China Urges Banks to Dump U.S. Debt

This Is Only the Beginning

If you’ve been following Crisis Investing for any length of time, none of what I’m about to tell you should come as a shock. But it’s still worth writing about — because what China used to do quietly, it’s now doing openly enough for the world to notice.

On Sunday, Bloomberg reported that Chinese regulators have verbally instructed the country’s biggest banks to rein in their holdings of U.S. Treasuries. Officials told banks to limit new purchases and ordered those with high exposure to start paring down their positions. The guidance was communicated privately in recent weeks to some of China’s largest financial institutions.

Beijing’s stated reasoning? “Concentration risk” and “market volatility.” In other words, the diplomatic version of: we don’t trust this stuff anymore.

Now, the directive doesn’t apply to China’s sovereign reserves — the state-level holdings managed by the People’s Bank of China (PBC). But as I’ll show you in a moment, those have been falling off a cliff for years anyway.

Not that Washington seems concerned. Treasury Secretary Scott Bessent recently waved off concerns that foreign investors were dumping Treasuries. Nothing to worry about, move along.

But the markets didn’t buy it. When they opened yesterday, Treasury yields climbed as much as four basis points, hitting 4.25%. The dollar slipped against major currencies. And analysts started talking again about the “sell America” trade — the idea that foreign holders are increasingly questioning whether U.S. assets deserve their traditional safe-haven status.

As Gareth Berry, a strategist at Macquarie, the Australian investment bank, put it: this is “the latest evidence of a pattern forming — a sign that the expectation of long-term structural outflows from the dollar is not just a mirage.”

He’s right. And for those of us who’ve been tracking this shift for years, the only surprise is that it took this long to make headlines.

The Numbers Speak for Themselves

Once again, this fits into the broader pattern of China systematically shedding its U.S. sovereign debt holdings, and at a pace that would have been unthinkable just a decade ago. If that was the first shoe to drop, this banking directive is the second.

As I wrote back in September, China sold $25.7 billion worth of Treasuries in July 2025 alone — the sharpest monthly cut in nearly two years. Before that, they dumped $53.3 billion in the first quarter of last year and $21 billion in the quarter before that.

