It’s Time to Buy the Most Hated Industry in the World

'Crisis Investing' Issue 4 / April 2025 – Vol 2

Dear Reader,

It’s Monday, April 28, 12:32 PM, Central European time.

An unseen fault ripples across Spain’s fragile, renewables-heavy grid.

The system begins to unravel — and within five seconds, fifteen gigawatts — 60% of all the power Spain was generating at that moment — vanish.

With Spain’s grid collapsing, neighboring Portugal — heavily reliant on interconnected flows — is dragged down too.

The entire Iberian Peninsula plunges into darkness.

Cities go dark.

Hospitals lose power.

Trains grind to a halt.

Planes are grounded.

Payment systems crash.

Mobile networks fail.

This was the scene tens of millions of Spaniards and Portuguese lived through just two days ago.

A friend of mine, who lives in Spain — and whom I'll be visiting this summer with my family — described it to me bluntly:

It felt like one of those zombie apocalypse movies. Only the zombies were missing.

The eerie silence, the paralyzed cities, the confusion — it was a stark reminder of how quickly modern life unravels when the grid goes down.

Hours after the blackout, much of Spain and Portugal — and even parts of France — remained crippled.

Millions were still trapped in traffic at dead intersections. Others were stranded underground in powerless subways or climbing out of elevators frozen between floors.

Here’s a satellite image, captured in the evening, showing the Iberian Peninsula — completely wiped off the map of lights.

Apparently, officials were more concerned with explaining away the failure than actually fixing it. Even after nearly 10 hours, only 35–40% of national power supply had been restored.

Authorities floated ideas of sabotage, cyberattacks, electromagnetic events, or faulty maintenance.

Eventually, Spain’s socialist Prime Minister Pedro Sánchez blamed a “strong oscillation.”

Sure. But that doesn’t explain how a modern, industrial nation blacks itself out — at midday.

I mean… how do you even “lose” 15 gigawatts of electricity?

Turns out, it’s not that hard — you just need to buy into the Net Zero scam.

The Sun Doesn’t Always Shine, Wind Doesn’t Always Blow

For years, the Spanish and Portuguese governments — like nearly all European governments — tirelessly promoted the virtues of green energy. Fossil fuels were vilified, and the public was told to embrace the bright, clean, wind-and-solar-powered future.

And they poured billions into the transition.

The numbers tell the story.

In 2008, renewables made up just 20% of Spain’s electricity generation. By 2013, that figure had doubled to 40%. And by the end of 2024, renewables accounted for 64% of Spain’s total installed capacity — with over half of that coming from just two sources: solar (26%) and wind (25%). These far outweighed more stable sources like gas, hydro, or coal.

Meanwhile, the government moved to shut down dozens of coal and nuclear plants — long before replacements were ready. Coal was demonized. Nuclear was branded unsafe.

At the same time, the public was sold on the idea that all electricity is created equal. And in Spain — a country where the word “equality” carries almost sacred weight — that idea was easy to embrace.

So when Spain launched what I can only call an experiment on April 16 — attempting to power the entire Iberian Peninsula with nothing but renewables — most people cheered.

Yet in under two weeks, the celebration gave way to crisis.

It was a harsh jolt from the renewable-induced siesta. Turns out, the “all power is equal” mantra Spaniards — and much of Europe — were sold was a flat-out lie.

Because for modern civilization to function, you need something called baseload power.

That’s the steady, reliable kind — always on, always available. The kind of power the grid can count on to meet guaranteed demand at any given time.

And to produce it, you need dense, abundant energy sources that are cheap and easy to access.

Solar and wind simply don’t cut it. As the old saying goes: the sun doesn’t always shine, and the wind doesn’t always blow. So, when you build your grid around intermittent sources like these, you introduce a whole new set of problems — even our overlords at the World Economic Forum (WEF) have had to admit as much (emphasis mine):

An energy system based on clean electricity would reduce the security risks presented by fossil fuels, but also present risks of its own. Because wind and solar power are intermittent, the need for flexibility of other sources of electricity to pick up the slack becomes greater than today's system can deliver. Moreover, a decarbonized system requires far more electricity for cars, heat, and other needs met by oil and gas today. For countries that depend on trade across borders for those sources of zero-carbon electricity, new energy security risks may arise, as electricity is harder to store or buy from other suppliers than oil and gas. A more electrified, digitalized, and connected smart grid may also be more vulnerable to cyberattacks.

