The Bull Market in Precious Metals May Have Just Begun—See the Chart

Chart of the Week #63

I don’t usually send these more than once a week—unless I come across something timely or compelling enough to share right away. This is one of those times.

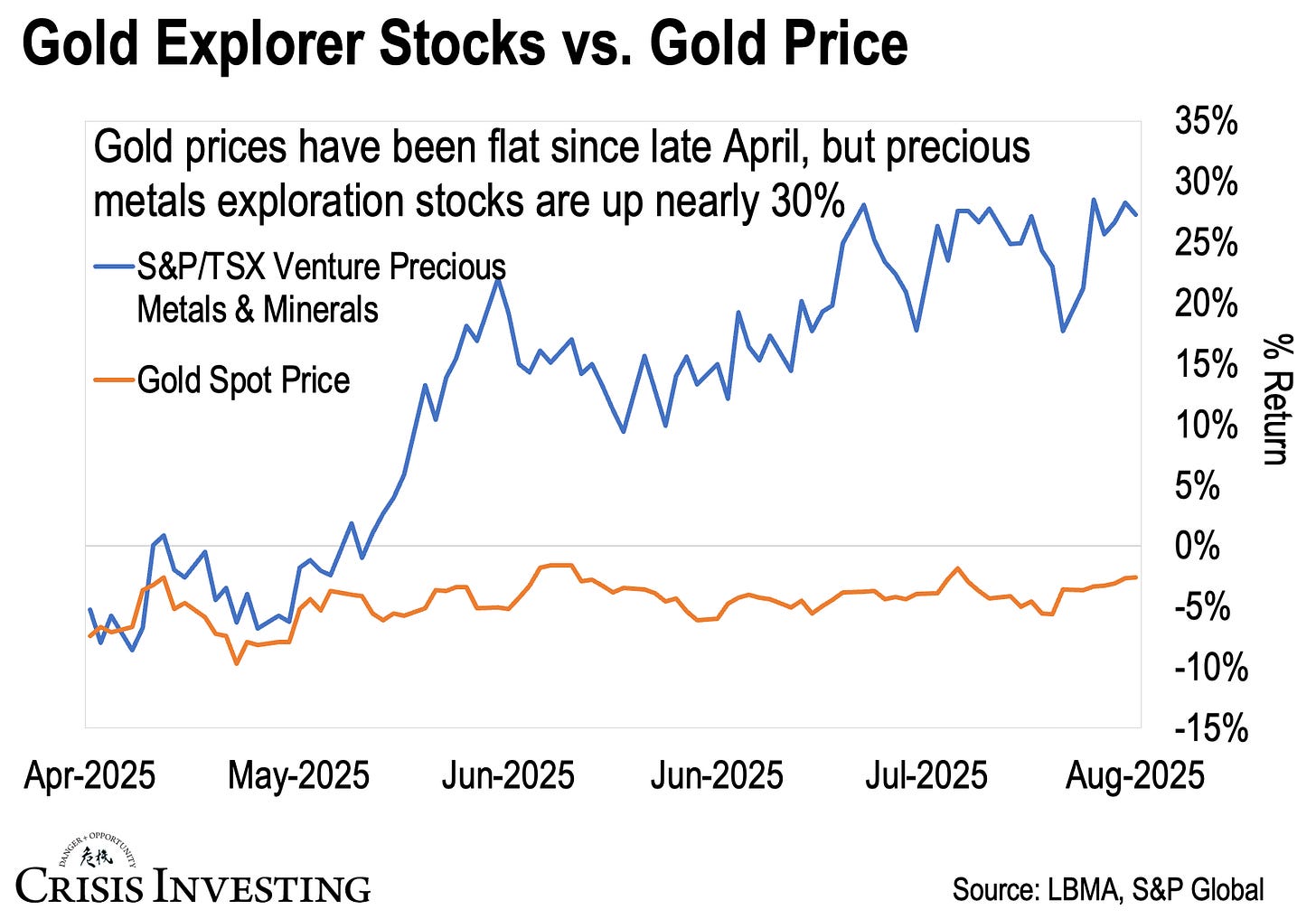

We just stumbled on what could be one of the most important charts of the year. Take a look below.

Since late April, gold prices have been dead flat—barely moving. Yet during that same stretch, precious metals exploration stocks have rocketed nearly 30% higher.

If you understand precious metals cycles, you know this could be big.

Explorers are the ultimate high-beta plays in precious metals. They get obliterated in downturns but absolutely explode in upswings. There's a simple reason for this: unlike major producers with steady cash flows, explorers live and die by market sentiment and the potential value of their undeveloped projects.

And here’s the critical part: explorers don’t move unless investors are convinced higher metal prices are here to stay. Nobody buys explorers for safety—they buy them for explosive upside.

Here’s how it usually plays out.

In the early stages of a metals bull market, money flows first into gold itself and the big producers—the safe, boring plays. As confidence builds, capital trickles down the food chain: first to mid-tier producers, then to the wild cards—the explorers.

Just think about the psychology here. If investors are willing to bid up the riskiest segment of the precious metals market while gold itself hasn't even broken out yet, what does that tell you about their expectations?

It screams they're positioning for much higher metal prices ahead. They're buying leverage to the leverage.

This is textbook behavior for the shift from a sleepy, sideways market into a genuine bull phase. The speculative money is starting to flow, and when that happens in precious metals, moves tend to get violent—in a good way.

We believe we’re in the early stages of that transition right now. If we’re right, this 30% run in explorers is just the opening act—and the kind of setup where 10-baggers are made.

Enjoy the rest of your weekend,

Lau Vegys

P.S. All this ties into what we’ve covered in the latest Crisis Investing. While explorers are signaling a major shift in precious metals sentiment, silver miners are still trading at cheap valuations—even after a strong year for silver. That disconnect is exactly the kind of early positioning we look for. And it’s why we’ve added a new, compelling silver pick to the portfolio. If you’re a paid subscriber and haven’t seen the latest issue yet, make sure you don’t miss it. And even if you’re not, I still recommend checking out the lead story—free to all our subscribers.

As you alluded to in other posts, Silver looks like the next mover, but what’s still underpriced is its role beyond the classic ‘poor man’s gold’ narrative. It’s a critical industrial metal for solar, electronics, medical tech — and potentially advanced energy applications still in R&D.

That mix of monetary and industrial demand means the next leg up isn’t just about safe-haven buying. It’s about securing the metal that sits at the intersection of currency insurance, infrastructure build-out, and high-tech manufacturing. That’s a rare setup — and one the market hasn’t fully priced in yet.Silver looks like the next mover, but what’s still underpriced is its role beyond the classic ‘poor man’s gold’ narrative. It’s a critical industrial metal for solar, electronics, medical tech — and potentially advanced energy applications still in R&D.

That mix of monetary and industrial demand means the next leg up isn’t just about safe-haven buying. It’s about securing the metal that sits at the intersection of currency insurance, infrastructure build-out, and high-tech manufacturing. That’s a rare setup — and one the market hasn’t fully priced in yet.

Doug, where's the best place to buy your books?