America's $1.66 Trillion Auto Debt Bomb

Chart of the Week #79

We just published our latest issue of Crisis Investing focused on America’s auto debt crisis—and specifically, how to profit from one company that perfectly embodies everything broken in this market.

If you haven’t read it yet, here’s the short version: Americans owe $1.66 trillion in auto debt. Delinquencies just hit levels not seen since the Great Financial Crisis. Nearly 30% of all trade-ins are underwater. And we’ve identified a specific trade to profit when this house of cards collapses.

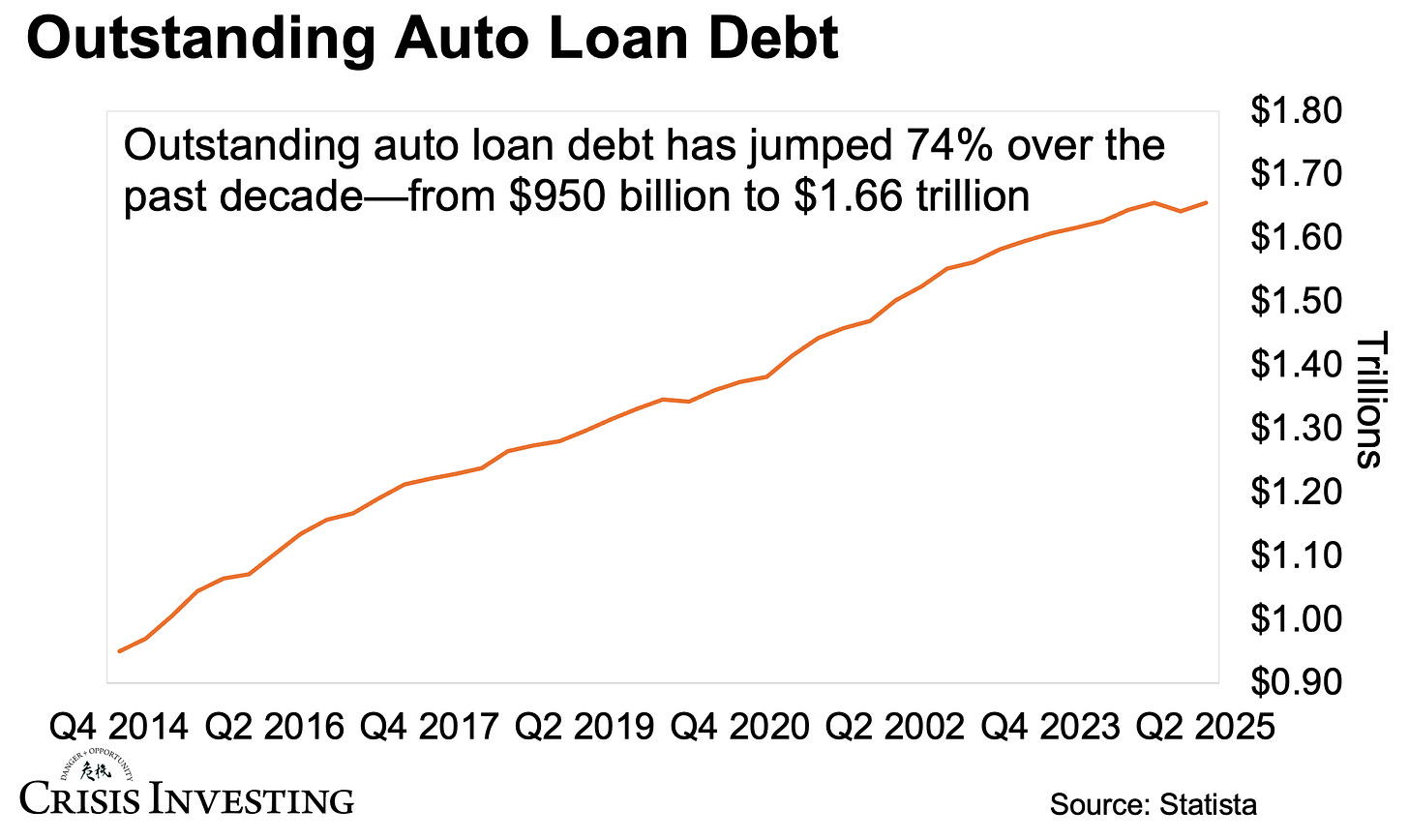

But after publishing that issue, I realized there are two charts that really drive home just how serious this situation has become. Take a look at the first one below, showing outstanding auto loan debt over the past decade.

As you can see, outstanding auto loan debt has surged 74% over the past 10-plus years—from around $950 billion in late 2014 to $1.66 trillion today.

