Social Security’s Broken Math

Chart of the Week #75

When the federal government shut down on October 1, 2025, millions of Americans feared their Social Security checks would stop arriving. They didn’t—and that’s not surprising. Social Security operates under mandatory spending, funded by payroll taxes rather than annual congressional appropriations. The checks keep flowing regardless of political gridlock in Washington.

But the real problem facing the program is far more fundamental. It’s a math problem—and the numbers don’t add up.

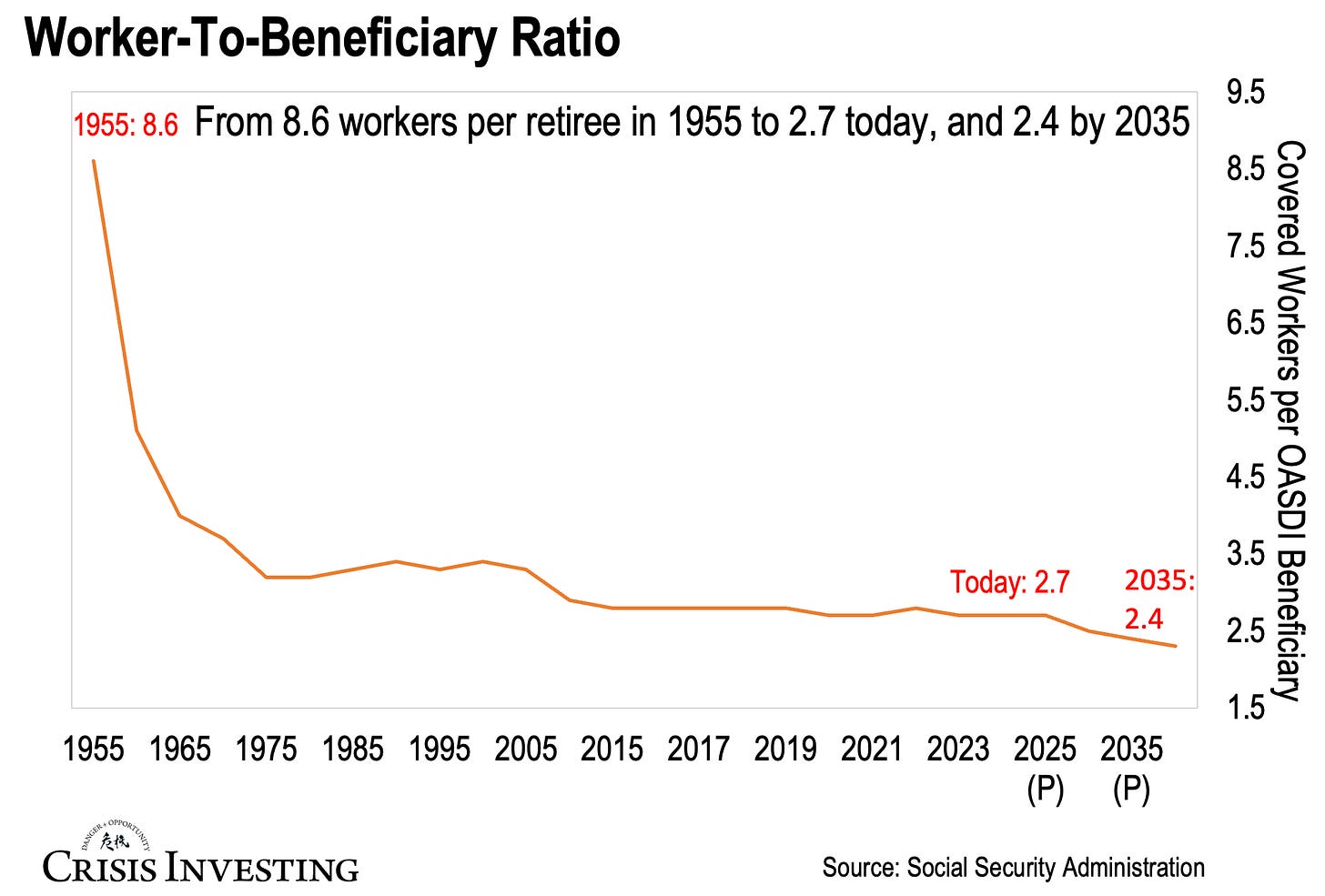

Consider this: when Social Security started paying benefits in 1940—five years after its launch—there were 159 workers for every retiree. Just 10 years later, that number had already dropped to 16.5 workers per retiree. And it only got worse from there. You can see this in the next chart.

As you can see, we’ve gone from 8.6 workers per retiree in 1955 to about 2.7 today—and it’s projected to fall to just 2.4 by 2035.

That’s an all-time low. And frankly, there’s no need for the timeline on the graph above to go any further—because 2035 is the year Social Security officially runs out of money.

You read that right. The combined OASI (retirement) and DI (disability) Trust Funds are projected to be depleted by 2035. In fact, the OASI fund is expected to run dry even sooner, by 2033.

In other words, Social Security is on track to be fully insolvent within the next decade.

In practical terms, that means unless something changes, benefits will automatically be cut by 20–25% across the board in 2033. But you can bet it will get worse from there.

The reason is obvious. Social Security was designed for a world where most people died before reaching 65, where families had more children, and where a large working population supported a relatively small number of retirees.

That world no longer exists. And the further we get from those original assumptions, the more untenable the system becomes.

So while Washington argues over political theater, the real crisis quietly ticks forward. Every year, the worker-to-retiree ratio deteriorates further. Every year, the trust funds draw down. Every year, we get closer to 2033/2035.

Something has to give. The only question is when—and what form that reckoning will take.

Regards,

Lau Vegys

P.S. When a government program promises more than the math allows, you don’t need a crystal ball to see how it ends. Doug Casey has been warning about exactly this kind of fiscal reckoning for years. But Social Security is just one example of the mounting fiscal pressures facing the U.S. government—and like everything else, it’s accelerating. In the latest Crisis Investing, we explore exactly that acceleration—in debt, interest, you name it—and how this sets up what could be the most explosive move in decades for precious metals. Even if you’re not a paid subscriber, I’d recommend checking out the lead story—it’s free for all subscribers.

I think relying on any government stipend is like walking into a sand trap.