2025: The Year Central Banks Finally Chose Gold Over U.S. Treasuries

Chart of the Week #69

I don’t usually send these more than once a week—unless I come across something timely or compelling enough to share right away. This is one of those times, not least because we just put out our latest gold-focused issue of Crisis Investing.

As I mentioned there, for three consecutive years now, central banks have purchased over 1,000 tons of gold annually. For context, the average annual buying in the decade before 2022 was just 400-500 tons. In other words, they’ve more than doubled their accumulation rate.

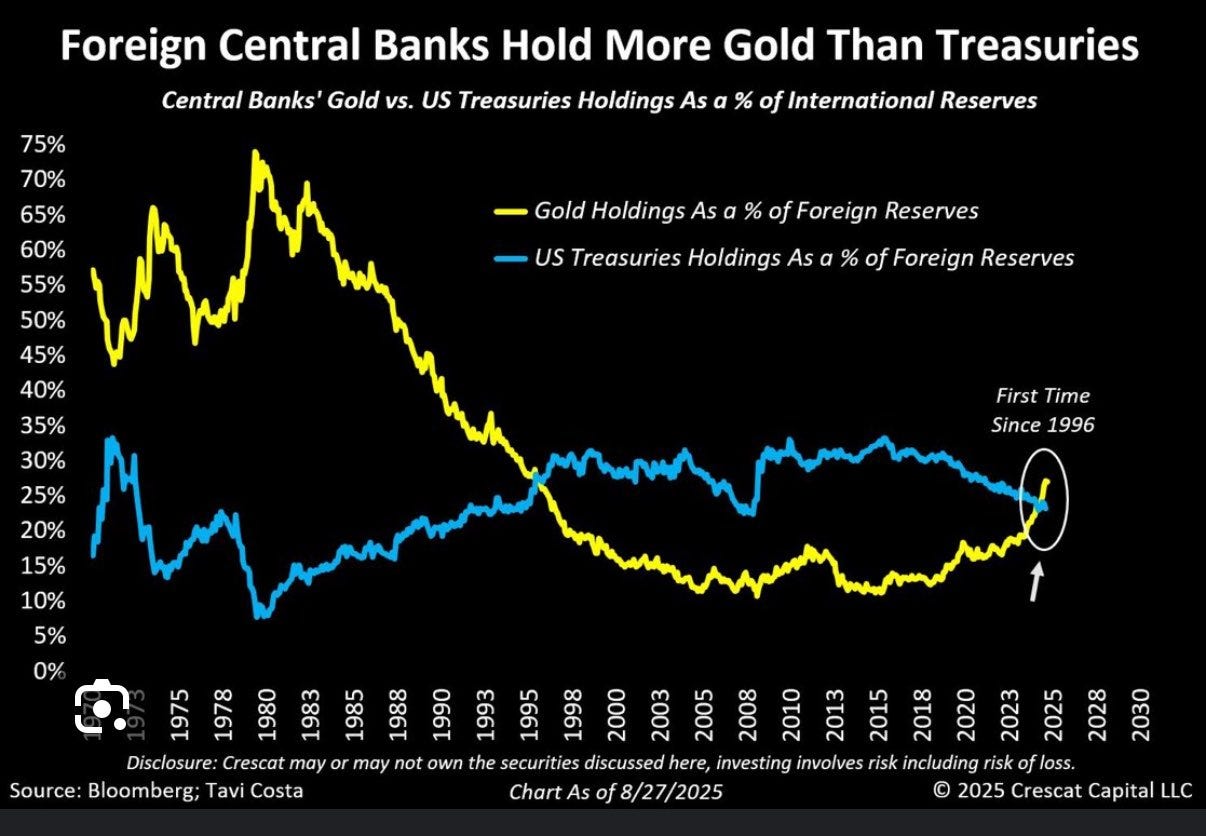

Take a look at today’s chart below. It shows central banks’ gold versus U.S. Treasuries as a percentage of their international reserves—and reveals the result of this buying spree: something that just happened this year for the first time in nearly three decades.

