In 1910 Normal Americans Were Rich. How We Lost It and How We Get It Back

What a Junior Engineer Can Teach Us About a Time When America Really Was Great

We're told we've never had it better. America and Americans are rich, they say. That wages are up, quality of life is high, and progress marches on.

We all know that isn’t quite true, but it’s hard to pinpoint the problem.

I just finished a great book recommended by Matt Bracken and Michael Yon. It’s called, The Path Between The Seas and it’s all about the creation of the Panama Canal between 1881-1914. The book is well written and researched, and several facts stuck out for me. There’s so much to tell, but this isn’t a book review.

I merely want to share a single important observation from the book. Being a great researcher, the author quotes a lot of dollar amounts associated with the project - including salaries of Americans who worked on the project.

By today’s standards, the amount seems small, but if you do the math something shocking becomes apparent.

In the early 1900s, when a man said he earned a dollar, it meant something real. Back then, $1 was 1/20th of an ounce of gold. That wasn't just a metaphor—it was the monetary system. So when someone earned $3,000, they were, in fact, earning 150 ounces of gold.

That one detail changes the way you read the book and reveals the single greatest ill destroying our society today. Broken money has impoverished all of us.

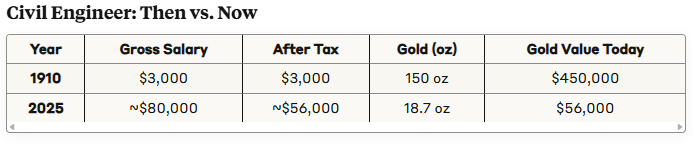

The Engineer Who Earned More Than You

In The Path Between the Seas, David McCullough describes life in the Panama Canal Zone around 1910. He notes that a junior civil engineer—just 2 or 3 years into his career—was paid $250 a month, or $3,000 a year. Working on the canal project was hazardous so the engineer earned $25 more a month than he would have earned if he’d stayed in the US as a form of hazard pay.

He also received:

42 paid vacation days

30 paid sick days

No income tax, because the U.S. didn't have one yet

Let’s put that in terms of hard money:

$3,000 ÷ $20 = 150 oz of gold

At today's price of $3,000/oz, that's $450,000/year

We’re not talking about Thomas Edison here, we’re talking a normal junior engineer. Now compare the actual value he received for his work to a civil engineer today with similar experience:

That's an 88% collapse in gold-based compensation—for the same job, same skill level, and same experience.

Top 1% of Income Earners Today

To be in the top 1% of individual income earners in the United States in 2025, you need to earn at least $407,500 per year.

In today’s context this makes no sense. This guy wasn’t a finance bro or a venture capitalist. He was just a guy with a skill doing his job, and yet, the gold equivalent of his 1910 income earned him more than 99% of all individuals today.

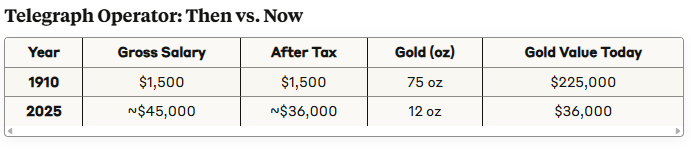

Even a Telegraph Operator Was Rich by Today's Standards

There were only about 150 American women working in the Canal Zone. The highest-paid among them was a telegraph operator, earning $125/month, or $1,500/year—tax free, of course.

$1,500 ÷ 20 = 75 oz of gold

At today's price of $3,000/oz, that's $225,000/year

Compare that to a hypothetical modern equivalent—let's say a mid-skill, technical support desk job paying $45,000/year before tax:

The decline in a role like this, for some reason, seems even more shocking than with Mr. Junior Engineer. Today's equivalent role earns 84% less real wealth than it did in 1910.

By today’s standards this telegraph operator would be extremely well off. Her gold-backed dollar income then would easily put her ahead of 95% of Americans today.

According to a 2024 Bankrate survey, the average American believes they need to earn approximately $186,000 per year to live comfortably - in the ballpark of what Ms. Telegraph Operator earned in 1910.

And yet, the median annual income for full-time workers, which stands at about $79,000. Plenty of Americans are feeling the pinch and far too many are flat broke.

So What Happened?

Two massive changes gutted the American middle class:

1. The Federal Income Tax (1913)

Before 1913, Americans kept every dollar they earned. Afterward, the government took an ever-growing share. What began as a small tax on the rich is now a mechanism to extract wealth from almost everyone who works.

2. The End of Gold for Americans (1933)

In 1933, FDR made it illegal for Americans to own or redeem gold. Overnight, people lost access to the one form of money that couldn't be manipulated. From that point on, the dollar became a fiat instrument—its value determined by political convenience, not economic discipline.

Measuring the Hollowing Out

Using gold as the yardstick makes the theft obvious:

A junior engineer in 1910 earned 150 oz of gold

Today, he earns 18.7 oz

A telegraph operator earned 75 oz

Her modern equivalent earns 12 oz

These weren't executives or tycoons. They were skilled professionals and civil servants. Today, the same careers pay a fraction of the real wealth, and most of it is taxed, inflated, or regulated away.

This Wasn't an Accident

People like to blame capitalism or globalization. But that's not the root cause. The decline began when we transitioned from:

Sound money to fiat money

Voluntary savings to forced taxation

A culture of independence to one of managed dependence

The system didn't fail. It evolved to serve different masters—and the productive class has been footing the bill ever since.

We weren't always this poor.

We were made this poor—by law, by design, and by a monetary system built on fiction.

If we want to reverse the damage, we need to start by recognizing how much was taken—and how little of it was ever honestly debated.

Best,

Matt Smith

Great essay, Matt. For added perspective, in 1990 I was a junior civil engineer earning $35K in Northern California. I was able to comfortably afford an apartment (no roommates), a car, and some entertainment and savings in one of the most expensive places in the country. At the prevailing price of gold (about $400), I earned ~60 oz/year after taxes. That’s about a third of what the engineer on the canal made. But today’s engineer makes only about a third of what I made just three and a half decades ago. He’d now need to make $260K just to match my salary when I started. As you noted, fiat money is destroying the ability of Americans to support themselves, and taking the culture with it. And the erosion is accelerating.

Very good history summary for the value of the USD vs Gold. Actually shocking to see the two examples. I am the same age as Doug and have been reading a lot of his writings for years (in parallel with Bill Bonner) but your association with Doug adds a great positive addition to your joint Crisis Investing writings. When the revalue of the USD comes it is going to be a mind blower for the world!

Jim Marshall