Central Banks Are Dumping Dollars for Gold at a Record Pace

Chart of the Week #60

The U.S. dollar has weakened more than 10% over the past six months.

To put it in perspective, the last time the dollar fell this much early in the year was 1973—right after the U.S. finalized its break from gold and the fiat era fully took hold.

And speaking of gold… it’s been doing the exact opposite of the dollar this year—rallying past $3,400 an ounce on the back of relentless central bank buying.

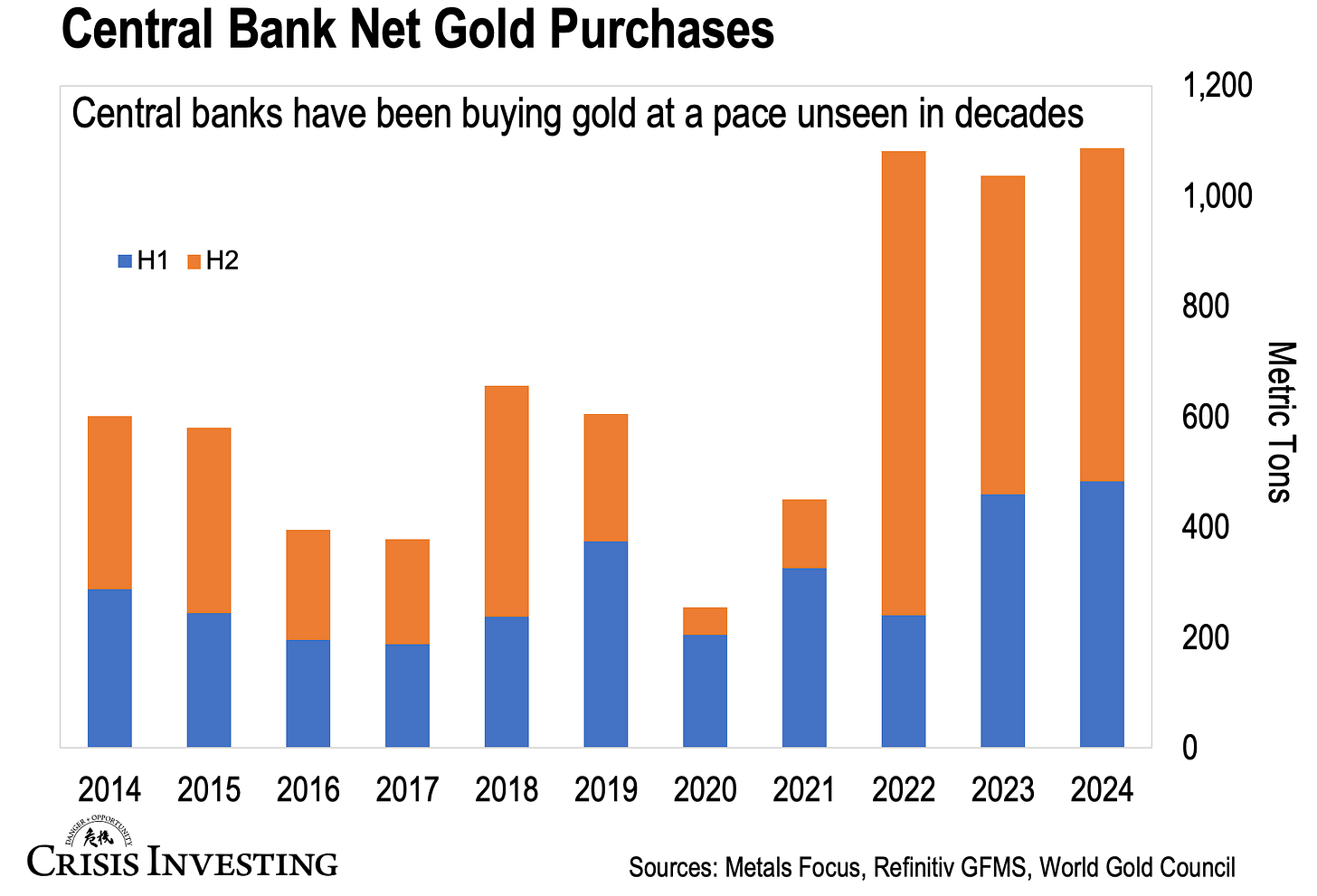

In fact, central banks have been buying gold at a pace we haven't seen in decades. Take a look at the chart below, and you'll see exactly what I'm talking about.

Some quick context:

In 2024, central banks made net gold purchases of 1,086 metric tons, beating the multi-decade record from 2022.

Their gold holdings increased from 15% to 20% of official reserves in a single year.

Today, central banks hold 17% of all gold ever mined—about 37,755 metric tons.

No surprise then that gold set a new record this year.

It’s also not surprising that big-name financial institutions like Goldman Sachs are now projecting gold to hit $3,700 an ounce by year-end.

That’s quite the turnaround. Not long ago, they were calling gold a pet rock.

Funny thing is, with everything going on right now, $3,700 might actually turn out to be conservative.

Keep in mind, that 1,086-ton figure I mentioned earlier amounts to about $80–$90 billion. That’s roughly 1% of central banks' U.S. dollar reserves moving into gold last year.

And that tiny 1% shift was enough to push gold above $3,400 an ounce.

Makes you wonder: what happens if they shift 5%? 10%? 20%?

My guess: the price goes vertical.

Bottom line? Gold isn’t waiting for retail to catch up.

It’s a race now—and we already know central banks aren’t letting up. They already bought 244 tons in Q1 2025, their strongest quarter in three years.

So as long as the Trump administration keeps favoring a weaker dollar, this gold bull market still has plenty left in the tank.

Regards,

Lau Vegys

P.S. Doug Casey always recommends holding gold, the commodity, in your long-term investment portfolio. But he also recommends investing in gold stocks for even more profits. That’s because they provide leverage to the underlying commodity. That’s also why a portion of our Crisis Investing portfolio is focused on these stocks—many of which Doug himself owns.

Central banks are buying from whom? Is it annual mine production or are they hoovering slowly from private hands? It is physical gold or just more paper gold where claims far exceed physical supply? Gold is polluted with banker games, so can we get to what’s real?

Doug and Matt,

like your opinion on Natgold ,

Regards

Michael

ps a subscriber to crisis investing