Judge Duncan and The Cultural Revolution Coming to America

Over the weekend, the Silicon Valley Bank failure wasn’t the only crisis in California.

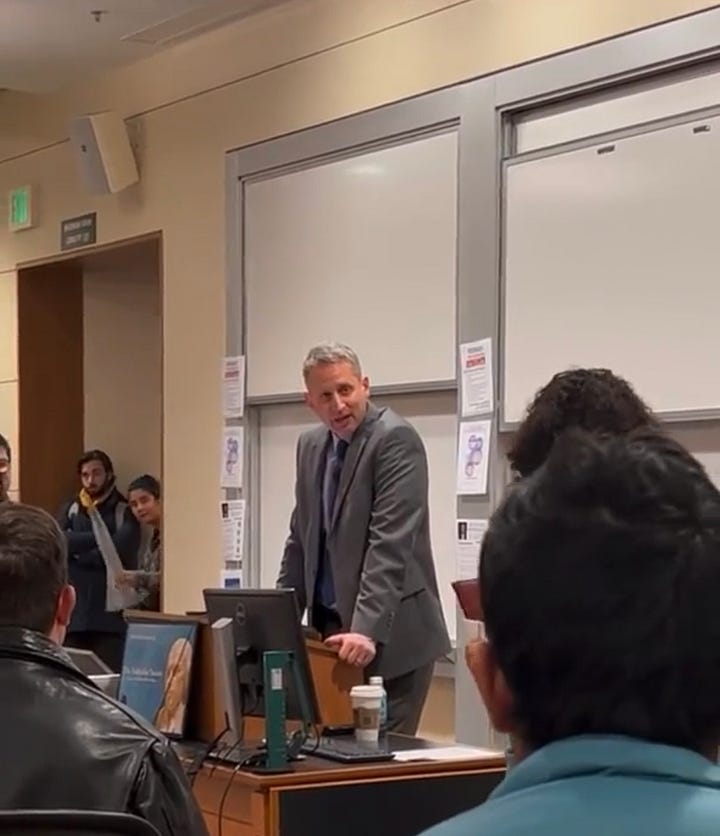

Judge Duncan, a 5th circuit judge, was invited to give a talk at Stanford Law school. What ensued gives us a preview of the coming revolution.

