LNG Boom Is Coming... Here's What You Need to Know

The Miracle That Natural Gas Is, Repowering, and Europe's Energy Problem

“Energy is the lifeblood of progress. Without it, societies stagnate, and civilizations crumble."

~ Frank Herbert

As I told you yesterday, the U.S. exported more LNG than any other country in 2023. And according to forecasts, U.S. natural gas exports are set to triple from 4.3 trillion cubic feet per year to about 12.75 trillion by 2033.

That’s because the world needs more power. Lots of power. We’ve written to you in these pages that global energy use is expected to increase 50% by 2050.

Now, quite a bit of this rise in global energy use will be covered by nuclear power.

As you probably know, we love nuclear. It’s the most superior source of reliable energy.

But it’s not a one size fits all solution.

Nuclear plants are big-ticket projects that take a lot of time and money to get up and running. They are great for providing steady, baseload power, but they're not so good at adapting quickly to changes in demand.

Enter natural gas. It’s flexible. We can use not only for baseload, but also for load-following, and peaking power.

Plus, since it emits about 60% less carbon dioxide than coal per unit of electricity produced, it doesn't exactly go against the zeitgeist of today's environmental craziness. So, it's not likely to be "canceled" anytime soon.

And, in the U.S., natural gas is abundant and super cheap.

Doug Casey: Natural gas is selling around $1.90 per million British thermal units (MMBtu) right now. That's close to its lowest level in history in real, inflation-adjusted, terms. And this comes at a time when its potential for explosive growth has never been greater.

All this makes natural gas probably the best power generation source today.

