It’s Still Early Days for Yellowcake

Nuclear Renaissance and the coming bull market in uranium

Uranium was one of the top-performing commodities last year…

Prices surged from below $50 per pound to finish the year well over $90.

Suffice it to say, anyone who had exposure to uranium in their portfolio in 2023 felt very good about.

But if you look at the figures, that's probably just a taste of what's about to come.

Miners Can’t Keep Up

Uranium – specifically U3O8, commonly referred to as "yellowcake” – is the main fuel for nuclear power plants. These plants generate about 10% of the world’s electricity.

But as electricity demand keeps rising worldwide (more on this below), nuclear power generation is projected to grow by nearly 3% annually, doubling by 2050.

That means one thing: a whole lot more demand for uranium.

In fact, uranium demand is expected to grow to 209 million pounds by 2035. You can see this in the next chart.

Meanwhile, supply is expected to fall to 114 million pounds by 2035.

So, what we’re seeing here is total demand outstripping supply.

But it’s more than just that… We're looking at huge deficits, with a shortage of 95 million pounds. In other words, the market will need to nearly double the amount of uranium that's available.

And here’s the thing… We can't count on commercial stockpiles to fill this gap anymore.

I'll touch on those in a bit, but basically, over the past 20 years, governments prioritized investing in solar and wind, leaving nuclear reactors and uranium exploration behind. That’s how we got to these projected shortages in the first place.

Naturally, when there are shortages, we also get price spikes.

And Doug Casey – who made his fortune speculating on beaten-down commodities, including uranium – agrees.

When I look at the uranium market right now, I see huge upside potential. Uranium stocks have only recently started their recovery from a deep bear market that’s lasted over a decade. There’s explosive upside for uranium companies.

Then, as Wall Street belatedly reacquaints itself with uranium, companies will get ridiculously inflated value for assets which few care about today. It’s an eternal cycle, and quite predictable – except for its timing.

Now, as you probably know, nuclear power suffered a terrible blow to its reputation after the 2011 Fukushima meltdown in Japan. The disaster set off a wave of reactor closures worldwide, singlehandedly pushing nuclear progress back by decades… and it stayed that way for many years.

But the tide is turning…

Nuclear Renaissance

The pivotal moment came last year.

On December 1, 22 countries, including the U.S., the U.K., France, Japan, the United Arab Emirates, and the Republic of Korea, pledged to triple their nuclear energy capacity by 2050. This commitment was made at the climate conference COP28 in Dubai.

This was as close as you'll ever get to governments publicly acknowledging that they have no chance of reaching their ridiculous net-zero targets without nuclear energy.

