Here’s Why and How the Fed's QT Was Always Fake (Spoiler: Fiscal Dominance)

Chart of the Week #80

Recently, we’ve spent a lot of time talking to you about the end of the Fed’s quantitative tightening (QT). And for good reason—because as we know, once QT ends, QE (money printing) is never far behind.

Since June 2022, the Fed has been letting up to $95 billion in securities mature each month without replacing them.

Of course, as I’ve said before, it’s all been for show. They chose the slowest possible method of tightening their bloated balance sheet—letting bonds “roll off” as they mature rather than actually selling them or forcing banks to return cash. And the result? After three years, they’ve barely made a dent. That’s because they’re still sitting on $6.5 trillion—nowhere close to the pre-pandemic levels of roughly $4 trillion.

Now that we’ve set the stage, I want to dig deeper into the whole “this has all been for show” argument. By the time we’re done, I hope you’ll see—more clearly than ever—that QT was never real to begin with.

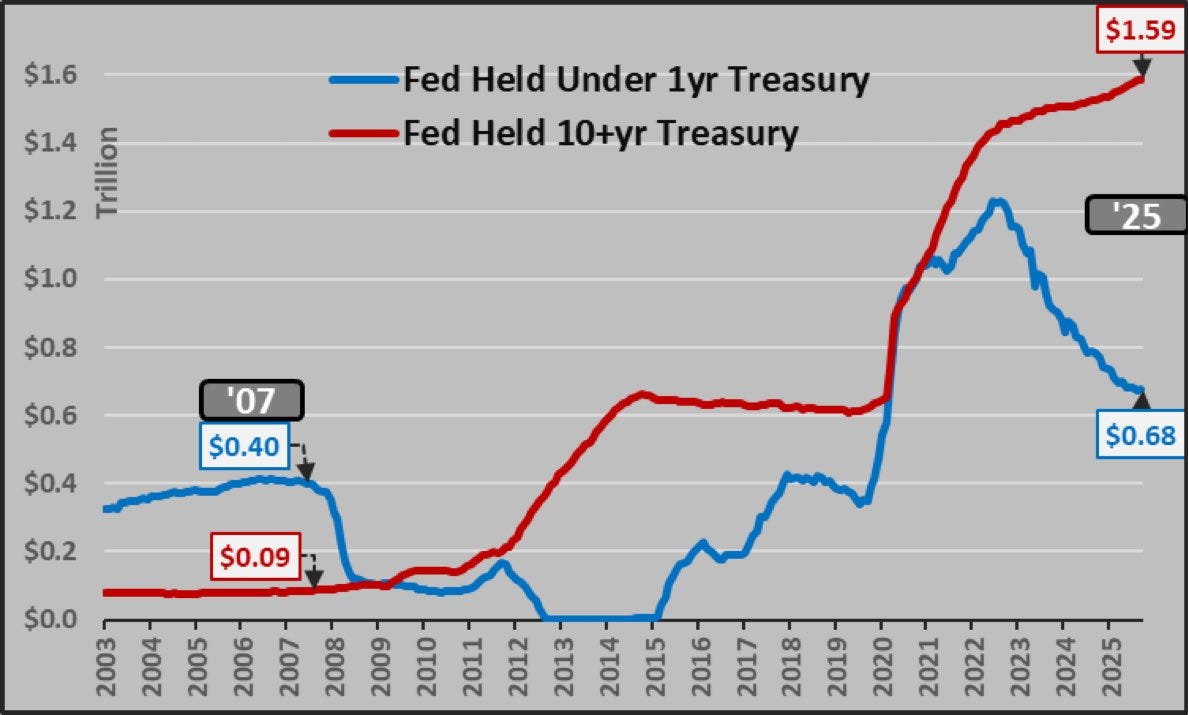

Take a look at today’s chart below, which breaks down the Fed’s Treasury holdings by maturity.

As you can see, the blue line tracks the Fed’s short-term Treasury holdings (under 1 year), and the red line shows its long-term holdings (10+ years). If I had to sum up what these two lines are telling us, it’s this: they’re the smoking gun of fiscal dominance.

Now, if you’re wondering what that actually means, fiscal dominance is when the central bank can’t really run monetary policy “independently” anymore—and yes, I’m using those quotation marks on purpose—because it has to manage policy in a way that keeps the government from going broke.

And that’s exactly what we’re seeing in the chart above.

From 2022 through today, the Fed allowed short-term Treasury holdings to collapse—from over $1.1 trillion down to just $0.68 trillion. That’s actual runoff.

Now look at the red line—the long-term Treasury holdings.

This is where real tightening would show up, because 10+ year bonds are what determine mortgage rates, corporate borrowing costs, and long-term financial conditions across the entire economy. When the Fed buys these in massive quantities, it artificially suppresses long-term yields and creates dependency on cheap credit. And when they’re supposed to be tightening? You’d expect this line to fall sharply.

Instead, it rose. From roughly $1.3 trillion in 2023 to $1.59 trillion today.

So what does this tell us? It tells us what I’ve told you many times before—that QT was always theater. The Fed made noise about shrinking its balance sheet, let some short-term bills roll off naturally (the least consequential part), and called it progress. But the core distortion—the trillions in long-term Treasuries artificially suppressing yields and propping up asset prices—never budged. In fact, it grew.

And there’s a reason for that. The Fed can’t unload long-term Treasuries, because dumping $1.59 trillion in 10+ year bonds into the market would spike long-term interest rates, crater the bond market, blow up the federal government’s interest expense, and potentially trigger a financial crisis. They know this. Everyone knows this.

It’s the monetary equivalent of that old Soviet joke: “They pretend to pay us, and we pretend to work.” The Fed pretends to tighten—letting short-term bills roll off while quietly protecting the long end—and the market pretends to believe them.

But even that glacial pace proved too much. And Fed Chair Jerome Powell, at the National Association for Business Economics conference in Philadelphia when announcing the end of QT, also said this:

Normalizing the size of our balance sheet does not mean going back to the balance sheet we had before the pandemic.

Translation: We’re done with the illusion. The new “normal” is $6.5 trillion—60% higher than before we destroyed your purchasing power. Deal with it.

The problem, of course, is that when the Fed fires up QE again to drag long-term rates lower, it’ll be starting from an already bloated balance sheet. The last time they unleashed trillions, inflation shot to 9%. Doing it again—starting from a much higher base, with liquidity still everywhere—practically guarantees double-digit inflation. That’s how you get currency destruction on a scale and speed this country has never seen.

Regards,

Lau Vegys

P.S. We believe the Fed’s move back into easy money will set off a massive bubble in commodities—especially in monetary metals like gold and silver. That’s why a big portion of our Crisis Investing portfolio is in mining stocks, which Doug Casey himself owns. We recently released our latest issue—if you haven’t read it yet, be sure to check it out.

Good job