Over 90% of Stock Market Value Is Now Intangible

Chart of the Week #49

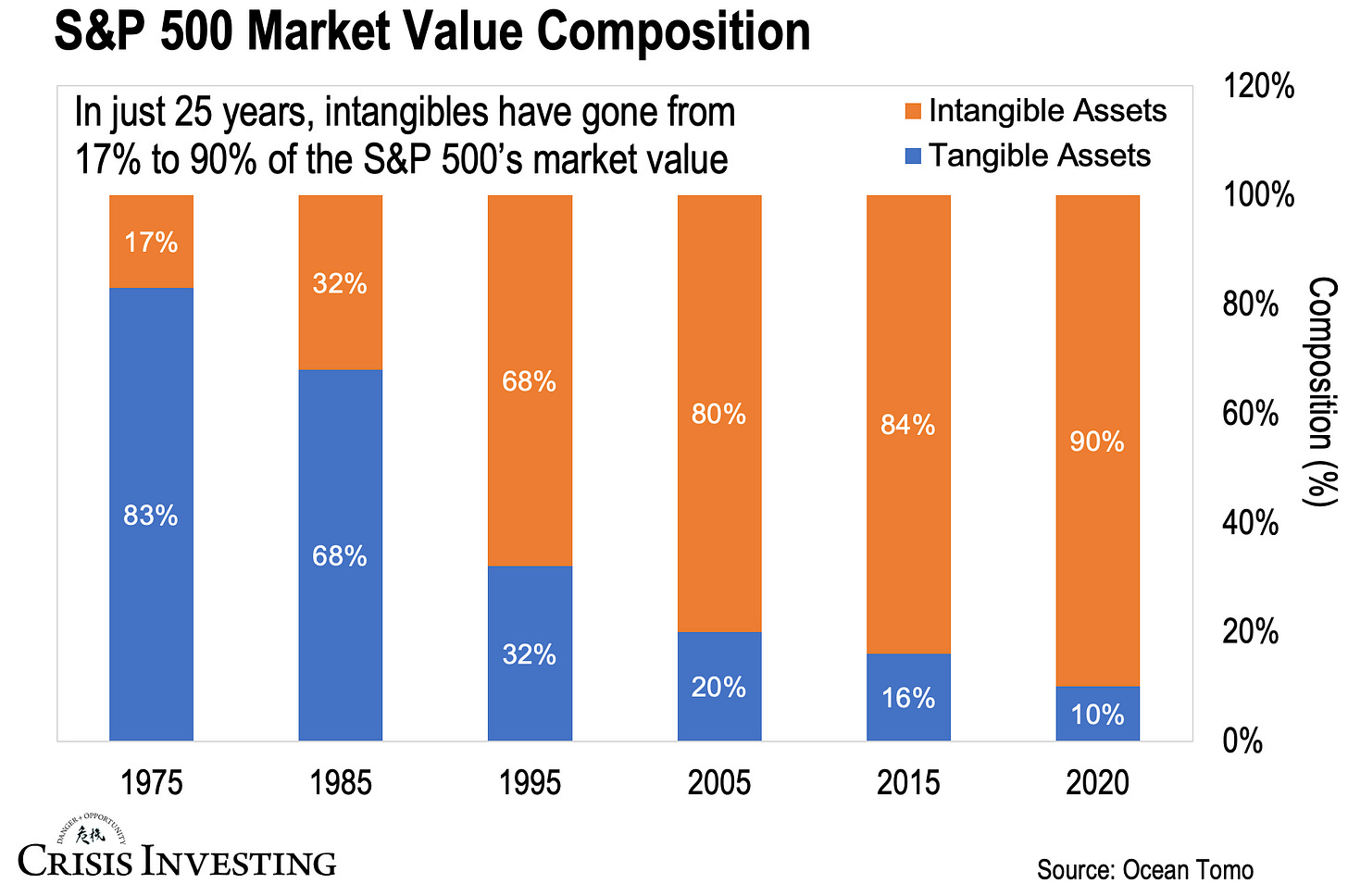

There's something deeply unsettling about today's stock market that most investors are completely ignoring. It's a transformation so profound that it undermines the very concept of "investment" as our grandparents understood it. Just take a look at this week’s chart below.

What you're seeing is nothing short of a revolution in what constitutes "value" in American corporations. In 1975, tangible assets—things you could touch, see, and count—made up 83% of the S&P 500's market value. Today? They've shriveled to just 10%.

