Gold’s Not #2 Anymore in 2025

Chart of the Week #81

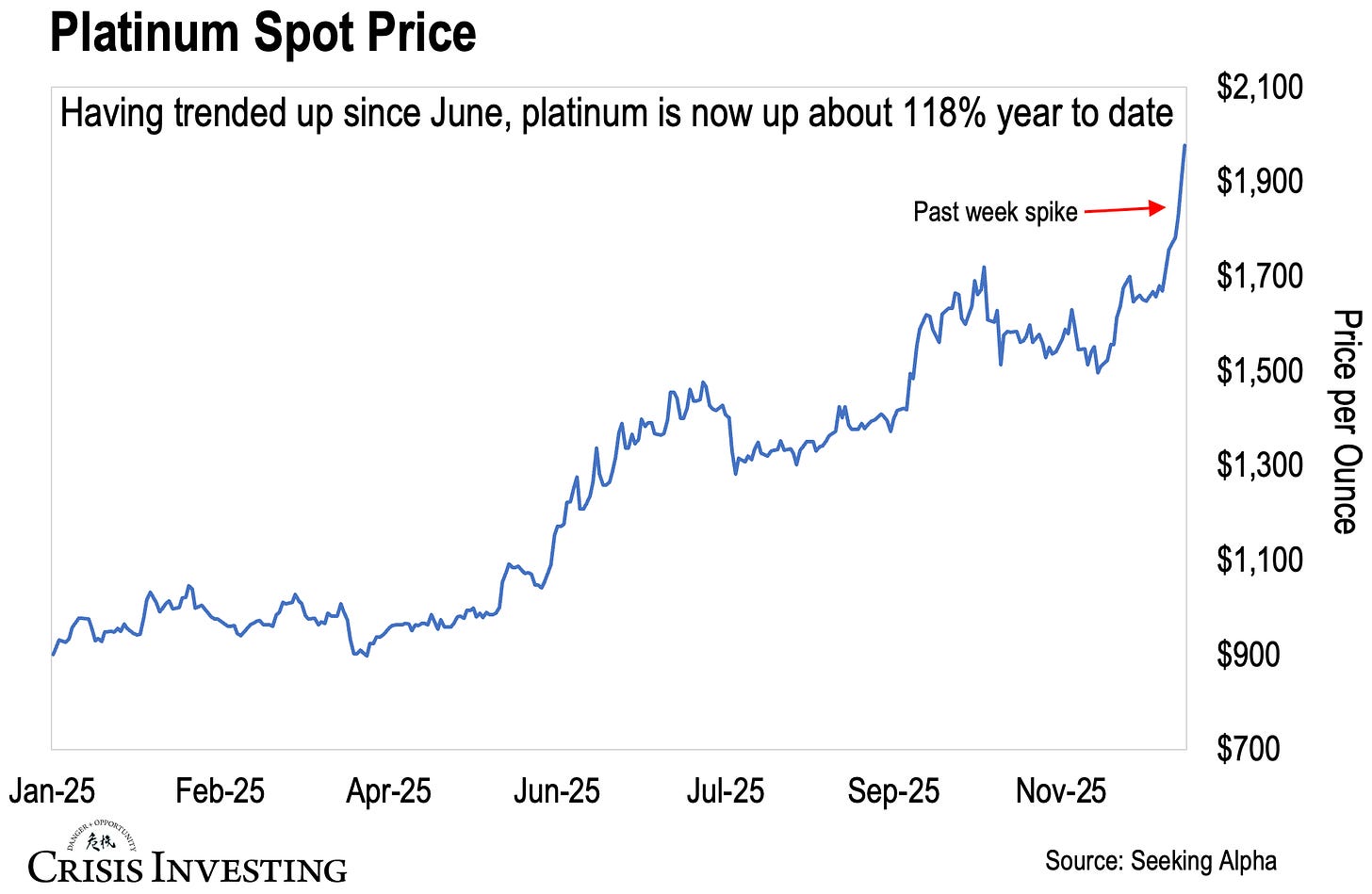

Silver’s the best performing precious metal this year. You probably knew that. But do you know what’s second? If you said gold, you’d be wrong. It’s actually a metal most investors don’t usually think of in the same bucket as gold and silver: platinum. That’s what today’s chart is about. Take a look.

Platinum is up 118% year-to-date, trading around $1,970 per ounce as of yesterday—its highest level since 2008. That makes it the second-best performing precious metal of the year, behind silver’s 126% gain but miles ahead of gold’s 65%.

Now, if you know anything about platinum, you know it isn’t a pure monetary metal like gold. It’s primarily an industrial metal—roughly 40–50% of demand comes from autocatalysts in vehicles, with the rest split between jewelry, industrial applications, and investment demand.

So when platinum surges like this, you’d expect the story to be about tightening supply or booming auto demand or some similar fundamental shift.

And to be fair, that’s part of it. South Africa and Russia—which together account for the lion’s share of global supply—both face serious production constraints. On the demand side, governments keep mandating stricter emission standards—Europe’s Euro 7, China’s China 6—all of which support ongoing demand for platinum in catalytic converters. Meanwhile, the slowdown in EV adoption is keeping traditional internal combustion engines and hybrids alive longer than expected (which is good for platinum since EVs don’t need catalytic converters at all).

But here’s where it gets interesting. If you zoom in on platinum’s recent price action—I’ve marked it with a red arrow on the chart above—you’ll see a sharp spike. In fact, the metal is up more than 10% in just the last five days alone.

I mean, just over the weekend—when I put out a profit-taking alert on a couple of our positions—I wrote this about platinum:

Even platinum, a metal not usually thought of as a monetary hedge, climbed above $1,750—its strongest level since 2011.

Fast forward less than a week, and it’s now over $1,970 per ounce.

So what’s happening?

Platinum's surge last week came on the back of two announcements from the Fed. On December 10th, they cut rates by 25 basis points (bringing the target range down to 3.5–3.75%) and announced a return to Treasury bill purchases—$40 billion per month starting December 12th.

They're calling it "reserve management" and insisting it's temporary (though they forgot to say when “temporary” ends). But make no mistake—this is money printing. The Fed's balance sheet is expanding again.

And as I wrote recently, if history is any guide, this is just the opening move in what will inevitably become full-blown quantitative easing.

That’s the kind of environment where precious metals tend to shine—including platinum. For context, during the last QE cycle from 2008 to 2011, platinum climbed 140%, gold gained 170%, and silver didn’t just rally — it went parabolic, soaring 440%. To me, that suggests we’re still in the early innings of the next leg higher in precious metals.

Regards,

Lau Vegys

P.S. We believe the Fed’s move back into easy money will set off a massive bubble in commodities—especially in precious metals like gold and silver and, yes, platinum. That’s why a big portion of our Crisis Investing portfolio is focused on precious metals miners—many of which Doug himself owns. Incidentally, the profit alert I touched on earlier was on a platinum-group metals play.

When Nixon severed the last link of the dollar to gold, that was "temporary" too.

And the EU abandonned the combustion engine ban from 2035. i guess this fueled platinum also.