The Job Market Collapse Just Got Worse

Unemployment Hits 4.6% as Job Cuts Surge 54%—Highest Since the Pandemic

Look, I hate to hit you with bad news right before Christmas. I promise this is the last gloomy piece you’ll get from me this week. But the jobs data released over the past week is too important to ignore—and frankly, too ugly to sugarcoat.

The official numbers for October and November paint a picture of a labor market that’s deteriorating faster than most people realize. I’ll get to the details in a second, but let me say this upfront—it’s probably much worse than the headlines suggest.

There are several reasons for that—all of which I get into below—but for one, remember the government shutdown in October? The Bureau of Labor Statistics (BLS) has since admitted it couldn’t accurately collect key data retroactively—especially from the household survey that feeds directly into the unemployment rate.

In plain English, the government is acknowledging a data gap right in the middle of what’s clearly becoming a serious labor market slowdown.

The Numbers Are Worse Than You Think

That’s bad—and ridiculous—enough. But let’s start with what they do, supposedly, know.

In October, the U.S. economy lost 105,000 jobs. That’s not a typo. It’s the biggest monthly decline since the end of 2020, when the country was still clawing its way out of pandemic shutdowns.

November wasn’t much better. The economy added just 64,000 jobs. In a country of 340 million people, that’s pathetic.

And here’s something Federal Reserve Chair Jerome Powell himself recently admitted: job figures are being drastically overstated—by as much as 60,000 jobs per month. So those already-weak numbers? They’re probably even worse than reported. That means November’s modest “gain” might not be a gain at all.

Then there’s the unemployment rate: 4.6% as of November. That’s the highest level we’ve seen in more than four years. You have to go back to the depths of the COVID pandemic to find a labor market this weak.

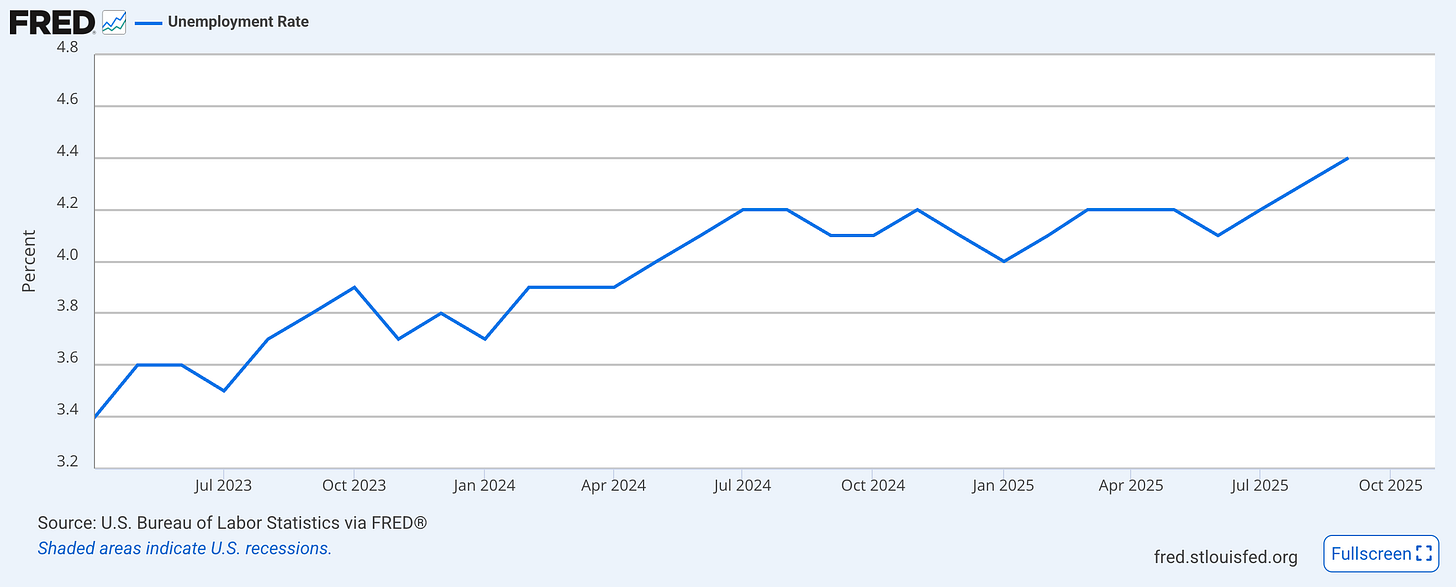

For context, unemployment stood at 4.4% in September. It’s jumped 0.2 percentage points in just two months—and the trend line is pointing straight up. Take a look at the chart tracking unemployment since April 2023. Up, up, and up.

