The Broken Promise of Adulthood in America

Chart of the Week #66

I’ve written before about how the American Dream has become prohibitively expensive, with home affordability at historic lows and the traditional middle-class lifestyle now out of reach for most ordinary people.

But no demographic has taken it more on the chin than young Americans.

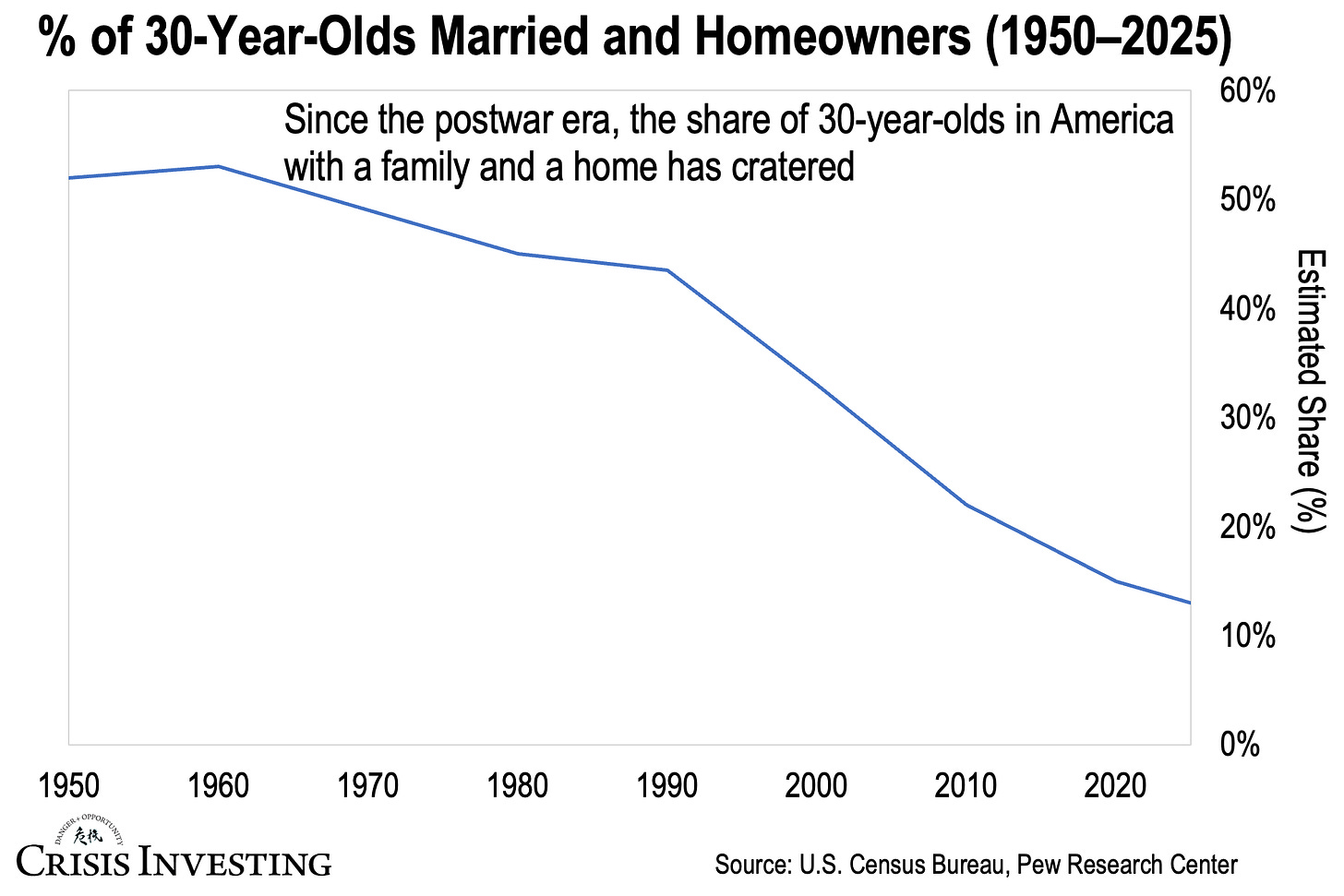

You can see it in stark terms in this week’s chart below. Since the postwar era, the share of 30-year-olds in America with both a family and a home has plummeted—from about 52% in 1950 to just 13% in 2025. That’s a staggering 75% decline over 75 years.

