The Rare Earth Crisis Is Real—And the Market Knows It

Plus: How We Got Here—and Why It Matters

This week I told you how the U.S.—and frankly, much of the developed world—is scrambling for rare earth supply after China tightened export restrictions. Automakers across the U.S., Europe, Japan, and Korea are either halting production or warning that full factory shutdowns “could be needed.”

That’s because on April 4, China imposed export restrictions on seven of the 17 rare earth elements (REEs), including high-performance permanent magnets—a move they’d been building toward for over a year. It’s a big deal. China continues to produce and process nearly 70% of the world’s rare earths—it’s a virtual monopoly.

That’s what pushed the U.S. to sit down with China for two days of trade talks in London, which ended Tuesday.

I’ll get to those talks in a second. But first, let’s address the elephant in the room…

Why is the U.S. in this situation at all? How did the world’s top superpower end up this dependent on an adversary for materials that make its economy hum?

How We Got Here

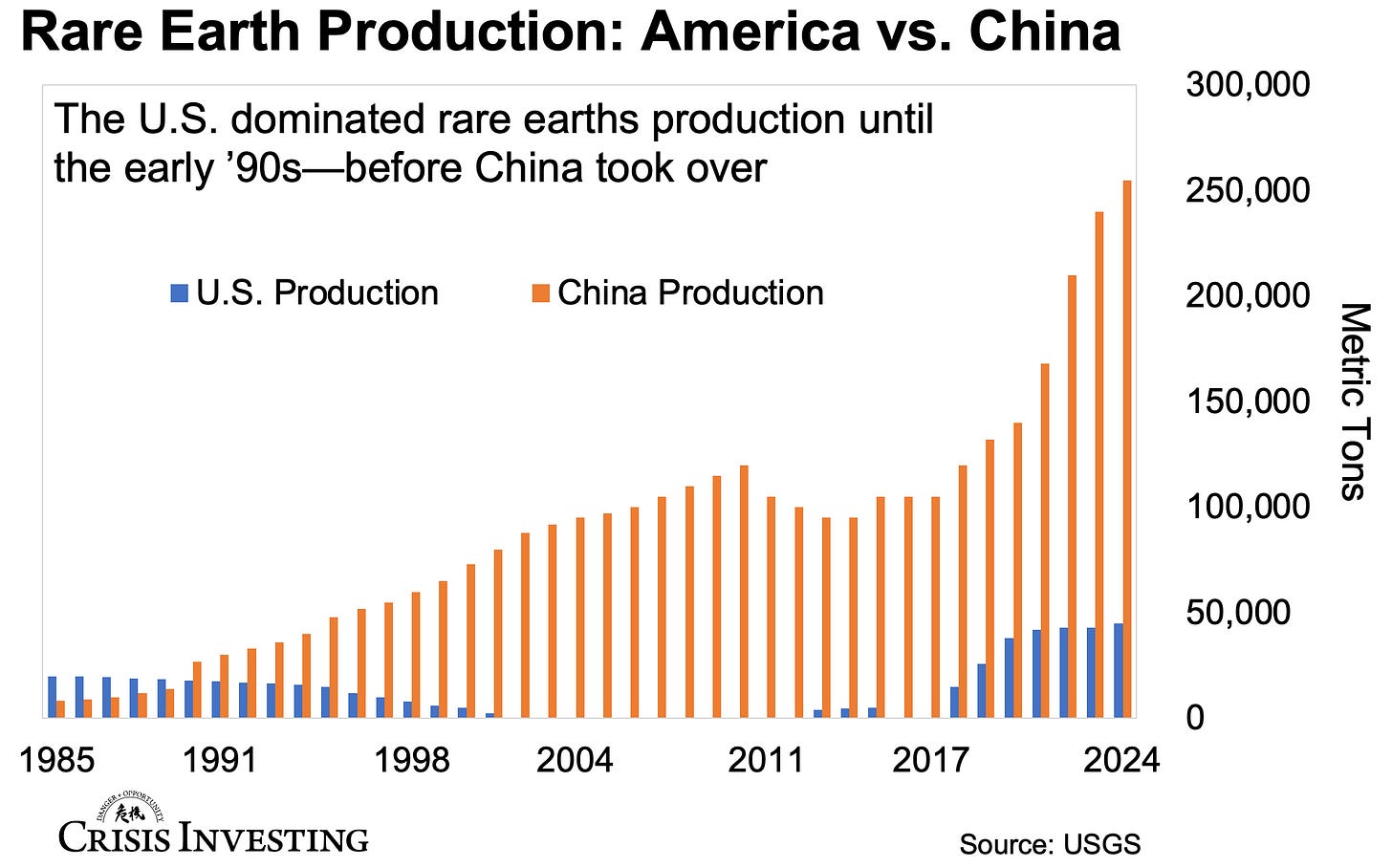

China’s rare earth monopoly wasn’t always a fact of life. A few decades ago, it was actually the U.S. that dominated global production.