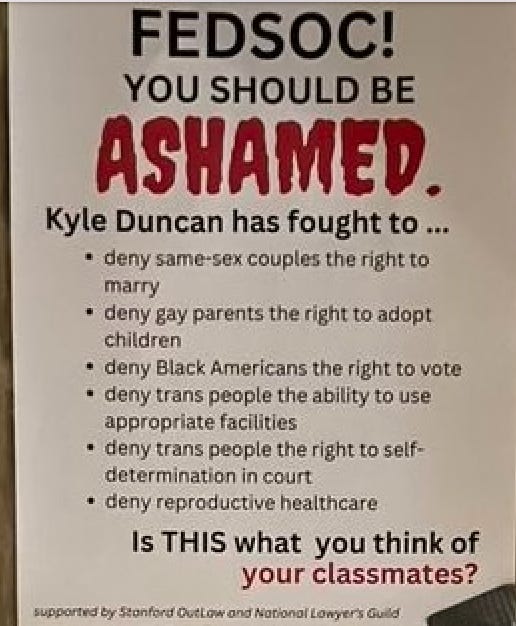

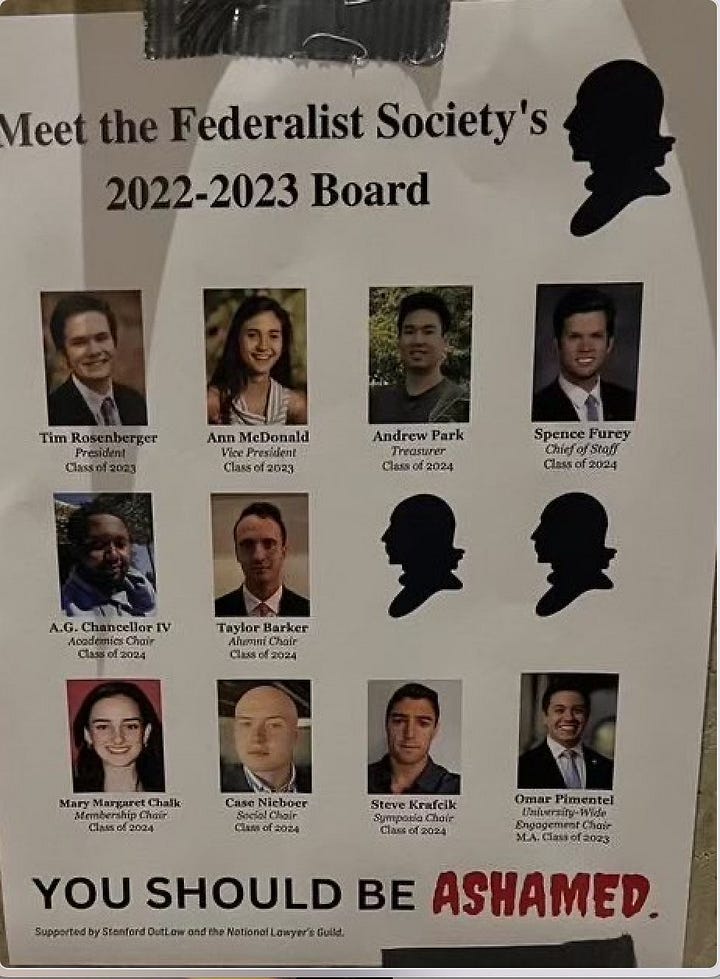

The story starts a few days prior to Kyle Duncan’s arrival to Stanford. 70 law students petitioned for the Federalist Society to cancel the event or move it to zoom. Posters put up by the Stanford Outlaw and National Lawyers Guild, shaming and condemning Federalist Society, identifying each member for their “Shameful” conduct. They wanted to cancel his talk on claims that Duncan has “proudly threatened healthcare and basic rights for marginalized communities.” When in reality the title of his lecture was on “Covid, guns, and twitter.” Three very important decisions made recently.

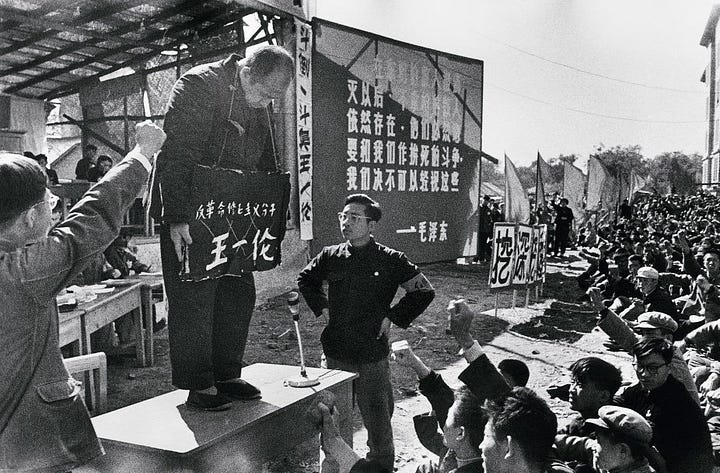

The Federalist Society ignored these harassment tactics. And Kyle Duncan arrived and was met by a crowd of future lawyers that would have made Mao ZeDong Proud.

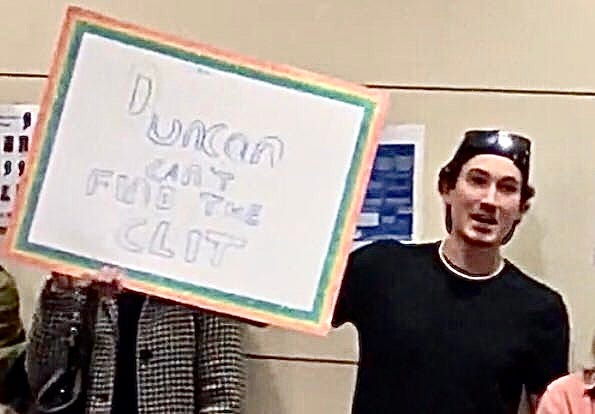

Even en route to the classroom, he was met with students yelling obscenities in his face. And when Judge Duncan started to give his speech the elite students yelled vile slanders against him. He attempted to address the crowd.

While these events occurred, FOUR STANFORD LAW ADMINISTRATORS and 2 DEANS SAT AND WATCHED.

