When Debt Strangles Growth

Chart of the Week #72

I don’t usually start the week with a Chart of the Week. But every now and then, something lands on my desk that’s too good to sit on—and I’d rather share it now than risk forgetting later.

But first, a bit of context.

As I write this, U.S. government debt is edging closer to the $38 trillion mark—now well over 120% of GDP. That puts us in the same league as basket-case economies like Venezuela, Sudan, and Lebanon. Not exactly the kind of company you want to keep. But it makes sense: history shows that once a country crosses this threshold, things start to break—and it’s rarely just one thing. I’ve talked a lot about that in the past.

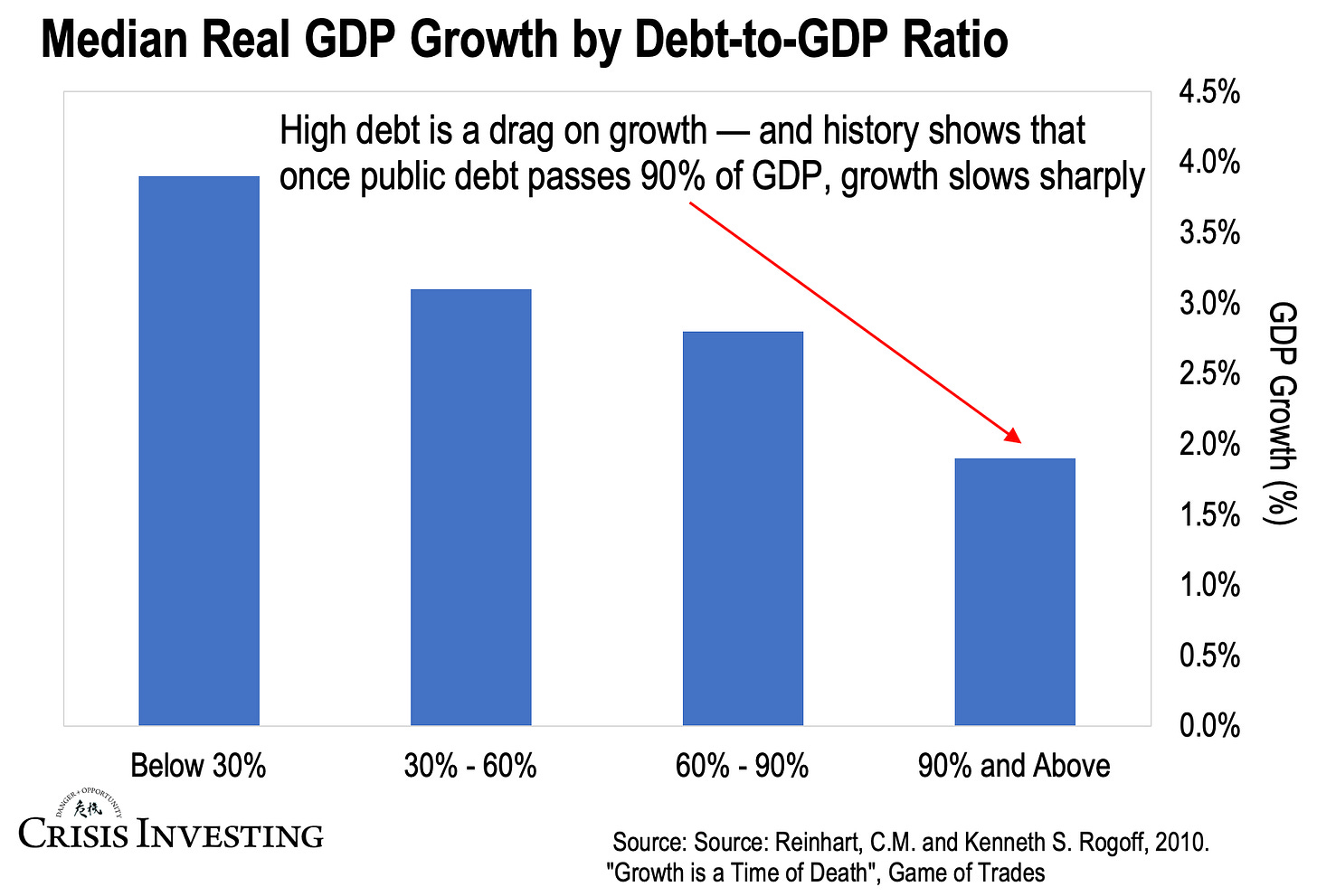

But what I haven’t shown you yet is what high levels of debt actually do to growth. That’s where this week’s chart comes in. Take a look below.

The chart tracks growth rates across 20 developed economies sorted by their debt levels. With data spanning from 1790 to 2009, it’s one of the longest looks we have at how rising debt eventually strangles economic growth.

As the chart makes clear, countries with debt below 30% of GDP grow at a healthy clip of nearly 4% a year. As debt rises into the 30–60% range, growth slows to around 3.1%. Push it further to 60–90%, and it slips well below 3%. But once you cross that 90% threshold—the rightmost bar in the chart—growth collapses to under 2%.

That’s not a coincidence. High debt levels act as a brake on economic expansion. They crowd out private investment, force higher taxes, and create uncertainty that discourages business activity. The more debt piles up, the harder it becomes for an economy to grow its way out of the hole.

Think about what that means.

Every percentage point of lost growth translates to fewer jobs, lower wages, and—ironically—even more debt as the government tries to paper over the weakness. It’s a self-reinforcing cycle that’s incredibly difficult to escape once you’re in it.

Now, as I mentioned earlier, things tend to break once you pass the 120% debt-to-GDP mark. The only country I can think of that has managed such a high debt load without complete disaster is Japan (its debt-to-GDP ratio is actually well over 200%). And that’s largely because of its peculiar advantages—it funds nearly all its debt domestically and benefits from a cohesive society willing to “tough it out together.”

But even Japan hasn’t escaped economic stagnation. Growth has been flat for decades, wages are stagnant, and the economy survives only on government and central bank life support. Japan is living proof that even when debt doesn’t blow an economy up, it slowly strangles its vitality.

Now, again, the U.S. is sitting at well over 120% debt-to-GDP. So, we’re not just past the danger zone (the point where debt exceeds roughly 90% of GDP)—we’re knee-deep in it.

Plus, the U.S. has neither of Japan’s advantages: only part of its debt is funded domestically, and it lacks the same kind of cultural cohesion. Nearly $8 trillion of the U.S. government’s $38 trillion debt is owed to foreigners who are growing increasingly uneasy about its fiscal trajectory—while the political class shows zero willingness, or courage, to confront the problem.

So if history is any guide, we’re probably not just facing a slowdown—we’re staring down a prolonged era of economic decay unless something breaks first.

Regards,

Lau Vegys

As Alaisdair Macleod says, "Get the hell out of credit and into gold."

Systemic perspective - the historical link between high sovereign debt and stagnating growth underscores risks that can ripple into B2B trade credit, corporate liquidity, and working-capital access. TCLM often explores how such macro shifts influence finance operations; might be a useful lens for external risk.

(It’s free)- https://tradecredit.substack.com/