Just look at the chart I shared in the latest Crisis Investing issue. In the 1980s and early ’90s, the U.S. was a major rare earth producer. Then production collapsed—just as China’s took off.

So, what happened?

Interestingly, the drop in U.S. rare earth output has everything to do with uranium.

You see, despite the name, rare earths aren't that rare. They're often found as by-products in common materials like iron ore or phosphate rock (used to make fertilizer). Back in the '80s, U.S. miners extracted rare earths from this by-product material. It was simple: take the waste, run it through a secondary process, and pull out the valuable elements.

Then came regulation.

Concerned about nuclear proliferation, regulators cracked down on companies handling ores with trace amounts of uranium—even if they weren’t enriched or dangerous. That was a big problem. The iron and phosphate feeds used to make rare earths often contained just enough uranium to fall under these rules.

Almost overnight, U.S. rare earth production shut down. Instead of recovering the metals, companies just buried them.

China didn't play by the same rules. It kept processing rare earth-rich by-products, especially from massive iron ore mines. That head start is a big reason why it dominates the industry today.

Why It Matters

To say China’s dominance is a headache for Washington is putting it lightly.

Most people know rare earths are key to consumer electronics like iPhones, flat-screen TVs, and computers. But what many don’t realize is just how critical they are to military tech. We're talking cruise missiles, bombers, rockets, drones—you name it. U.S. Javelin missiles and F-35 fighter jets are practically bursting at the seams with these things.

The Trump administration isn’t oblivious to this. Since day one of his second term, it’s been treating rare earths like a wartime supply chain issue. Below are some of the measures they've rolled out so far.

Emergency mining powers: Trump's March 2025 Executive Order invoked emergency authorities to fast-track domestic rare earth mining and processing, streamlining permits and directing agencies to identify strategic mineral zones.

National security investigation: The April 15 Executive Order launched a Section 232 probe into critical mineral imports.

Defense spending: The Pentagon allocated over US$100 million under the Defense Production Act to establish domestic rare earth refining capabilities.

Strategic reserve: Trump's team is developing a Strategic Minerals Reserve (modeled after the oil reserve), stockpiling neodymium, lithium, and other critical defense inputs.

Now, it’s true that China’s April 4 rare earth export restrictions are just that—export restrictions. They aren't a blanket ban like what China did to Japan back in 2010. The U.S. is still getting Chinese rare earths—albeit with tighter controls and longer wait times—and global export quotas haven’t been slashed either.

But the Trump team rightly sees this as just the opening move—and they’re taking it seriously.

Which brings us back to those U.S.-China trade talks in London I mentioned earlier.

Just yesterday, I saw a report saying both sides have struck a deal to help ease the trade tensions. Here’s a line from AP News:

Senior U.S. and Chinese negotiators have agreed on a framework to get their trade negotiations back on track after a series of disputes that threatened to derail them, both sides have said.

But don't pop the champagne just yet.

If you dig a little deeper, you’ll see what they actually agreed to was reviving the 90-day May Geneva truce. And you know why it even needed reviving in the first place? Because that truce never really held—it unraveled within weeks amid finger-pointing and fresh tensions.

Honestly, I don’t see why this one wouldn’t follow the same path.

That’s one thing. The other is, like I’ve suspected all along, it’s just a half-measure. Key details—like enforcement mechanisms and timelines for lifting restrictions—are conspicuously absent. That makes it more of a patch job than a real peace deal.

The final agreement isn’t expected until August 10, and both sides still need sign-off from Trump and Xi—which, let’s be honest, might easily not happen if tensions flare up again or either leader needs to look tough back home.

The market reaction to the “deal” tells you everything you need to know.

U.S. stocks barely moved—S&P 500 up just 0.1%, Nasdaq +0.3%. Asian and European indices rose modestly, then faded. There was no broad relief rally. Clearly, investors see it for what it is—a stopgap, not a real resolution.

Meanwhile, in our Crisis Investing portfolio, our recent rare earths pick is already up over 20% since we put out the recommendation. Now, we can’t reveal the name—out of fairness to paying subscribers—but I will say this: it’s a clear sign that smart money is already positioning for the rare earths supply chain disruption ahead… politics be damned.

Regards,

Lau Vegys

In my opinion, It will never work in the long run allowing China to play this game.. they violate their agreements consistently, they will use their leverage as an economic war tool, and the only true strategic option is to use the resources we have, in this hemisphere, and particularly in the Lithium triangle in South America. 🇺🇸 and 🇦🇷 are poised to be the powerhouse but must ramp it up now in joint effort and cooperation.

You're right, especially if we include silicon and other essential materials.

Who said that China doesn't have any leverage...