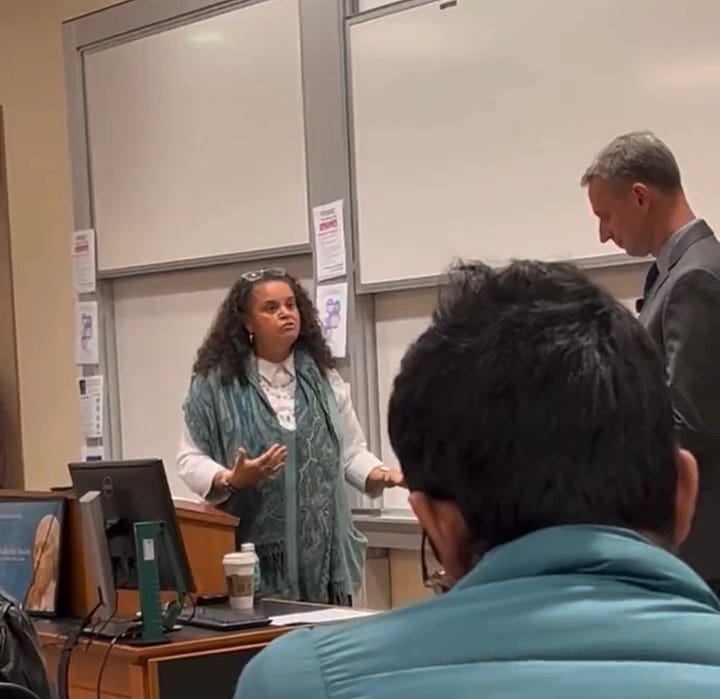

Finally, someone Tirien Angela Steinbach, the brave Dean of Diversity, Equity and Inclusion, stepped into the fray. Her nearly 10 minute self righteous monologue was captured on video.

The video is painful to watch, but I recommend you suffer through it so that you too can witness the plague that has overtaken our institutions. It’s worse than you think.

Steinbach condemned the judge in front of hundreds of students: “Your opinions from the bench land as absolute disenfranchisement" of the students’ rights, Steinbach said, accusing him of "tearing the fabric of this community."

"Do you have something so incredibly important to say," she asked him, that it is worth the "division of these people?"

Judge Duncan kept asking for an administrators help so he can give his speech. In another video the crowd is yelling over him, one student yells “You’re racism is showing!”

At some point you must be wondering “What were Judge Duncan’s crimes?” Naturally, the zombie hoards believe he ruled incorrectly on a number of cases. But what really triggered them is that he referred to a convicted pedophile in his court by their biological gender.

That’s right. The judge choose violence by misgendering a male pedophile masquerading as a female. For the woke, the only appropriote response to such a heinous crime is the nuclear option.

This isn’t the first time students have protested or shouted down conservative guest speakers or teachers. There are hundreds of cases similar to Judge Duncan. And the students GET AWAY WITH IT.

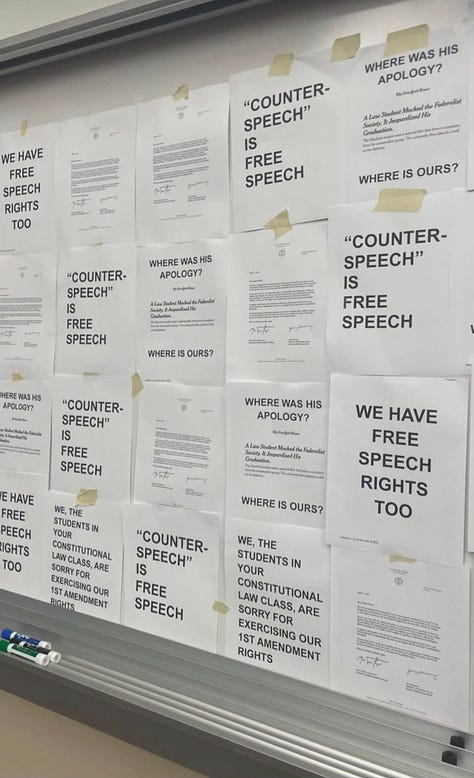

After the video of Steinbach went viral over the weekend. The dean of Stanford’s Law School Dr. Martinez released a apology to quell the media attention. The students in the Federalist Society received an email from the Dean of students recommending they “ should consider pausing their student organization social media accounts until this news cycle winds down, as the law school and university have done. Try your best not to engage on Twitter or any other social media platform, as issues tend to escalate and trolls are looking for a fight.”

Unfortunately, the woke mob can move in only one direction - escalation.