Powell himself has said that when it comes to labor markets, “the main number to look at is the unemployment rate.” Well, there you have it. Look at the chart. It’s ugly.

What’s more, black unemployment jumped to 8.3% in November, up from 7.5% just two months earlier. Historically, that’s often one of the earliest warning signs that broader weakness is spreading across the economy.

The Bigger Picture

The official data already looks bad. But to get a fuller picture of what’s really going on beneath the surface, I went a step further and dug into the Challenger report, which tracks announced job cuts. What I found was even grimmer than I expected.

From January through November 2025, companies have announced 1,170,821 job cuts. That’s a staggering 54% higher than the same period in 2024.

Let that sink in.

We’re talking about more than a million job cuts in a year when we’re supposedly not in a recession, not dealing with a pandemic, and not facing an obvious financial crisis. The only other time we’ve seen numbers this high was 2020.

So what’s actually driving these cuts?

Start with DOGE—the Department of Government Efficiency. Direct government cuts account for 293,753 jobs, with another 20,976 coming from downstream effects. Since most of these were government roles of questionable value, we probably don’t need to shed too many tears there.

But here’s the rest of the picture:

Market and economic conditions: 245,086 cuts.

Store closings and restructuring: 306,786 cuts combined.

AI-related cuts: 54,694 cuts—a number that’s rising fast.

Add it up, and job cuts driven purely by economic weakness—excluding government reductions—come to roughly 552,000. That’s a massive figure, and a clear sign that labor conditions are deteriorating far more seriously than the headline jobs numbers suggest.

What’s more, these cuts aren’t confined to one corner of the economy. They’re broad-based—telecommunications, tech, food, services, retail, nonprofits, and media are all shedding workers.

The Fed Sees the Problem—But Can’t Admit It

The Fed knows the economy is starting to crack. As I wrote in a recent essay, after cutting rates three times in a row, it has quietly shifted its focus—from fighting inflation to protecting the labor market.

In fact, when Powell was pressed on why the Fed is deprioritizing inflation even though prices remain elevated, he argued that the best path forward is to support the economy and push wages higher so people can “start feeling good about affordability.”

Translation: We can’t actually bring prices down, so we’ll try to make wages rise faster than inflation and hope people feel better about it.

But here’s the problem. The Fed can’t fix the underlying issue with rate cuts alone. Wages are growing at just 3.5%, while the real rate of inflation—measured by money supply growth, not the government’s CPI charade—is running closer to 5–6%.

That means wages are not keeping up with inflation. Most Americans are taking real pay cuts in 2025, whether they realize it or not.

And with rate cuts proving insufficient, the Fed is reaching for its other favorite tool: quantitative easing (QE).

In fact, as I highlighted previously, the Fed has already restarted stealth money printing. Beginning Friday, December 12, it started purchasing $40 billion in Treasury bills per month. Powell can call it “reserve management” or technical “plumbing” as much as he likes, but history tells a different story. Every time the Fed launches operations like this—whatever the label—it ends the same way: with full-scale QE not far behind.

What This Means for You

If you’re an investor in stocks, precious metals, or commodities, this situation isn’t necessarily bad. Here’s Doug Casey:

Money printing means more bubbles will be created. And while bubbles are the enemies of a sound economy, they’re the friend of the speculator. The current mania in Bitcoin is an example.

In particular, I’m looking forward to a bubble in commodities in general, and precious metals in particular. And not just a bubble, but a hyper bubble in mining stocks.

But if you’re a worker—particularly in a sector vulnerable to slowdowns, restructuring, or automation—it’s a different story. Especially if you don’t own “unprintable” assets like gold.

As noted above, the labor market is weakening faster than most people realize. Job cuts are accelerating. Unemployment is climbing to levels we haven’t seen since the pandemic. Opportunities are shrinking. Meanwhile, the Fed is responding the only way it knows how: by making money cheaper and cranking up the money printer.

That means one thing: inflation’s about to take another bite out of your wallet.

Regards,

Lau Vegys

P.S. As Doug says, the Fed’s return to easy money will set off a massive bubble in commodities—especially in monetary metals like gold and silver. And the market’s already getting the message: gold just climbed to a one-month high following the Fed’s announcement, while silver hit a record high. That’s why a big portion of our Crisis Investing portfolio is in mining stocks, which Doug himself owns.