart below shows the magnitude of the spike.

The ban also sparked a veritable mania in REE stocks that lasted for nearly a year. Companies involved in rare earth mining and processing saw their shares soar to record highs. Mining companies that hadn't produced an ounce of rare earths—some that barely even had plans on paper—saw their stock prices multiply virtually overnight.

If history is any guide, a Chinese ban on rare earths could trigger another massive bull market—potentially one for the record books, even surpassing the 2010-2011 boom. While this could spell serious trouble for the global economy, it could also present a golden opportunity for savvy investors.

Regards,

Lau Vegys

P.S. It doesn’t take much to see that these are uncertain times. And if there’s one thing you’ll want when things start to unravel, it’s a Plan B. If you’re seriously considering one, we’re hosting The Plan B: Uruguay Conference, March 21-24, 2025, in Punta del Este. There’s going to be a lot going on, but the goal is simple—to show you why an increasing number of people, including Matt Smith and Doug Casey himself, chose Uruguay as their Plan B destination, and how you might, too. It’s gearing up to be a fantastic event, and I suggest you take a look. Here’s the link for more information.