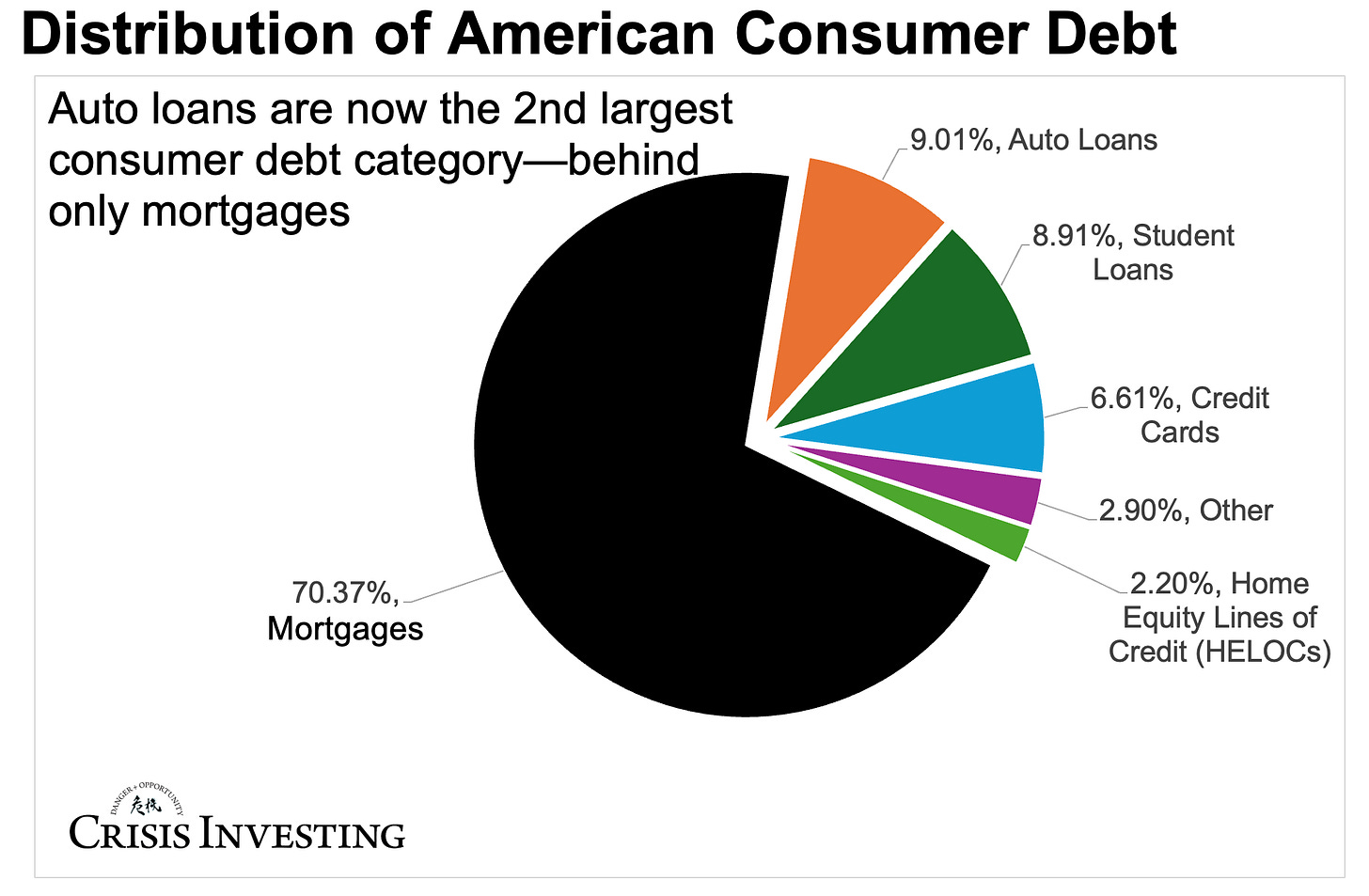

The trend has been so relentless that car loans now make up the second-largest consumer debt category—behind only mortgages. Just take a look at the distribution of American consumer debt below.

Auto loans are now a bigger consumer debt category than student loans (8.9%) and significantly larger than credit cards (6.6%).

Think about that for a moment.

We’ve spent years hearing about the student loan crisis and worrying about credit card debt. But auto loans have quietly become a bigger piece of the consumer debt puzzle than either of those.

And unlike mortgages, which are backed by appreciating real estate, auto loans are secured by vehicles that lose value the moment you drive them off the lot. In fact, they depreciate 20-30% in the first year alone.

And that’s the problem…

Because, as I mentioned earlier (and in the issue), nearly 30% of borrowers are already underwater on their car loans—owing an average of $7,000 more than their vehicles are worth.

None of this is “natural” or market-driven.

Just take another look at the first chart above. If you examine it closely, you’ll see how the debt line skyrocketed during the COVID years.

And it’s no wonder. During the pandemic, the government flooded consumers with stimulus checks while lockdowns and supply chain disruptions sent car prices soaring. People paid whatever they had to, financed at whatever rate they could get, and dealers pushed loans that should never have been written.

Now those inflated prices are coming back to earth, but the loan balances aren’t. Consumers are trapped—they can’t sell without taking a loss, and they can’t refinance into better terms. Meanwhile, stimulus money is long gone, real wages haven’t kept pace with inflation, and credit card balances are at all-time highs.

All these factors combined are creating a ticking time bomb—one that’s already starting to detonate in the subprime market.

Regards,

Lau Vegys

P.S. We’ve laid out the complete thesis in the latest issue, including the specific trade we’re recommending. If you’re a paid subscriber and haven’t read it yet, be sure not to miss it. And even if you’re not a paid subscriber, the lead story—which unpacks the auto loan crisis in more detail—is available to all readers.

Thanks Lau, I put the recommended trade on and feel good about it.

my goodness, auto debt is the best that can happen to an economy.

the banks work, the carproducers work, for a while the carowners work.

the building of roads for access to gasstations is tradition. the govt.

need not building rail for commuters, would restrict freedom of driving.

just get a second job.