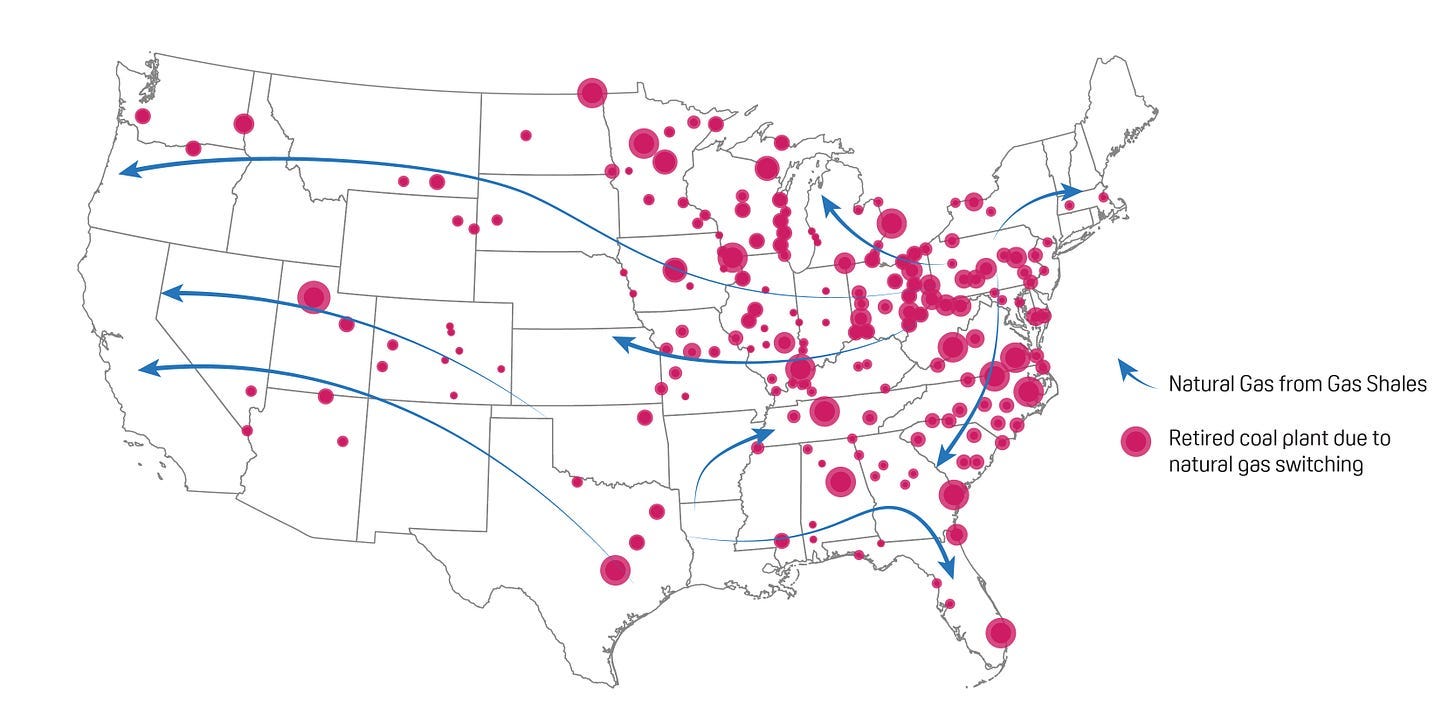

That’s why over a decade ago, the U.S. started to switch from coal to natural gas. This was around the same time oil and gas companies unleashed the resources trapped in shale formations. Massive amounts of low-cost gas became available.

That allowed the switch from coal to natural gas for hundreds of power plants across the country. Just take a look at the image below.

You see, coal-fired power plants can undergo conversion to natural gas through a process known as repowering. This involves replacing the coal-burning boiler and other components with natural gas-fired ones. Voila! You've got yourself a "cleaner" power plant with an extended operational life.

Today, natural gas generates 40% of U.S. electricity.

Initially pioneered in the U.S., this trend is now spreading to other countries as well amidst the global environmental hysteria and push for ever lower emissions.

The Energy-Starved Europeans

But here’s the problem. Most countries are not blessed with an abundance of natural gas.

In fact, two-thirds of the world’s economically recoverable natural gas resources are concentrated in just four countries – the U.S., Russia, Iran, and Qatar.

Even a country like China, which is still building a lot of coal capacity to meet its demands, is the leading importer of natural gas in the world.

On the flip side, the U.S. is the complete opposite - the leading exporter.

We’ve gone from exporting virtually no natural gas to becoming the world’s top liquefied natural gas (LNG) exporter in just six years. And one factor that will drive even more of this going forward is the energy-starved Europeans.

Doug Casey: In other parts of the world, especially in Europe, natural gas sells for around $12 per MMBtu. That’s much higher than here in the U.S.

Now, because of difficulties transporting natural gas, it has previously been a local market, with local pricing. But that's changing with the mass advent of LNG. And the U.S. is now the top LNG producer and exporter. Prices will almost inevitably equalize with the cleanest burning of all hydrocarbon fuels. All things considered, the risk-reward ratio looks very favorable with natural gas.

Look no further than Germany, the world's third-largest economy and the "California of the European Union."

German electricity costs are up more than 2x since 2000. On average, Germans pay 43 cents per kilowatt-hour, compared to 15.5 cents in the U.S.

The reason?

The stupidity of German politicians is certainly a big one.

You see, Germany is all-in on green energy. Over the past two decades, it installed nearly 30,000 windmills and 3 million solar arrays. German officials were counting on these sources to power the country.

At the same time, Germany has closed most of its nuclear plants. That was a dumb move. Plus, at the start of the Ukraine war, Germany had agreed to sanction Russia by ceasing all imports of cheap Russian natural gas. Starved for energy, the German economy was on the ropes.

LNG, at any price, was Germany’s best option. They already had three floating import terminals in operation and three more set to be deployed in the coming months.

The U.S. has been the dominant LNG supplier to Germany since the first terminal came online at the end of 2022. In 2023, deliveries totaled 4.1 million metric tons, or 82% of total imports.

Germany might be the best example, but it’s not the only one. The trend of growing demand from Europe and other places for cheap U.S. gas will not let up anytime soon, and that’s a huge opportunity for the best of the breed U.S. natural gas companies.

Regards,

Lau Vegys

P.S. Our excitement about natural gas is so big that we’ve recently added a natural gas pick to our Crisis Investing, joining several others plays we already had. I’m also currently working on a special report about natural gas, which we’ll be sharing with our subscribers once it's ready.

There is one thing that should be taken into consideration. Crazy european politicians came up with "green deal". One of the main assumption of green deal is quitting gas as a fuel for heating houses. From 2030 using gas to heat up new houses will be forbiden. After NS2 blow up and Germans can not sell gas from Russia it is not seen as a green fuel...