Dear Reader,

Today’s opportunity revolves around nickel.

For decades, nickel’s main use has been in the production of stainless steel. But things have changed relatively recently with the advent of electric vehicles (EVs) and Western governments' push to "electrify the world by 2050."

Suddenly, the West has found itself needing more nickel for making EV batteries, rechargeable batteries, and storage systems for solar and wind energy. And they need a whole lot of it since these technologies gobble up a lot of nickel. In fact — and not many people know this — even lithium-ion batteries have more nickel than lithium in them.

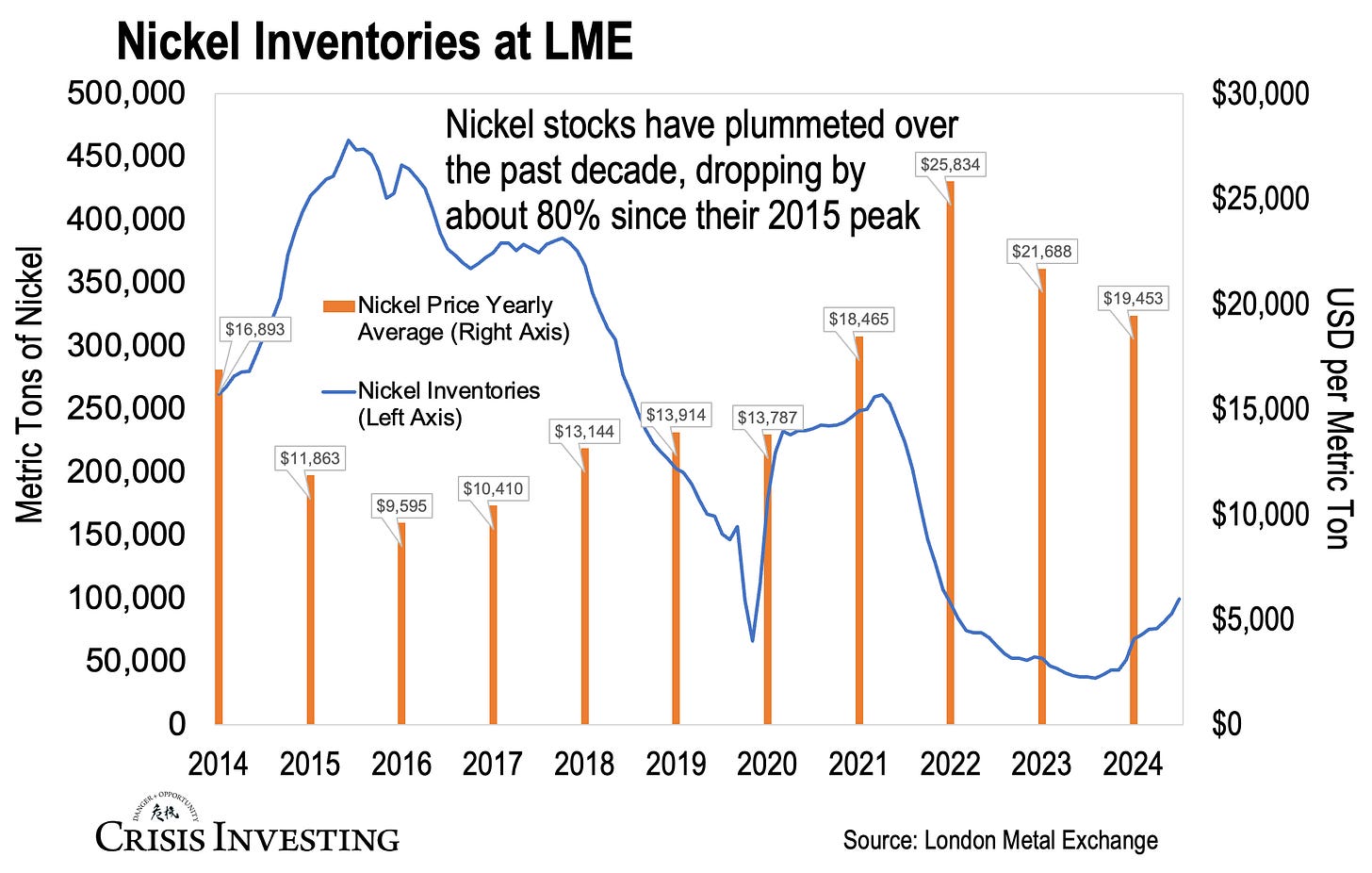

You can see how all this extra demand has impacted global nickel inventories and their prices over the last decade in the chart below.