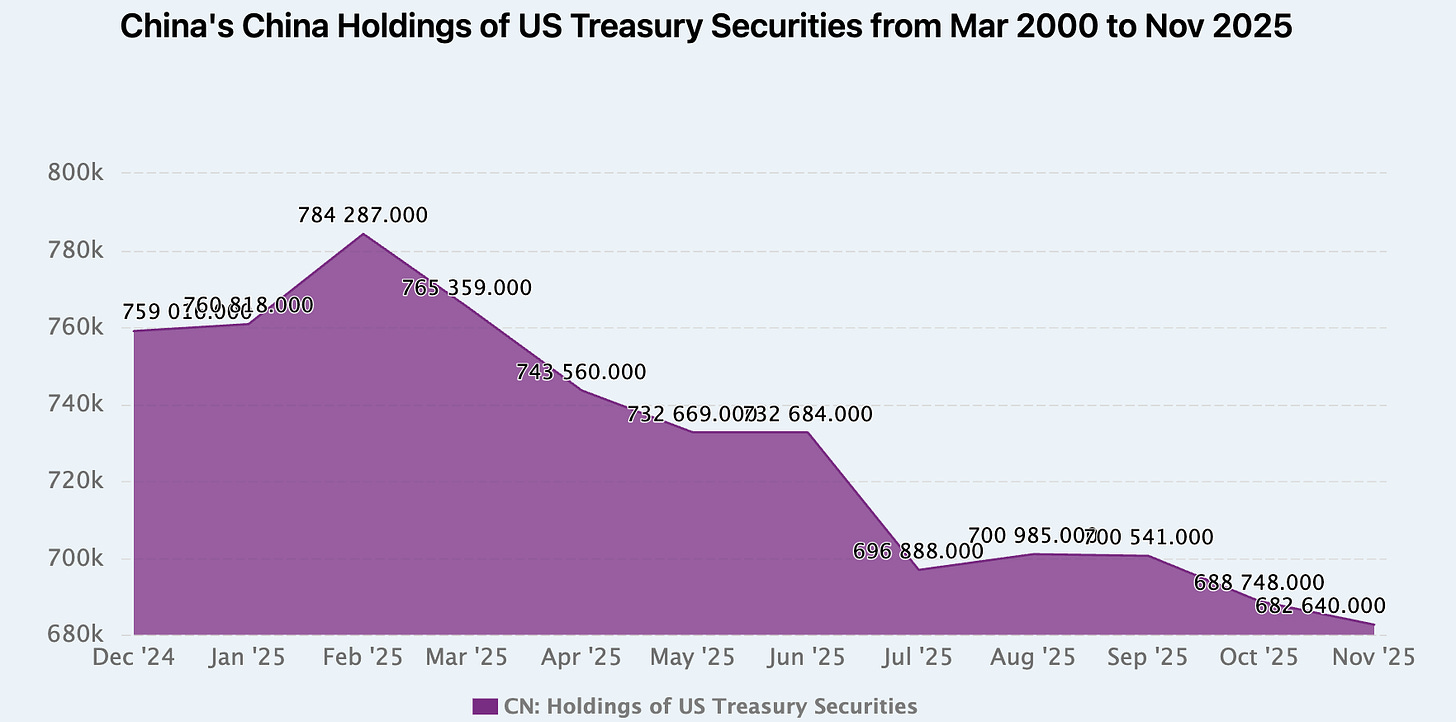

As a result, the latest official U.S. data shows China’s Treasury holdings have fallen to $682.6 billion. Words don't really do justice to how dramatic this drawdown has been relative to just a year ago, so here's a visual.

That’s roughly two-thirds of the $1.10 trillion reached in 2021 — just several years ago. It’s also the lowest level since 2008, right in the middle of the Global Financial Crisis.

This is really something when you consider that until relatively recently, China was the biggest holder of U.S. debt. But that started to change in 2018 with the trade war. By 2019, Japan had taken the lead. And now? China has slipped to third place — behind both Japan and the United Kingdom.

The logic here is simple: cutting back on U.S. Treasuries means less dependence on American monetary policy, less exposure to the mess in U.S. finances, and less risk of having assets frozen — like Russia’s were in 2022 when Washington froze its reserves and cut it off from SWIFT. That was the real wake-up call for Beijing.

Okay, but where is the money going?

The same place it’s been going for years: gold.

In fact, the inverse relationship between China’s gold buying and its U.S. debt selloff has been one of the clearest trends in global finance since 2018. Gold’s share of China’s foreign reserves has surged from under 2% a decade ago to nearly 8% today, while its U.S. debt holdings relative to reserves have dropped from 44% to around 30%.

It’s Not Just China Anymore

But here’s what a lot of people don’t get: China isn’t alone in heading for the exits.

Sure, it may have been the first major economy to sound the retreat. But other heavyweights — particularly the BRICS nations, the bloc of emerging economies that have been openly challenging the U.S.-led financial order — are doing the exact same thing.

For instance, did you know that India slashed its Treasury holdings by 21% in a single year — from $241.4 billion in October 2024 to $190.7 billion by October 2025? That’s a $50.7 billion cut and the first annual decline in four years. Meanwhile, the Reserve Bank of India (RBI) has been aggressively buying gold — reserves now sit at about 880 metric tons, with gold accounting for 13.6% of India’s total forex reserves (up from 9.3% the year before).

Then you have Brazil, whose U.S. debt holdings dropped by $61.1 billion over the same period. Brazil was actually the third-largest foreign holder of U.S. debt back in 2018 and has been steadily cutting since.

When you put it all together and add China, that’s over $183 billion shed by just three countries in one year.

And it’s not just BRICS. Not even just governments, for that matter. Just recently, we learned that European pension plans — some of the most conservative institutional money managers on the planet — have also started trimming their U.S. Treasury holdings. Sweden’s Alecta sold between $7.7 and $8.8 billion in U.S. Treasuries over the course of last year, citing “reduced predictability” of U.S. policy. The Netherlands’ ABP, Europe’s largest pension fund, cut its Treasury holdings from roughly $30 billion to $19 billion in just six months. And Denmark’s largest fund, PFA, sold out of U.S. Treasuries entirely.

When institutions that have treated U.S. government debt as the bedrock of their portfolios for decades start pulling back, something fundamental is changing.

Needless to say, all of this is a bit of a problem for Washington, given that about $9 trillion — or roughly a third of its publicly held debt — sits in foreign hands. With the national debt now pushing past $38.6 trillion, the question isn’t whether more countries and institutions will continue to follow China’s lead. It’s how many.

Because at some point, the U.S. government will have to face an uncomfortable truth: you can’t count on foreigners to bankroll your spending forever when more and more of them are quietly heading for the exits.

Regards,

Lau Vegys

P.S. This is exactly the kind of macro shift that drives the investment thesis behind our Crisis Investing portfolio. In fact, in our latest issue, we did just that — outlined our thesis for the year (and raised buy guidance on several of our precious-metals positions). If you’re a subscriber, make sure you haven’t missed it.

Nice article, you should have added the effect it has had on the US economy.

Seems like the Shanghai exchange is playing it wisely. Dump treasuries whilst keeping their prices higher than US exchanges for gold and silver. Then metals bought in the US cheaper can be sold in Shanghai for more. US traders think they got a great deal and made a big profit on the arbitrage, when all they got was shitty dollars and Shanghai ends up with more metals. Not sure I understand this all, but seems pretty reasonable on their part.