Let that sink in. In 1950, more than half of 30-year-olds had achieved what most would consider the basic markers of adult stability: marriage and homeownership. Today, it's barely one in eight.

If you look closer, the graph shows two distinct phases of decline. From 1950 to 1990, there was a steady but manageable erosion—the share of 30-year-olds with both a family and a home dropped from 52% to about 43% over those 40 years.

That represented the gradual social changes we're all familiar with: more women entering the workforce, people marrying later, changing cultural attitudes toward marriage.

Then something dramatic happened around 2000. The decline went into freefall. Between 1990 and 2025, the rate collapsed from 43% to 13%—a 70% drop in just over three decades.

What explains it?

We could, of course, blame this on changing cultural preferences—young people choosing career over family, prioritizing experiences over stability. That’s certainly part of the story. Young people today do have very different priorities than those more than half a century ago.

But there’s another side to this: the economics of young adulthood have become impossible. Keep in mind, today’s families would need the combined income of three households just to match the home affordability levels of a single family in 1959.

The situation gets worse when you factor in the debt burden crushing young adults. As I explored in a recent essay, the very institution supposedly preparing young people for economic success—college—has become a wealth destroyer. Average student debt more than doubled from $17,297 to $37,850 between 2006 and 2024 alone (with total outstanding student debt exploding from $500 billion to $1.8 trillion).

Think about the brutal math facing today's 30-year-olds.

They graduate with an average of $38,000 in student debt—though plenty are actually walking away with $60,000, $80,000, or even six-figure debt loads. They need $130,000+ in annual income to afford the average home, and compete in a job market where wages haven't kept pace with housing costs.

In other words, they’re entering their peak family-formation years already financially crippled.

No wonder marriage and homeownership rates have collapsed.

The cruel irony is that we—scratch that, America’s political class—has created a system where the very credentials supposedly required for middle-class success have priced young people out of middle-class life.

Regards,

Lau Vegys

P.S. If you have young people in your life wondering what the future holds in this broken system, Doug Casey and Matt Smith’s “The Preparation” offers a radical break from the usual path. Instead of piling on debt for credentials of questionable value, the book lays out a blueprint for building real competence and independence outside traditional institutions. For those willing to think differently about their future, it may be the most valuable roadmap available.

In addition, by choice, some have chosen to rent, instead of buying a home. The costs to maintain a home over the years can be substantial, and some areas of the country now have very high property taxes (the cities, counties, states pick up the theft where the Feds left off), and the tax write -off has been limited in recent years (changing now).

There’s also this: Young men increasingly came to the same (obvious) conclusion that modern marriage is broken. If you took marriage law, adapted it to resemble a contract for a business deal, and gave it to your attorney, he’d say: “What is this? Who gave you this? Who thinks you’re stupid enough to put yourself in this position? You’re not signing this.”

I’m generalizing here, but this generalization is generally true: The *day* a man gets married, he loses all of his leverage; he has the same responsibility his grandfather did in the 1950s (if not more, now that many WFH), but practically none of the authority. Whoever controls the purse strings in any relationship, has all the authority — do you decide whether your boss deserves a pay cut vs. a raise? Everyone understands why that’s a preposterous question.

If your wife wakes up the day (strangely, it’s often a day soon after the 10th anniversary….when alimony payments become payable for life) and decides she’s “outgrown” you, files for divorce, gets the house, the kids, half of everything else, and a paycheck for decades if not for life, what can you do? Other than ask yourself wtf you were thinking?

The male suicide rate between 40-60 is out of control. Any guess what the number one preceding event is? Yep, it’s divorce. So taken together, when you factor in our reproductive longevity (sperm doesn’t expire), the divorce statistics, and the obvious but frowned-upon fact that most men around 30 aren’t keen on having one woman in bed for the rest of their lives, it makes a lot more sense.

Because: Who proposes to who, after all?