In 2015, inventories stood at 463,000-plus metric tons at the London Metals Exchange (LME), the world’s leading industrial metals market. Today, there are about 100,000 tons there. That’s nearly an 80% drop.

You can see in the chart above that as stockpiles shrank, nickel prices soared.

Now, it’s true that nickel prices have since pulled back from their 2022 highs due to oversupply fears from major producers like Indonesia and weaker demand from China. But that's just a blip in the long-term trend. Fitch, a global financial analytics firm, is projecting a steady rise in nickel prices, expecting them to hit US$21,500 per metric ton by 2028. That’s up about 34% from around US$16,000 per ton right now. Goldman Sachs is even more optimistic, predicting that nickel prices could double by 2050.

There are many reasons for this, but the gist is that in the last two years, almost no one has been building new mines or discovering significant new nickel projects (even as demand from batteries skyrocketed). It also didn’t help that many nickel miners halted production during the pandemic.

This was why, back in 2020, Tesla CEO Elon Musk pleaded with mining industry CEOs to mine more nickel:

Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.

Musk also later tweeted:

Nickel is our biggest concern for scaling lithium-ion cell production.

Did miners take heed of Musk’s pleas?

Sort of, but not really. In 2020, production actually fell to 2.4 million metric tons from 2.6 million the year before. After that, it gradually started going up by 100,000 tons annually, reaching 2.8 million metric tons last year. That’s a bump of just 200,000 metric tons, or 7.8% higher than 2019 levels, around the time Musk started worrying about his supply.

So, it's a meh kind of growth at best... And it's set the stage for the shortages the nickel market is bound to face over the next few years.

Thanks to the U.S. government, though, these shortages will likely be much worse than most people think. This ties back to when, under the guise of pandemic aid, the Biden Administration went on a trillions-of-dollars spending spree to fund its liberal agenda.

In 2021, for instance, Biden signed a US$1.2 trillion infrastructure bill, with funding spread through the end of the decade.

The funds are going toward updating highways, bridges, power grids, energy storage, and much more. Sure, there will be waste and misallocation, but most of these projects need a lot of raw materials, like nickel (and copper).

In 2022, Biden also signed the ironically titled U.S. Inflation Reduction Act (since when did runaway government spending help lower inflation?), earmarking billions for grid modernization and EV charging infrastructure.

Speaking of EVs, the two bills allocate more than US$135 billion towards “building America’s electric vehicle future.” That’s a lot of money going into things that will need a lot of nickel.