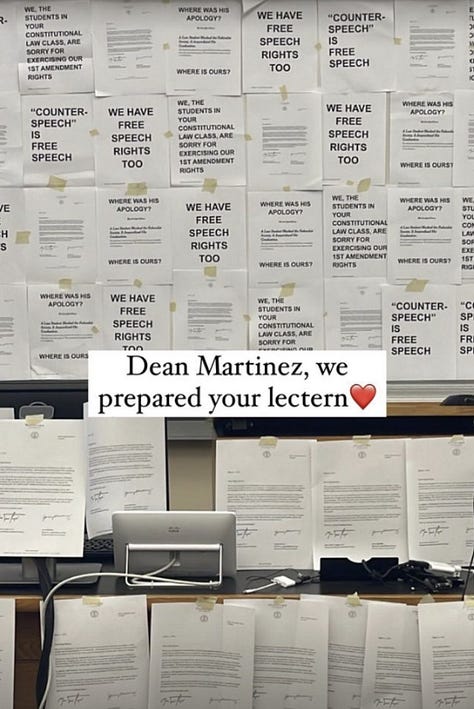

In response to Dr. Martinez, hundreds of Stanford Law students held a retaliation protest against Dr. Martinez for daring to apologize to Judge Duncan.

In an email the leaders of the protest “This protest represented Stanford Law School at its best: as a place of care for vulnerable people, and a place to challenge oppression and bigotry in all their forms, including on the federal bench.”

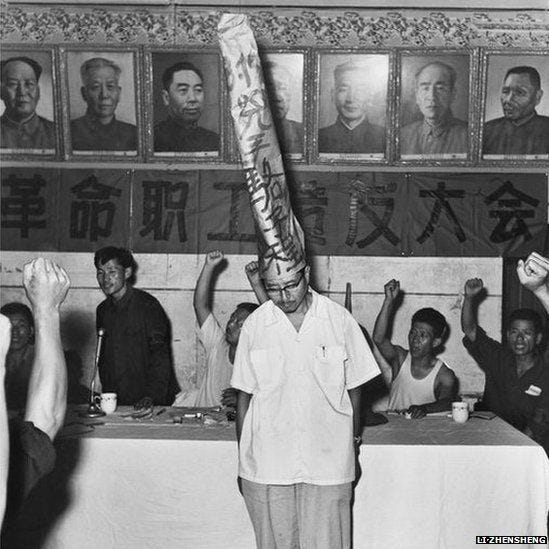

The United States is in the throes of it’s own cultural revolution. If it continues, it’ll lead to a type of violence and disorder never before seen in America.

And, odds are, it will continue. The students involved should be expelled. More likely, they will be loosely reprimanded at wort. The Dean of DEI will still get her cushy 6 figure salary for all her good work! And this ideology that has inculcated and hypnotized these student protesters will be allowed to fester continuing to rot away in their mind and pervert their views of the world around them. These students will graduate and as this disease in their mind grows so will their power as they move into positions at law firms. Let’s play this scenario out shall we?

Instead of being expelled and back to working as a barista at Starbucks. They will become associates who demand safe spaces at firms like Kirkland & Ellis or Latham & Watkins. When arguing in the courtroom they’ll use tactics like whoever yells the loudest wins. Or “why should witnesses be feel safe when the community doesn’t feel safe!” Or, “who are you to judge my client, white man”!

What are the consequences for a society that comes to be ruled by minds like these.

We don’t even have to imagine it because history shows the ramifications in China from 1966- 1980’s. It’s coming to America. Be ready.

Stanford Law School is not crafting lawyers; they are generating thugs and enforcers for [whatever your term is for Davos / The Great Reset / Global Capitalism / New World Order].

Stanford Law School Dean Tirien Steinbach told Federal Judge Kyle Duncan, "Do you have something so incredible important to say about Twitter and guns and COVID that that is worth this impact on the division of these people who have sat next to each other for years, who are going through what is the battle of law school together, so that they can go out into the world and be advocates. And this is the division it's caused. . . And I understand why people feel like the harm is so great that we might need to reconsider those policies [of guest speakers]. And luckily they're in a school where they can learn the advocacy skills to advocate for those changes. I hope that you have something to share with us that we can learn from. I hope you can learn too while you're in this learning institution. "

Jurisprudence is pivoting before our eyes, and we are not stopping it.

If they have followed the science and kept up with their necessary medical treatments-they may not be leading the country. They may not be well enough to lead.