BlackRock’s CEO Is Alarmed About U.S. Debt... So You Should Be Too. Very.

"Very Dangerous" Debt, Larry Fink, and the Snowballing Effect

“I place economy among the first and most important virtues, and public debt as the greatest of dangers to be feared."

~ Thomas Jefferson

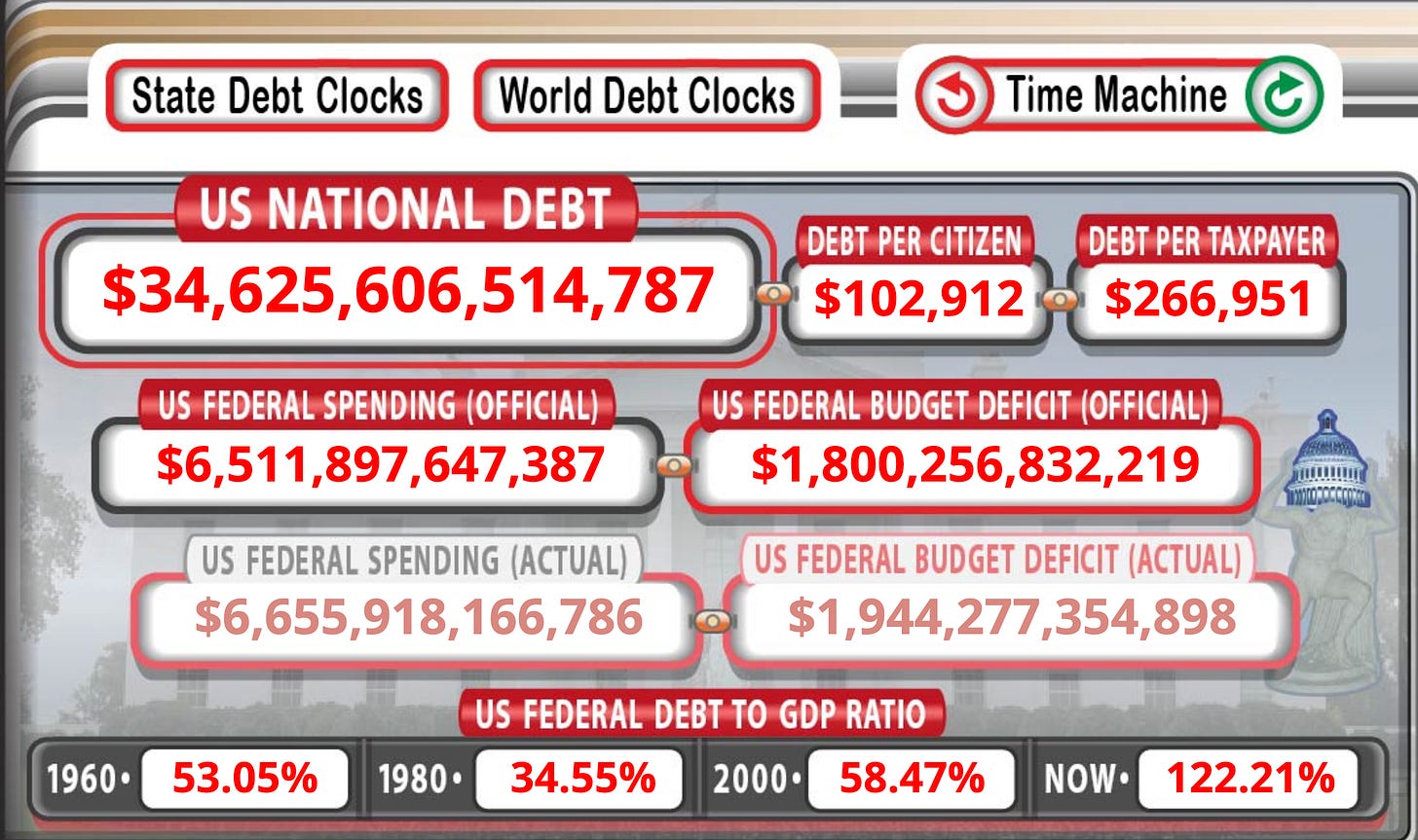

As you read this, the U.S. debt smashed through a record level of $34.6 trillion. Its growth sped up in recent months, with increases totaling roughly $1 trillion every 100 days. And it’s rising by the second.

Here’s a link if you want to watch it tick up live, but be warned, it’s quite disturbing.

In short, America’s finances are sinking into a quagmire.

If you've been following us for a while, this might not come as a surprise. Doug Casey has been sounding the alarm about the dangerous levels of U.S. debt for decades, yet Wall Street and mainstream media have largely ignored it. Until now...

