Gold's 2025 Blowout Wasn't a Fluke

Gold Keeps Beating Stocks—Even in "Normal" Times

Yesterday, I wrote to you about how gold demolished stocks this year—finishing 2025 up 73% compared to just 18% for the S&P 500. A few readers wrote in pushing back with a familiar objection: sure, gold crushed it in 2025, but only because of the chaos—Trump’s tariffs, geopolitical turmoil, and general boat-rocking. In normal times, stocks are still the better bet.

I disagreed. So much so that I wanted to show you that 2025’s blowout wasn’t a fluke—it’s part of a much longer pattern.

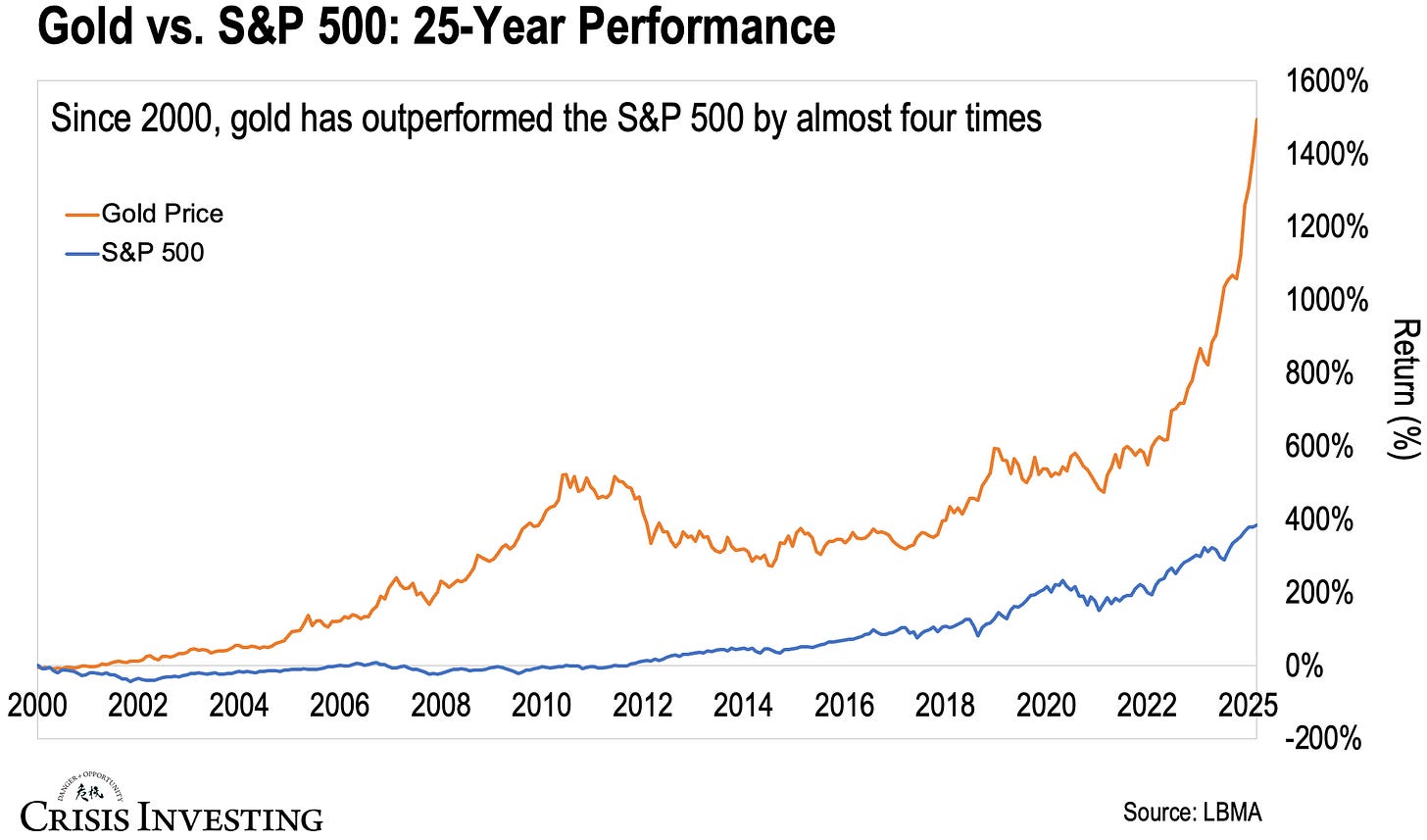

Let’s start with this chart showing gold versus the S&P 500 over the past 26 years. Take a look.

As you can see, gold is up nearly 1,500% since 2000, while the S&P 500 has returned 385%. That’s gold outperforming stocks by almost fourfold.

Put in dollar terms: if you’d invested $5,000 in gold back in 2000, you’d have around $79,700 today. That same $5,000 in the S&P 500? About $24,200.

Big difference.

Again, we’re talking plain old gold here—physical metal, not mining stocks (many of which, by the way, delivered much higher returns over the same period). But nearly 1,500% without the added risk of stock picking? That’s pretty impressive.