For the first time since 1996, central banks around the world now hold more gold than U.S. Treasuries as a percentage of their reserves.

As of the latest data, gold represents about 28% of global central bank reserves, while U.S. Treasury holdings have fallen to roughly 24%. The gap isn’t huge yet—but the trend is unmistakable.

Of course, this rotation didn’t happen overnight. It’s been building for years, quietly accelerating in the background.

But look closer at the graph above, and you’ll see the yellow line (representing gold’s share) starting its uptrend around 2015—just as the blue line (U.S. Treasuries) began trending down. That’s no coincidence.

After the U.S. weaponized the dollar through sanctions against Russia in 2014, other nations realized that holding dollar reserves meant accepting potential financial subjugation. If Washington decides your foreign policy isn’t aligned with theirs, your reserves can be frozen or seized. Gold can’t be sanctioned away.

(The U.S., of course, doubled down on Russian sanctions in 2022, and the yellow line started climbing at an even steeper trajectory.)

Will gold’s share ever return to the levels seen during the inflationary chaos that followed the 1971 Nixon Shock?

I don’t know—but it’s clearly heading higher, driven by rising prices and expanding central bank holdings feeding into each other. A virtuous cycle, if you will.

And here’s the critical point: this demand is largely price-insensitive. Central banks aren’t momentum traders worried about quarterly returns. They’re accumulating gold as a long-term store of value and hedge against dollar debasement. Whether gold trades at $3,000 or $4,000 matters less to them than whether they hold enough of it before the next crisis hits.

So it’s hardly surprising that in a recent survey, 43% of central bankers said they plan to increase their gold reserves over the next 12 months—up from just 29% a year ago.

As impressive as that figure is, I suspect many more simply weren’t willing to disclose it, because when asked whether they believed global official gold reserves would continue to rise, a stunning 95% said yes.

Think about that for a moment. The institutions that manage trillions in reserves—the most risk-averse financial managers on the planet—are nearly unanimous in believing their gold holdings will keep growing.

Have a great rest of your weekend!

Lau Vegys

As it should be, the Central bankers understand implicitly true financial risk buttressed hegemony, neutral purveyors of the same for as long as said hegemony does not impact their fiscal risk management methodologies they will go along to get along, never wanting to be seen to be the outlier or to rock the boat metaphorically speaking… however present as if your policy will have a negative impact, then despite to whom they are subservient, instinct and learned calculus will take and hold sway, hence the need to hedge what is viewed globally as a truly deteriorating fiscal calculus and forward position.

Thus Central Bankers many of them servants of the ultimate beneficial owners the IMF, World Bank, and BIS are merely doing the correct and appropriate action, hedging against an uncertain geo politik Global Economic outlook… not for the true owners at the top watching on benignly as their literal trillions evaporate predicate a fall and ultimate breakdown of trust, afterall as many know the entire edifice that is international finance and economics, trade is built upon the foundations of trust, trust relied upon in huge measure, remove or attack that foundation and it implodes, in othe4 words, our fiscal monetary system is built upon a foundation of sand, those of us who understand and have read of such understanding implicitly that a rock is the better foundation to sow your seed upon… hence the swing to gold … it has withstood and is proven as the perfect adjunct to such temporal behavioural traits as hast been expereinced ever since Bretton Woods that ushered in the despicable manipulation of a system designed to benefit the few over the many, something when given thought, especially understanding human history hast been man’s want, those authorities in high places able to manipulate such, with each iteration of such eventually failing, thus the flight yo gold something many outside of the Central banks have long understood… watch this space, grab your popcorn, we’ve watched the opening act, now it’s time for the main reel to play out… just saying ..

Kia Kaha (Stay Strong) from New Zealand

You're notes are always timely and appreciated.