Let me be clear: intangible assets aren't inherently bad. Some shift toward intangibles was inevitable and proper as our economy evolved from manufacturing to services and technology. Software companies, for instance, naturally have more value in code than in physical assets. Microsoft's Windows operating system, Apple's iOS ecosystem, and Amazon's logistics algorithms are genuine innovations worth billions. Things like customer lists, intellectual property, and digital infrastructure can create tremendous value.

But at 90% of market value? The pendulum has swung to an extreme that should concern any serious investor.

This imbalance didn’t emerge overnight, mind you. It’s the product of more than a decade of near-zero interest rates, which fueled speculation and the financialization of nearly everything. With cheap money flooding the system, investors increasingly prioritized growth narratives and theoretical future profits over real production and durable, income-generating assets.

As a result, when you "invest" in the stock market today, you're largely buying assets that exist on paper, in the cloud, or as projections of future potential. And this lopsided ratio—9 to 1 in favor of intangibles—creates a precarious market structure more vulnerable to sudden shifts in sentiment.

Consider what happens when crisis strikes. Tangible assets maintain intrinsic value regardless of market conditions. A factory doesn’t vanish in a downturn—it’s still a building with real-world utility. Equipment can be repurposed or sold for parts. Inventory, even if discounted, can be liquidated.

But intangible assets? Their value can evaporate overnight.

Just ask shareholders of companies like WeWork, Bed Bath & Beyond, or countless dot-com era casualties how quickly "brand value" and "growth potential" can turn to dust when sentiment shifts.

That's because intangible valuations aren't just fragile — they're also easy to manipulate. Physical assets follow generally accepted accounting principles with relatively straightforward valuation methods. But how do you objectively value a brand? A patent? An algorithm? These are subjective judgments that leave tremendous room for creative accounting and outright fraud.

Think about Enron's "mark-to-model" valuation methods that helped disguise their fraud. Or FTX's made-up balance sheet. These were extreme cases, but they illustrate how slippery intangible valuations can be.

A healthy, modern economy needs both innovation (intangibles) and production (tangibles). Companies like Tesla combine cutting-edge software with manufacturing capacity. Apple pairs its valuable ecosystem with sophisticated production capabilities (albeit mostly outsourced). The most resilient businesses maintain this balance.

But at the current 90/10 split, the S&P 500 has clearly lost that balance.

Enjoy the rest of your weekend!

Lau Vegys

P.S. Speaking of tangible things—since December, roughly 2,000 metric tons, or 64 million ounces, of gold have flowed into the U.S. That’s nearly a quarter of America’s official reserves—and it’s no coincidence. We’re convinced this is part of Trump’s plan to overhaul the American economy and monetary system. Matt Smith has meticulously documented how this could trigger a financial transformation unlike anything we've ever witnessed. If you haven’t read his latest report yet, make sure you do.

Wow… what a stunning statistic, terrifying when one truly considers that reality, literally 9 of 10 buying fresh air, the very definition of hopium, yet it is that precisely that is on offer, contrast that with an economy like… oh, China, where the statistic noted herein will be the exact inverse still likely I would guess without being privy the full metrics applicable, but nevertheless likely to be a similar 9 to 10 ratio, with the caveat, they are an economy and investment market heavily centric tangibles, manufacturing and supply chains required to support manufacturing at the scale China dominates the globe in…

I know where I want my money to be, that and assets, markets similar, together now buying up anything that owns or is engaged in real stuff, mining for example comprised only of companies actually engaged in mining, buying companies with great track records, not buying akin as so well Opined in this article… Intangibles, the intangibles equivalent for mining being companies owning licenses to mine, yet haven’t yet mined or have no track record of having successfully mined resources.. they need to be avoided at all costs or at best I would only commit 1 - 1.5% maximum of a portfolios value into such… the risk simply to great.

I agree every company needs to start and how can they start unless backed, my retort is simply, they and myself are more than happy they get backing just not from me, I’d prefer to forgo the big hit of a 10 - 12 bagger+ to gaining 3/4x doing so after a company proves resource and has mined whatever it is they are mining… otherwise you might as well hit the casino with your hard earned.. truly enjoyed this read… just saying..

Kia Kaha (Stay strong) from New Zealand

It does reflect the shift to a more digital world . A good book to read on then topic is capitalism without capital. These companies do Scale with mush lower associated cost . They do benefit from Synergies in the ecosystem they operate in like for example the internet and software together. They also produce spill overs where the tech is exploited by others building new product and spawn new and other innovations at the same time It totally true that when these companies fail the total value of the digital asset is lost. Not sure where it leaves us though