Baseload power plants — coal, gas, hydro, nuclear — do something no other type of generation (like peaking or load-following plants) can do: they anchor the grid.

That’s because they’re the exact opposite of intermittent sources like wind and solar. They’re reliable. They’re always on. They provide steady, around-the-clock power you can count on.

And crucially — they provide something else that’s vital for grid stability: inertia.

You see, electricity grids need inertia to stay balanced and maintain a stable frequency. Inertia comes from spinning generators — like turbines in coal, gas, or hydro plants — whose momentum helps absorb shocks and smooth out fluctuations. Think of it like the shock absorbers on your car: when you hit a bump, they keep everything from falling apart.

Wind and solar simply don’t do that.

Note: Wind turbines do spin, obviously. But most modern wind farms — especially large ones connected through inverters — don’t contribute much real inertia. Coal, gas, and hydro plants use synchronous generators, physically tied to the grid’s frequency. Their mechanical rotation directly stabilizes the system.

Experts have warned for years that grids overloaded with renewables lack the inertia to handle disturbances. But energy has become so politicized — especially in Europe — that few wanted to hear it.

In hindsight, it was all too predictable.

I remember tracking Spain’s electricity prices a few weeks ago — yes, ever since the war in Ukraine, I’ve been a little obsessed with European energy markets — and watching as, on many spring days in 2025, Spain’s midday solar generation actually exceeded total afternoon demand.

The result? Frequent negative electricity prices.

That might sound like a good thing — cheap power for consumers — but in reality, it’s a red flag. These prices only exist because subsidized renewables keep pumping out power even when the grid doesn’t need it.

This dynamic has been playing out in Spain for years — especially during spring, when solar output spikes and demand stays low. The grid floods, prices crash, and reliable baseload plants go out of business.

And so a bad situation gets worse.

Rude Awakening

Okay, so with all that context in mind—what exactly happened on Monday? How does a modern country, go dark in just five seconds?

It started with a violent disturbance on one of Spain’s key electrical highways: the Aragón–Catalonia corridor.

This corridor wasn’t just carrying power from Spain’s vast solar and wind farms — it was also importing critical backup electricity from France.

The problem? Spain’s grid was saturated with fragile, inverter-driven renewable energy. So when even a small disturbance hit, it triggered a violent oscillation across the system.

The connection to France snapped.

And the rest of the grid — without real baseload support — simply couldn’t absorb the shock.

The frequency collapsed.

Solar and wind farms, extremely sensitive to instability, shut off almost instantly.

And it got worse.

Spain didn’t have enough backup plants to restart the grid. Three out of five black-start-capable hydroelectric plants were offline for scheduled maintenance — an astonishing failure of foresight.

In short:

Too much reliance on intermittent renewables.

Not enough baseload power.

Not enough inertia to absorb shocks.

Not enough backup capacity to recover.