One of Wall Street’s most influential insiders, BlackRock CEO Larry Fink has recently voiced his belief that the ballooning debt represents a real threat to the nation’s fiscal future.

Now, I'm not a fan of the guy. Fink, from his perch as head of the world's largest asset manager, has pushed for woke capitalism and ESG investing. Under his leadership, BlackRock shifted decision-making power in American capitalism away from shareholders and towards the so-called stakeholder capitalism. He prioritized Net Zero emissions, board diversity, and "purpose-driven" commerce over actual value creation. A buddy of Klaus Schwab, he sits on the boards of the World Economic Forum (WEF), part of the "Great Reset" crowd advocating for people to "own nothing and be happy" by 2030.

But you can't deny Fink’s financial sway. When he talks, people listen. And the fact that he's bringing this up now suggests that the U.S. debt situation might be even worse than we think.

The Snowball of Debt

Larry Fink is worried about what he calls the U.S.'s "snowballing debt."

In his annual letter to shareholders, he wrote:

More leaders should pay attention to America's snowballing debt. There's a bad scenario where the American economy starts looking like Japan's in the late 1990s and early 2000s, when debt exceeded GDP and led to periods of austerity and stagnation.

He's not alone.

Among those who are also worried, we have JPMorgan Chase CEO Jamie Dimon, Bank of America CEO Brian Moynihan, and even Fed Chairman Jerome Powell.

Quite the lineup. Things must be pretty dire then.

They sure are.

You see, America’s $34.6 trillion debt is already about 122% of GDP. Even if you take out debt owed to Social Security and other federal trust funds, it's still sitting pretty at 99% of GDP.

And according to a recent report from the Congressional Budget Office (CBO), by 2051 public debt will represent 202% of GDP.

Now, that's one heck of a snowball effect for you.

But even that is probably overly optimistic given the aging workforce and how fast the debt's been piling up.

So, what are we facing then?

Well, as per the CBO:

This mounting debt would slow economic growth, push up interest payments to foreign holders of U.S. debt, and pose significant risks to the fiscal and economic outlook; it could also cause lawmakers to feel more constrained in their policy choices.

Sounds like Japan in the late 1990s and early 2000s, alright.

Then the report goes on to add that there's a higher chance of a financial crisis looming because of the growing debt. This could trigger a sudden spike in interest rates, and if inflation goes up too, it “could erode confidence in the U.S. dollar as the dominant international reserve currency.”

Coming from a government agency, this should really make you worried.

Exploding Interest Costs

That’s before you even consider how much the government is paying in interest. Here’s Larry Fink again:

In America, the situation is more urgent than I can ever remember. Since the start of the pandemic, the U.S. has issued roughly $11.1 trillion of new debt, and the amount is only part of the issue. There’s also the interest rate the Treasury needs to pay on it.

Three years ago, the rate on a 10-year Treasury bill was under 1%. But as I write this, it’s over 4%, and that 3-percentage-point increase is very dangerous. Should the current rates hold, it amounts to an extra trillion dollars in interest payments over the next decade.

In 2023, the federal government had to shell out $879 billion on interest payments alone. That was with an average interest rate below 3%. Now, it’s more like 4.4%.

But as interest costs on the national debt are skyrocketing, it's noteworthy that tax revenue is actually falling.

Tax revenue was $4.4 trillion in fiscal 2023. That’s down 12% from almost $5 trillion the previous year.

So, my dear reader, envision this: Several years from now, the national debt will surpass $50 trillion. At this rate, it's a fact.

With interest rates of 4.4%, the government would have to pay $2.2 trillion every year just to cover interest charges.

Numbers that big soon start to lose meaning. But consider this: The entire U.S. federal budget revenue for 2024 is projected to be about $5.18 trillion.

So, $2.2 trillion on interest alone would account for nearly 43% of that.

That's simply not manageable, and it's yet another sign that our financial system is falling apart, something I discussed in an essay earlier this week.

Until next time,

Lau

P.S. There are those who think that fretting over the national debt is overblown. They say it’s just “money we owe to ourselves." Stay tuned for Part 2 of my U.S. debt series later this week, where I’ll debunk this ridiculous argument and reveal the only way out of this mess the U.S. has.

Well, since Fink and his buddies all made so much from sending the country into the debt hellhole, maybe they can sacrifice their funds to bail it out.

If Larry Stink is all on board Klaus Scab’s ‘choo-choo train to hell’ why would he be worried about the U.S. fiscal bag of rotting fish heads. Shouldn’t he be rubbing his hands with glee? Just curious 🧐