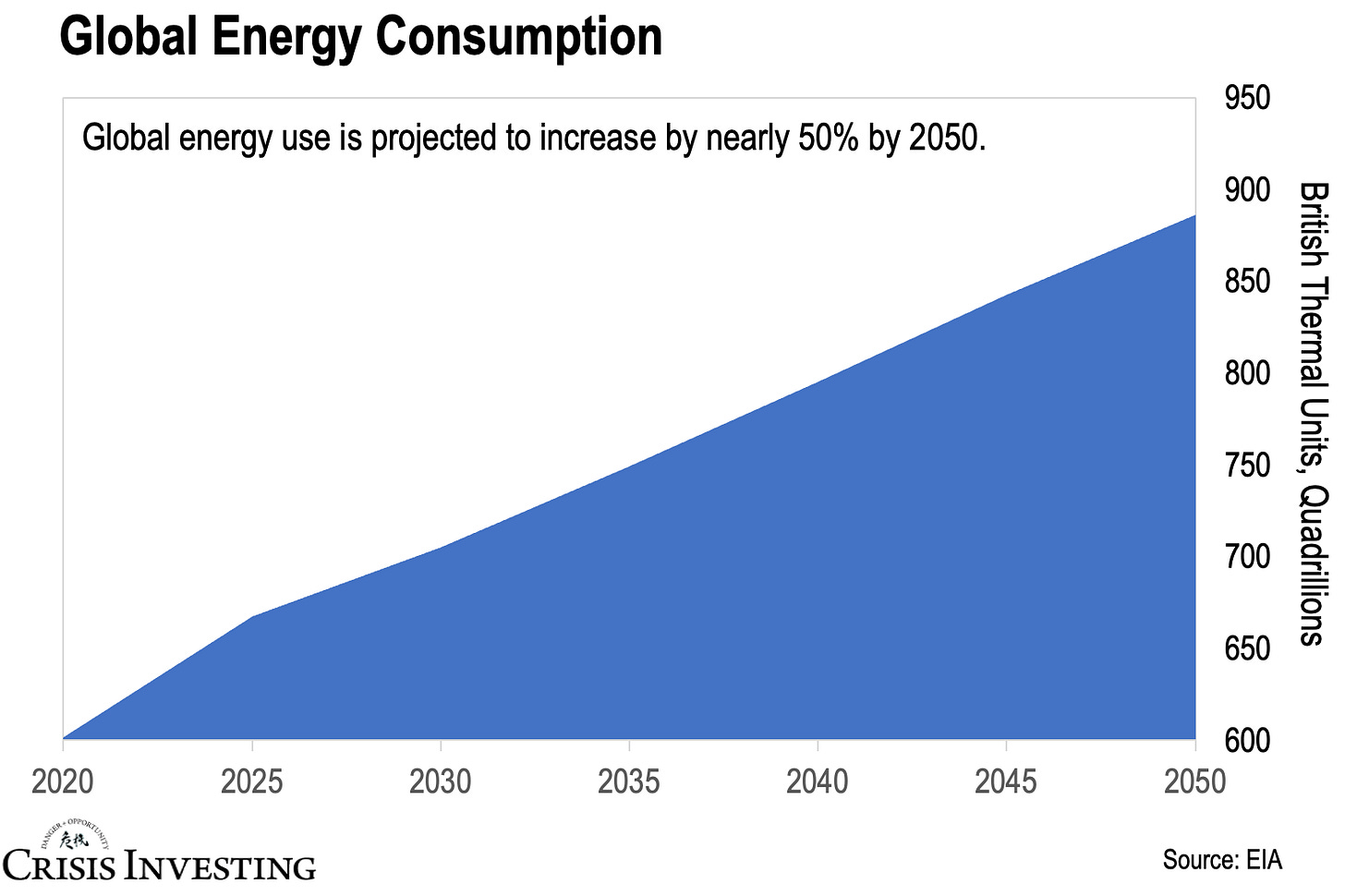

And you can see why. The EIA projects a nearly 50% increase in global energy use by 2050. There’s no way they are reaching that on the back of renewables.

One country that understands the importance of nuclear is China.

China is aggressively building out its nuclear sector. For example, it’s setting aside $440 billion for its nuclear program. And China’s president, Xi Jinping, is planning to build 150 new reactors by 2037.

That’s more than the rest of the world has built in the last 35 years.

India is planning to triple its nuclear power over the next decade.

Then there’s Japan, the world’s third-largest economy. After the meltdown at its Fukushima nuclear power plant in 2011, Japan essentially abandoned nuclear energy.

But now the Japanese are bringing many idle reactors back online. That’s on top of building 20 new reactors to replace the ones shut down after Fukushima.

In South Korea, they're aiming for six new nuclear plants by 2036. The goal is to have nuclear power make up one-third of the electricity supply by 2030. Meanwhile, renewables have been reduced from 30% to 22%.

Saudi Arabia plans to use domestically sourced uranium to build up its early-stage nuclear power industry. Several other Gulf Arab states are contemplating a nuclear program too.

They're the countries leading the charge in the Nuclear Renaissance. That's where most of the demand for uranium will come from until 2030.

Europe (and much of the West) are lagging behind, as usual.

In fact, until recently, Europe was on the verge of decommissioning its entire nuclear power fleet. Germany had already embarked on that path, and France, Belgium, and the UK were all heading in that direction as well.

But after seeing their energy bills double after the outbreak of war in Ukraine, they, too, have been coming to their senses…

For instance, the U.K. announced plans to triple its nuclear power generation capacity by 2050.

France aims to add 14 new reactors in what they call “the rebirth of France’s nuclear industry.”

Even the world's fourth-largest economy and the "California of the European Union," Germany, decided to extend the life of several of their reactors.

In total, there are 60 nuclear power plants currently being built around the world. Plus, there are another 90 in the pipeline and over 300 more proposed.

Uranium Is Primed to Rally

It took more than a decade for uranium to slowly start its recovery from the post-Fukushima bear market.

This was because the sudden pullback in demand after Fukushima led to increased commercial stockpiles of uranium. This meant that utilities had been able to rely on the sale of existing uranium inventories to continue operating.

We're talking a huge pile, something like 500 million pounds of extra uranium just sitting on top of the market.

But then, from 2020 on, those stockpiles began to shrink quickly, and are all but gone now.

That tells me that the Nuclear Renaissance could usher in a uranium bull market of monumental proportions. Just how “monumental?”

Well, the last time uranium went on a multi-year bull run, prices topped out at $140 per pound, delivering more than an 1,800% return. Here's a quick visual to give you an idea of what that ride must have felt like for those invested.

That's impressive on its own, but uranium miners’ share prices exploded. In fact, even the worst-performing companies in the uranium sector delivered 20-to-1 returns. Savvy investors made fortunes.

Doug Casey: When the market wants into gold stocks it’s like trying to force the contents of Hoover Dam through a garden hose. In the case of uranium stocks, it’s more like a soda straw.

Yes, it’s true that we’re not exactly at the bottom of the cycle right now... But it is still early days. With nuclear power capacity set to double in the coming years, there just won't be enough supply to keep up with the upcoming nuclear power buildout for decades to come.

The upshot is that there’s still a lot of bullish momentum in this market. It's not impossible to think that uranium may eventually surpass $300 per pound for this cycle.

That means we’re only a third of the way there. And, of course, I expect many uranium companies to do many times better.

Until next time,

Lau Vegys

P.S. The thing to understand about uranium is that there aren't many ways to get exposure to it. But that’s actually a plus. It means that if you pick quality investments, you'll likely see a ton of cash flowing in when the market goes wild. That's also why we’ve recently added a uranium pick to our Crisis Investing portfolio and plan to include two more soon.

Serious question- you show a massive shortfall between supply in demand. How will this work in actual practice in the short run as it applies to the price of uranium?