Now, you might be thinking: okay, but what if I didn’t hold gold for the full 26 years? What if I bought and sold year to year?

Fair question.

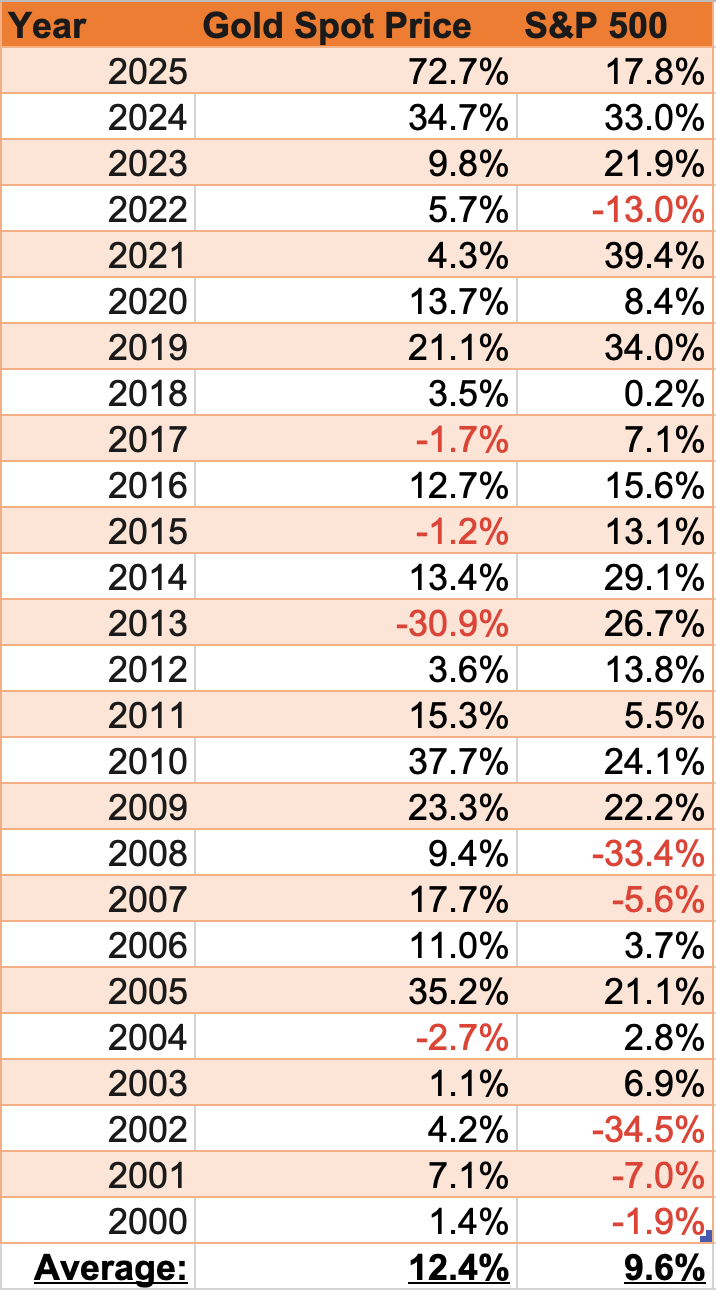

Here’s a table I compiled that breaks down year-by-year returns for gold and the S&P 500 over the past 26 years.

Two things jump out.

First: gold had only 4 down years during that time. The S&P 500 had 6.

Of those 4 red years for gold, only one—2013—was significant (down 31%).

The others were minor (under 3%).

Meanwhile, most of the S&P’s down years were deeper, with three double-digit losses.

In short, gold gave you fewer chances to get burned, especially if you were jumping in and out.

Second: gold delivered better average annual returns.

Gold averaged 12.4% per year.

The S&P 500 averaged 9.6%.

That difference may not look dramatic at first, but as you saw earlier, compounding adds up—and over 26 years, it turns into a massive gap.

Now, am I saying gold will always beat the stock market? Of course not. There’ve been plenty of periods where stocks came out ahead. But this idea that gold only shines in “crazy” times and is a poor investment in “normal” times just doesn’t hold up.

Have a great rest of your weekend, and happy New Year.

Regards,

Lau Vegys

P.S. As I showed you earlier this month, the Fed just restarted the money printer—buying billions in Treasury bills with no stated end date. They’re calling it “reserve management,” but it’s stealth money printing that's paving the way for full-scale QE. We believe this will set off a massive bubble in commodities—especially precious metals like gold and silver. That’s why a big portion of our Crisis Investing portfolio is focused on precious metals miners—many of which Doug himself owns.

Thank you very much Doug!

It is Much appreciated!

Happy new year wishes to all!

Relative value depends on when you start counting. Let’s start when gold decoupled from its long term steady price. Gold sold for $20/oz continuously until January 30th, 1934. Dow sold for 103.74 on that date. At current prices, the DOW is up approximately 468 times since then and gold is up about 225 times. That’s not counting dividends. Nowhere near a superior performance for gold.