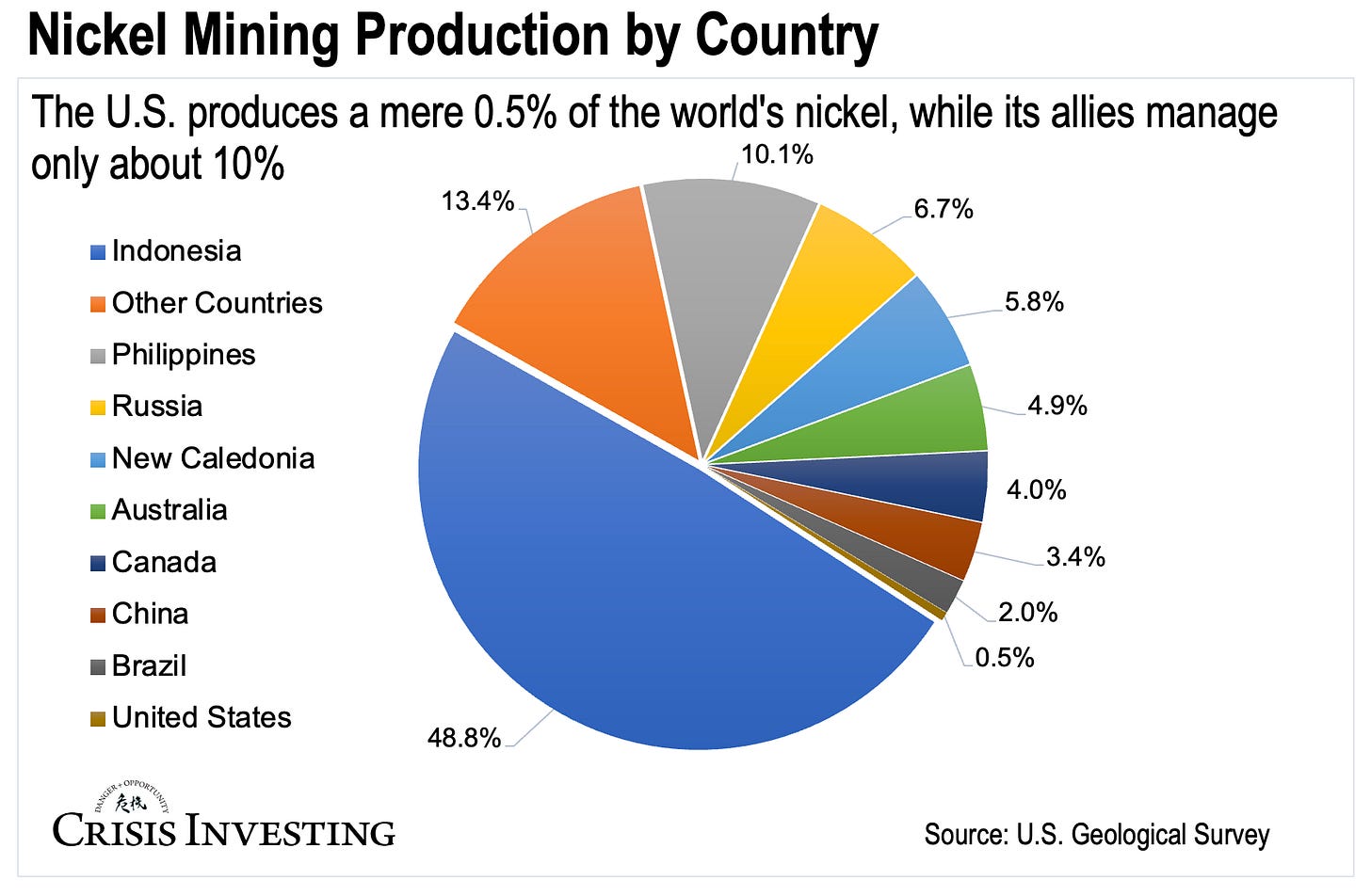

But here’s the problem. America produces almost none of it from its mines. Just take a look at the chart below—it’s a measly 0.5%.

This means that the U.S. imports nearly 100% of the nickel it consumes.

Meanwhile, it’s countries like Indonesia and China that control much of the world’s nickel supply today.

China? But its mines account for barely 3.4% of the world’s nickel production (as shown above), you’re probably wondering. Yes, but China has a strong grip on Indonesia's nickel industry through heavy investments and running key mines. Chinese companies also own major stakes in many of the country's smelters and processing facilities.

Bloomberg projects that Indonesia and China will control 71% of the nickel market by 2030.

If the U.S. were on good terms with China, this wouldn’t be such a big deal. But as we know, relations are far from friendly, and that’s putting it mildly.

Unsurprisingly, the Biden bills I mentioned put tight restraints on where metals can be sourced – Free Trade countries. Imports from other countries are disincentivized. But if you check the country list in the chart above, it’s basically just Canada and Australia that fit the bill. And there’s not enough nickel in these nations to meet U.S. demand, even if they sent all their nickel to us.

This means one thing: as de-globalization, protectionism, and international trade disputes ramp up, the U.S. will find itself scrambling to secure domestic sources of battery metals like nickel. It just has to, unless it’s willing to be at China's mercy.

This brings us to this month’s pick, a stock that Doug himself has found for you, keeping all the above realities in mind. Details below…