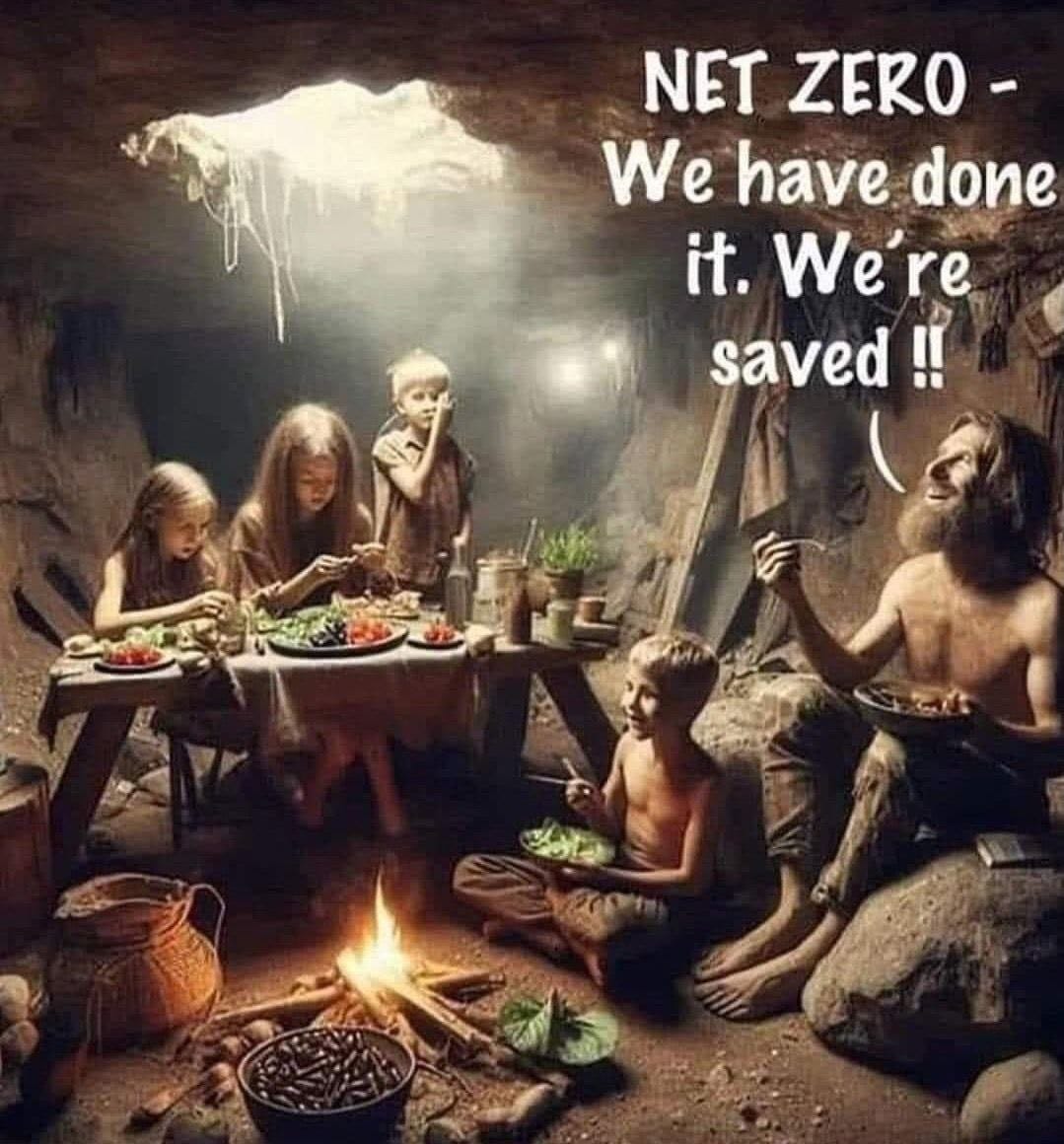

Ironically, on that Monday, Spain and Portugal did reach net zero — just not the way anyone (except maybe the most unhinged environmental radicals) would have wanted: by sending their entire societies back to cavepeople times.

Now, this isn’t the version the Spanish government wants the Spanish people to hear — certainly not in these terms. In fact, with investigations now opened into potential sabotage or cyberattacks — despite earlier denials from both Madrid and Brussels — there’s every chance this ends up swept under the rug.

But here’s the thing: this isn’t just a Spanish or Portuguese problem. It’s a Western problem — and just like in Spain, it’s a self-inflicted one.

Take the U.K., where under plans drawn up by Ed Miliband, Labour’s Energy Secretary, the country hopes to fully decarbonize its grid by 2030. It’s one of the most aggressive Net Zero targets anywhere in the world.

Good luck with that. The British grid already suffers over 500 frequency breaches every winter.

In Canada, newly elected Prime Minister Mark Carney has doubled down on his Net Zero commitment, declaring:

We can deliver the net zero world that you've demanded — and that our future generations deserve.

Right. I can only imagine what “net zero” looks like, Spanish-style — in Canada. Without the forgiving Mediterranean climate.

I could go on — Germany, the Netherlands, you name it. But the point is this:

Western governments are sprinting toward Net Zero with no brakes and no backup plan.

And they’re in for a rude awakening.

Because without dependable baseload power — coal, gas, nuclear — modern economies simply don’t work.

Maybe the crisis doesn’t happen tomorrow. Or next year. But it will happen. Sooner than most expect.

Because when ideology drives energy policy, reality eventually strikes back. Spain was just a preview.

Fortunately, amid all this madness, there’s one notable exception: America.

Love him or hate him, President Trump is setting the stage for a real energy revival. One built on actual baseload power — not fantasy.

And fortunately for investors, there’s a smart way to profit from this shift. You can bet on reality — and get paid handsomely for it.

Which brings us to this month’s recommendation.